Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question number 1 Soal 5-1 Wilson Corporation, which operates on a calendar year basis, purchased land for the company for $ 100,000 per cash on

question number 1

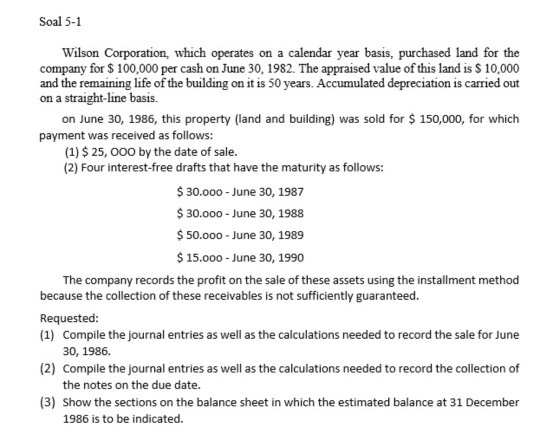

Soal 5-1 Wilson Corporation, which operates on a calendar year basis, purchased land for the company for $ 100,000 per cash on June 30, 1982. The appraised value of this land is $10,000 and the remaining life of the building on it is 50 years. Accumulated depreciation is carried out on a straight-line basis. on June 30, 1986, this property (land and building) was sold for $ 150,000, for which payment was received as follows: (1) $ 25,000 by the date of sale. (2) Four interest-free drafts that have the maturity as follows: $ 30.000 - June 30, 1987 $ 30.000 - June 30, 1988 $ 50.000 - June 30, 1989 $ 15.000 - June 30, 1990 The company records the profit on the sale of these assets using the installment method because the collection of these receivables is not sufficiently guaranteed. Requested: (1) Compile the journal entries as well as the calculations needed to record the sale for June 30, 1986. (2) Compile the journal entries as well as the calculations needed to record the collection of the notes on the due date. (3) Show the sections on the balance sheet in which the estimated balance at 31 December 1986 is to be indicatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started