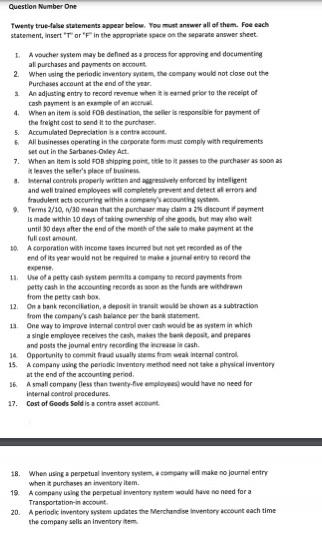

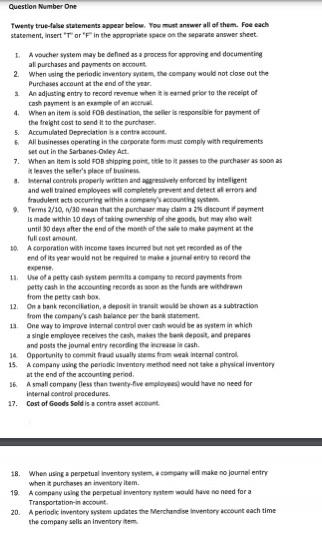

Question Number One Twenty true false statements appear below. You must answer all of them. Fee each statement, insert 'T' or 'F in the appropriate on the parte answer sheet A voucher system may be defined as a process for approving and documenting all purchases and payments on account 2 When using the periode inventory, the company would not close out the Purchases account at the end of the year 1 An adjusting entry to record revenue when it's red prior to the receipt of cash payment is an example of an al 4. When an item is sold Fos destination, the seller is responsible for payment of the freight cost to send it to the purchaser 5 Accumulated Depreciation is contract 6 All businesses operating in the corporate for most comply with requirements set out in the Sarbanes Oxley Act 7. When an item is sold FOB shipping pont, title to passes to the purchaser as soon as it lesves the seler's place of business Warnal controls properly written and vel enforced by intelligent and well trained employees will completely and detectaron and fradulent acts occurring within a conccounting system Terms 2/10, 1/30 mean that the purchasermaydama 2 discount of payment Is made within 10 days of taking ownership of the goods, but may also wait until 10 days after the end of the month of these to make payment at the Full cost amount 10. A corporation with income taxes de recorded of the end of its year would not be redeunty to record the expense 11. We of a petty cash system permis company to recordements from petty cash in the accounting records on the funds are withdrawn from the petty cash box 12. Ona bank reconciliation deposit in transit would be shown as a subtraction from the company's cash bulance per the bank statement 11 One way to improveternal controvers would be as item in which a simple employee receives the cash makes the deposit and prepares and posts the journal entry recording the cash 14 Opportunity to commit fraudulystems from weak internal control 15. A company using the periodic Inventory method med not take a shysical Inventory at the end of the accounting period 16 A small company less than twenty-five employees would have no need for internal control procedures. 17. Cost of Goods Sold is a contra assent 18. When using a perpetual inventory system company wil make no journal entry when purchases an inventory item. 19. A company using the perpetual inventorystem would have no need for a Transportation in account 20. A periodic Inventory system updates the Merchandise ventory account each time the company sells an Inventorytem Question Number One Twenty true false statements appear below. You must answer all of them. Fee each statement, insert 'T' or 'F in the appropriate on the parte answer sheet A voucher system may be defined as a process for approving and documenting all purchases and payments on account 2 When using the periode inventory, the company would not close out the Purchases account at the end of the year 1 An adjusting entry to record revenue when it's red prior to the receipt of cash payment is an example of an al 4. When an item is sold Fos destination, the seller is responsible for payment of the freight cost to send it to the purchaser 5 Accumulated Depreciation is contract 6 All businesses operating in the corporate for most comply with requirements set out in the Sarbanes Oxley Act 7. When an item is sold FOB shipping pont, title to passes to the purchaser as soon as it lesves the seler's place of business Warnal controls properly written and vel enforced by intelligent and well trained employees will completely and detectaron and fradulent acts occurring within a conccounting system Terms 2/10, 1/30 mean that the purchasermaydama 2 discount of payment Is made within 10 days of taking ownership of the goods, but may also wait until 10 days after the end of the month of these to make payment at the Full cost amount 10. A corporation with income taxes de recorded of the end of its year would not be redeunty to record the expense 11. We of a petty cash system permis company to recordements from petty cash in the accounting records on the funds are withdrawn from the petty cash box 12. Ona bank reconciliation deposit in transit would be shown as a subtraction from the company's cash bulance per the bank statement 11 One way to improveternal controvers would be as item in which a simple employee receives the cash makes the deposit and prepares and posts the journal entry recording the cash 14 Opportunity to commit fraudulystems from weak internal control 15. A company using the periodic Inventory method med not take a shysical Inventory at the end of the accounting period 16 A small company less than twenty-five employees would have no need for internal control procedures. 17. Cost of Goods Sold is a contra assent 18. When using a perpetual inventory system company wil make no journal entry when purchases an inventory item. 19. A company using the perpetual inventorystem would have no need for a Transportation in account 20. A periodic Inventory system updates the Merchandise ventory account each time the company sells an Inventorytem