Answered step by step

Verified Expert Solution

Question

1 Approved Answer

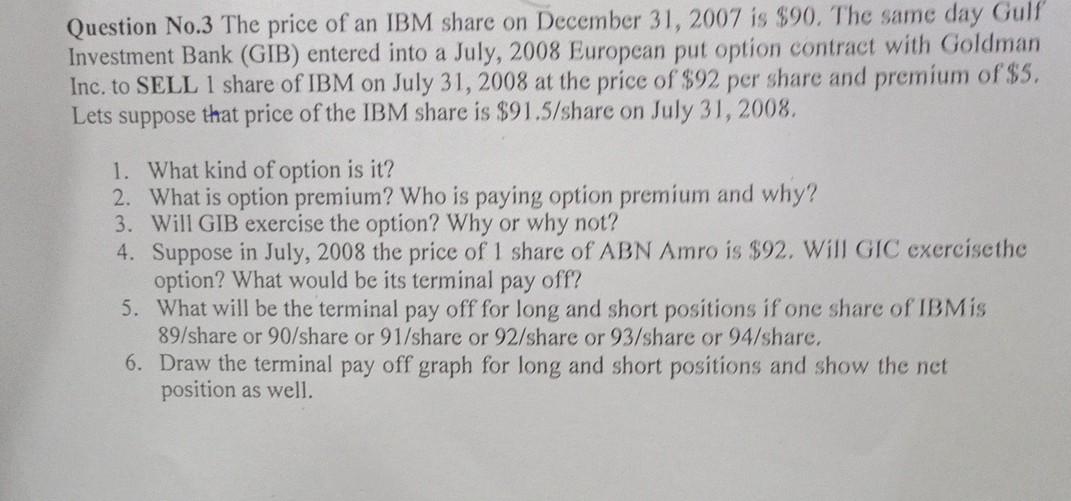

Question No.3 The price of an IBM share on December 31, 2007 is $90. The same day Gulf Investment Bank (GIB) entered into a July,

Question No.3 The price of an IBM share on December 31, 2007 is $90. The same day Gulf Investment Bank (GIB) entered into a July, 2008 European put option contract with Goldman Inc. to SELL 1 share of IBM on July 31, 2008 at the price of $92 per share and premium of $5. Lets suppose that price of the IBM share is $91.5/share on July 31, 2008. 1. What kind of option is it? 2. What is option premium? Who is paying option premium and why? 3. Will GIB exercise the option? Why or why not? 4. Suppose in July, 2008 the price of 1 share of ABN Amro is $92. Will GIC exercisethe option? What would be its terminal pay off? 5. What will be the terminal pay off for long and short positions if one share of IBMis 89/share or 90/share or 91/share or 92/share or 93/share or 94/share. 6. Draw the terminal pay off graph for long and short positions and show the net position as well

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started