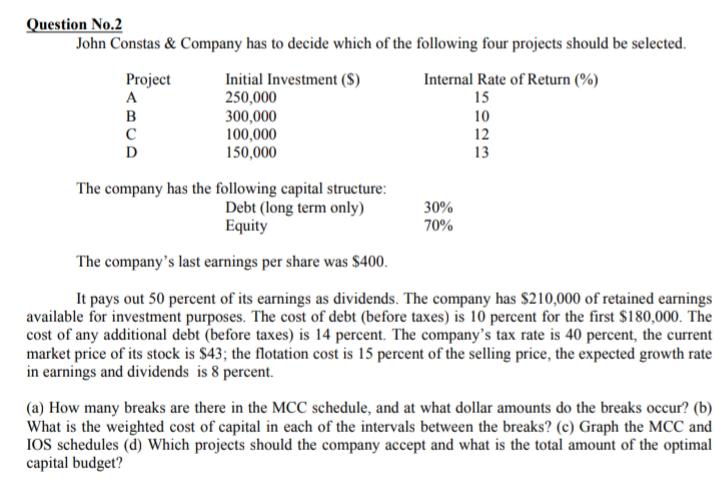

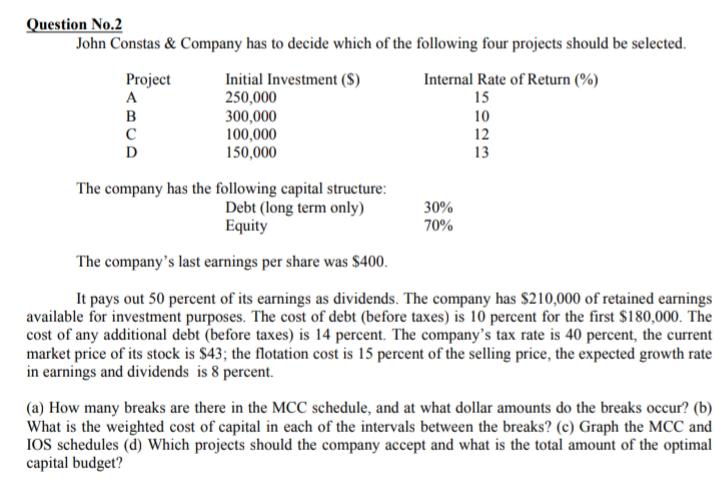

Question No.2 John Constas & Company has to decide which of the following four projects should be selected. Project Initial Investment ($) Internal Rate of Return (%) A 250,000 15 B 300,000 10 100,000 12 D 150,000 13 The company has the following capital structure: Debt (long term only) 30% Equity 70% The company's last earnings per share was $400. It pays out 50 percent of its earnings as dividends. The company has $210,000 of retained earnings available for investment purposes. The cost of debt (before taxes) is 10 percent for the first $180,000. The cost of any additional debt (before taxes) is 14 percent. The company's tax rate is 40 percent, the current market price of its stock is $43; the flotation cost is 15 percent of the selling price, the expected growth rate in earnings and dividends is 8 percent. (a) How many breaks are there in the MCC schedule, and at what dollar amounts do the breaks occur? (b) What is the weighted cost of capital in each of the intervals between the breaks? (c) Graph the MCC and IOS schedules (d) Which projects should the company accept and what is the total amount of the optimal capital budget? Question No.2 John Constas & Company has to decide which of the following four projects should be selected. Project Initial Investment ($) Internal Rate of Return (%) A 250,000 15 B 300,000 10 100,000 12 D 150,000 13 The company has the following capital structure: Debt (long term only) 30% Equity 70% The company's last earnings per share was $400. It pays out 50 percent of its earnings as dividends. The company has $210,000 of retained earnings available for investment purposes. The cost of debt (before taxes) is 10 percent for the first $180,000. The cost of any additional debt (before taxes) is 14 percent. The company's tax rate is 40 percent, the current market price of its stock is $43; the flotation cost is 15 percent of the selling price, the expected growth rate in earnings and dividends is 8 percent. (a) How many breaks are there in the MCC schedule, and at what dollar amounts do the breaks occur? (b) What is the weighted cost of capital in each of the intervals between the breaks? (c) Graph the MCC and IOS schedules (d) Which projects should the company accept and what is the total amount of the optimal capital budget