Question on a finance case called Are we getting too big for our boots"

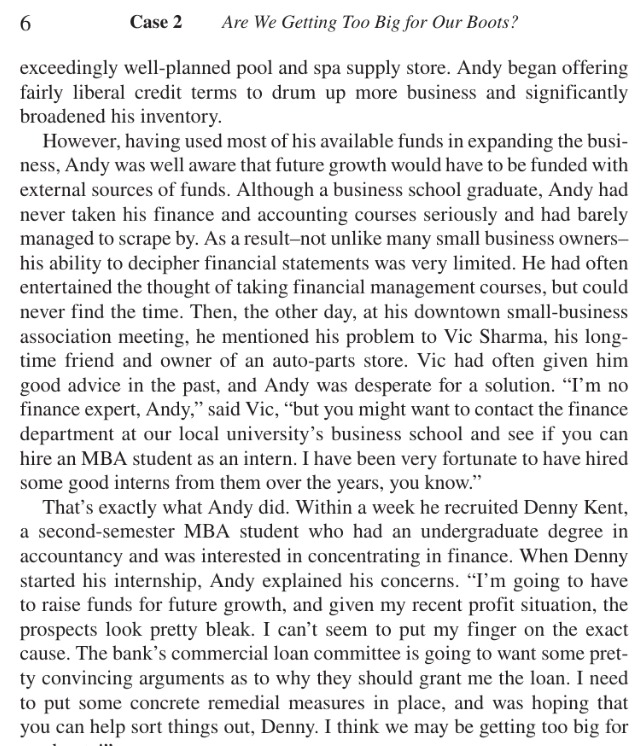

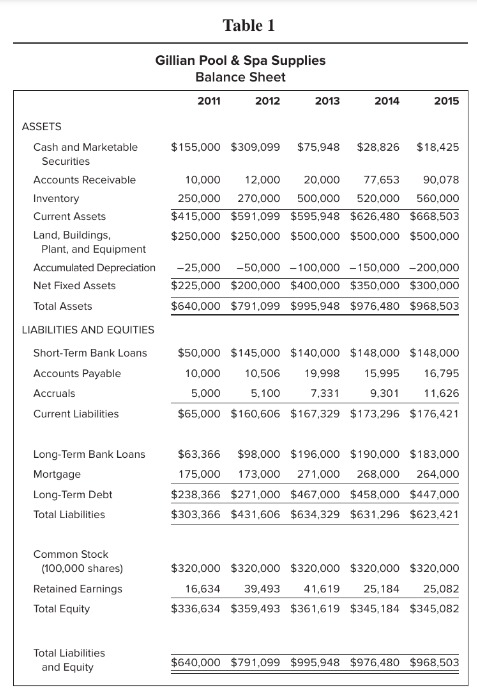

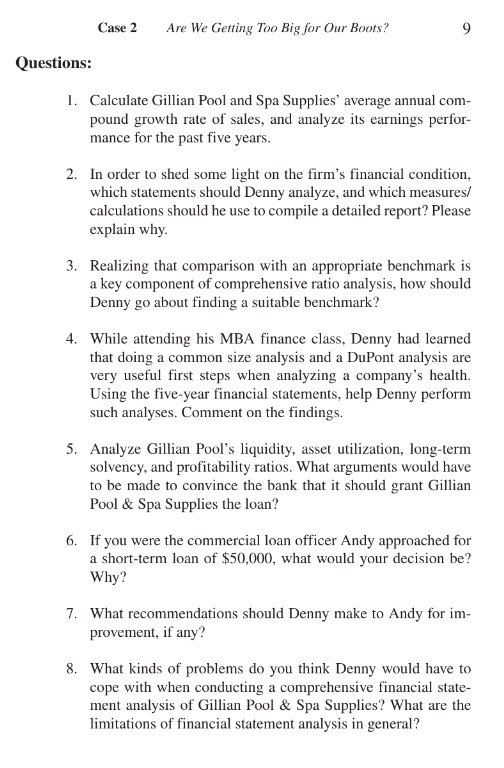

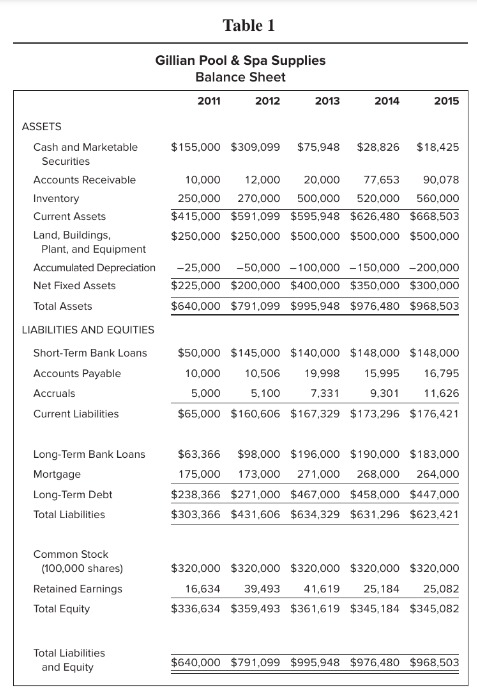

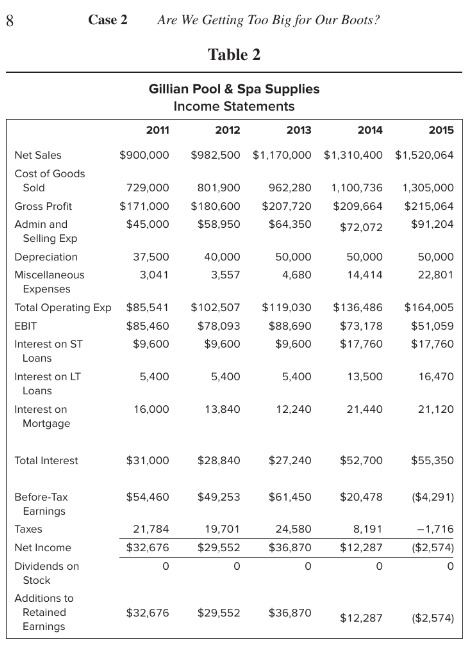

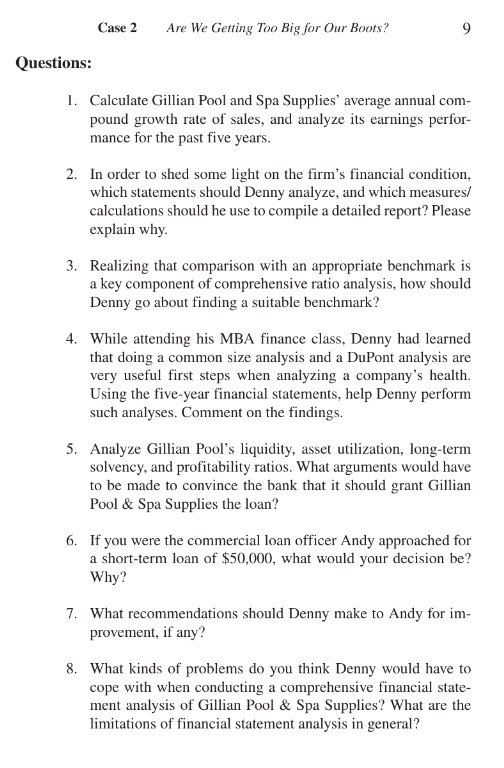

Table 1 Gillian Pool \& Spa Supplies Balance Sheet Case 2 Are We Getting Too Big for Our Boots? Case 2 Are We Getting Too Big for Our Boots? 9 stions: 1. Calculate Gillian Pool and Spa Supplies' average annual compound growth rate of sales, and analyze its earnings performance for the past five years. 2. In order to shed some light on the firm's financial condition, which statements should Denny analyze, and which measures/ calculations should he use to compile a detailed report? Please explain why. 3. Realizing that comparison with an appropriate benchmark is a key component of comprehensive ratio analysis, how should Denny go about finding a suitable benchmark? 4. While attending his MBA finance class, Denny had learned that doing a common size analysis and a DuPont analysis are very useful first steps when analyzing a company's health. Using the five-year financial statements, help Denny perform such analyses. Comment on the findings. 5. Analyze Gillian Pool's liquidity, asset utilization, long-term solvency, and profitability ratios. What arguments would have to be made to convince the bank that it should grant Gillian Pool \& Spa Supplies the loan? 6. If you were the commercial loan officer Andy approached for a short-term loan of $50,000, what would your decision be? Why? 7. What recommendations should Denny make to Andy for improvement, if any? 8. What kinds of problems do you think Denny would have to cope with when conducting a comprehensive financial statement analysis of Gillian Pool \& Spa Supplies? What are the limitations of financial statement analysis in general? 