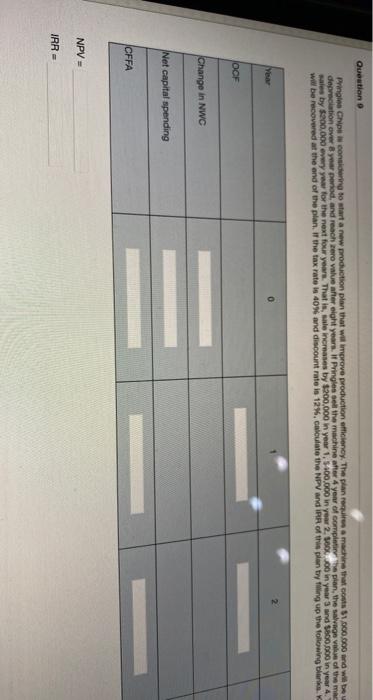

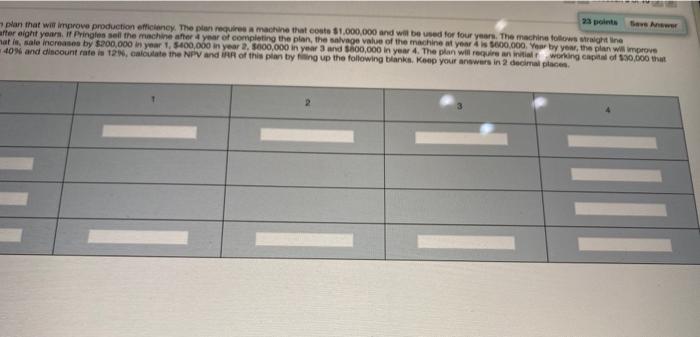

Question o Pringles Chips considering to start a new production plan that will improve production efficiency. The pian recurs machine than 1.000.000 und wie depreciation over year period, and reach zero value after eight years, if Pringles sell the machine after 4 year of complete plan, the salvage of the me sales by $200,000 every year for the next four years. That is, sale increases by $200,000 in year 1,400,000 in year 2.500.00 in year and $800 in year wwl be recovered at the end of the plan. If the tax rate is 40% and discount rate is 12%. calculate the NPV and IRR of the plan toy tiling up the following blank Year OCF Change in NWC Net capital spending CFFA NPV = IRR - plan that will improve production efficiency. The plan require a machine that costa 31,000,000 and will be used for four years. The machine for ne after eight years. If Pringles sall the machine after year of completing the plan, the salvage value of the machine of year is 5000,000 Year by year, the plan will improve mat, sale increase by $200,000 year 1,400,000 year. 5000,000 in year 3 and 700,000 in year 4. The plan will require working Capital of $30,000 40% and discount rate is 12N, calculate the NPV and is of this plans by filing up the following banks. Koop your answers in 2 decimal places TITI Question o Pringles Chips considering to start a new production plan that will improve production efficiency. The pian recurs machine than 1.000.000 und wie depreciation over year period, and reach zero value after eight years, if Pringles sell the machine after 4 year of complete plan, the salvage of the me sales by $200,000 every year for the next four years. That is, sale increases by $200,000 in year 1,400,000 in year 2.500.00 in year and $800 in year wwl be recovered at the end of the plan. If the tax rate is 40% and discount rate is 12%. calculate the NPV and IRR of the plan toy tiling up the following blank Year OCF Change in NWC Net capital spending CFFA NPV = IRR - plan that will improve production efficiency. The plan require a machine that costa 31,000,000 and will be used for four years. The machine for ne after eight years. If Pringles sall the machine after year of completing the plan, the salvage value of the machine of year is 5000,000 Year by year, the plan will improve mat, sale increase by $200,000 year 1,400,000 year. 5000,000 in year 3 and 700,000 in year 4. The plan will require working Capital of $30,000 40% and discount rate is 12N, calculate the NPV and is of this plans by filing up the following banks. Koop your answers in 2 decimal places TITI