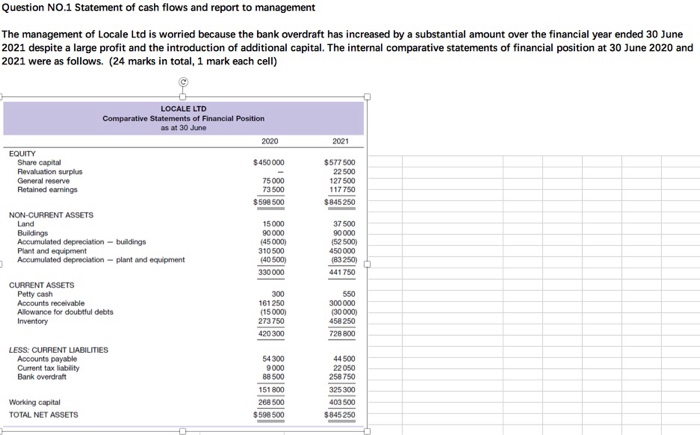

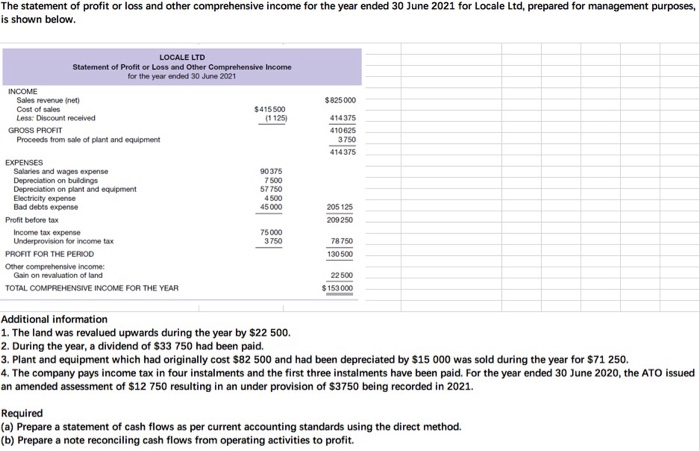

Question NO.1 Statement of cash flows and report to management The management of Locale Ltd is worried because the bank overdraft has increased by a substantial amount over the financial year ended 30 June 2021 despite a large profit and the introduction of additional capital. The internal comparative statements of financial position at 30 June 2020 and 2021 were as follows. (24 marks in total, 1 mark each cell) LOCALE LTD Comparative Statements of Financial Position as at 30 June 2020 2021 EQUITY Share capital Revaluation surplus General reserve Retained earnings $450 000 75000 73500 $598 500 $577500 22 500 127500 117 750 $845250 NON-CURRENT ASSETS Land Buildings Accumulated depreciation - buildings Plant and equipment Accumulated depreciation - plant and equipment 15000 90000 (45000) 310 500 (405001 330000 37500 90000 (52 500) 450000 (83 250 441750 CURRENT ASSETS Petty cash Accounts receivable Allowance for doubtfuldebts Inventory 300 161 250 (15000) 273750 420 300 550 300 000 (30000) 458 250 728 800 LESS: CURRENT LIABILITIES Accounts payable Current tax liability Bank overdraft 44500 54300 9000 88500 151 800 268 500 $598 500 22050 258 750 325 300 403 500 $845250 Working capital TOTAL NET ASSETS The statement of profit or loss and other comprehensive income for the year ended 30 June 2021 for Locale Ltd, prepared for management purposes, is shown below. LOCALE LTD Statement of Profit or loss and Other Comprehensive Income for the year ended 30 June 2021 INCOME Sales revenue Inet) Cost of sales $415500 Less: Discount received GROSS PROFIT Proceeds from sale of plant and equipment $825000 414 375 410625 3750 414 375 90375 7500 57750 4500 45000 EXPENSES Salaries and wages expense Depreciation on buildings Depreciation on plant and equipment Electricity expense Bad debts expense Profit before tax Income tax expense Underprovision for income tax PROFIT FOR THE PERIOD Other comprehensive income: Gain on revaluation of land TOTAL COMPREHENSIVE INCOME FOR THE YEAR 205 125 209250 75000 3750 78 750 130500 22 500 $ 153000 Additional information 1. The land was revalued upwards during the year by $22 500. 2. During the year, a dividend of $33 750 had been paid. 3. Plant and equipment which had originally cost $82 500 and had been depreciated by $15 000 was sold during the year for $71 250. 4. The company pays income tax in four instalments and the first three instalments have been paid. For the year ended 30 June 2020, the ATO issued an amended assessment of $12 750 resulting in an under provision of $3750 being recorded in 2021. Required (a) Prepare a statement of cash flows as per current accounting standards using the direct method. (b) Prepare a note reconciling cash flows from operating activities to profit