6 Case 2 Are We Getting Too Big for Our Boots? exceedingly well-planned pool and spa supply store. Andy began offering fairly liberal credit terms to drum up more business and significantly broadened his inventory. However, having used most of his available funds in expanding the business, Andy was well aware that future growth would have to be funded with external sources of funds. Although a business school graduate, Andy had never taken his finance and accounting courses seriously and had barely managed to scrape by. As a result-not unlike many small business ownershis ability to decipher financial statements was very limited. He had often entertained the thought of taking financial management courses, but could never find the time. Then, the other day, at his downtown small-business association meeting, he mentioned his problem to Vic Sharma, his longtime friend and owner of an auto-parts store. Vic had often given him good advice in the past, and Andy was desperate for a solution. "I'm no finance expert, Andy," said Vic, "but you might want to contact the finance department at our local university's business school and see if you can hire an MBA student as an intern. I have been very fortunate to have hired some good interns from them over the years, you know." That's exactly what Andy did. Within a week he recruited Denny Kent, a second-semester MBA student who had an undergraduate degree in accountancy and was interested in concentrating in finance. When Denny started his internship, Andy explained his concerns. "I'm going to have to raise funds for future growth, and given my recent profit situation, the prospects look pretty bleak. I can't seem to put my finger on the exact cause. The bank's commercial loan committee is going to want some pretty convincing arguments as to why they should grant me the loan. I need to put some concrete remedial measures in place, and was hoping that you can help sort things out, Denny. I think we may be getting too big for