Answered step by step

Verified Expert Solution

Question

1 Approved Answer

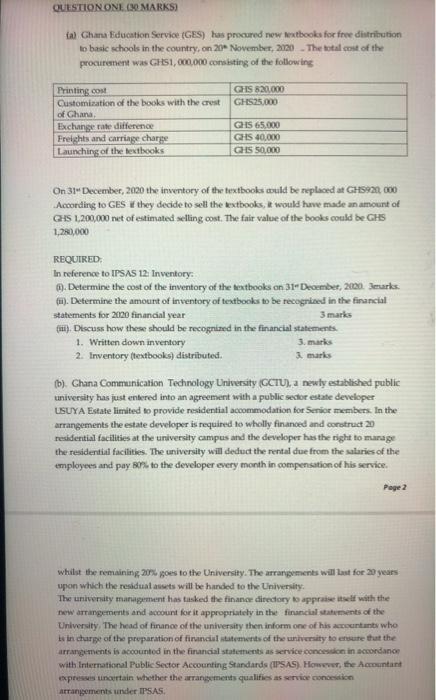

QUESTION ONE (30 MARKS) (a) Ghana Education Service (GES) has procured new textbooks for free distribution to basic schools in the country, on 20

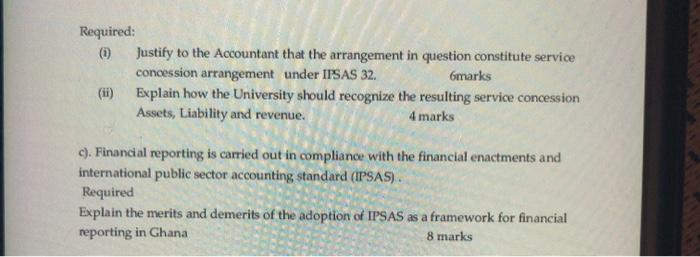

QUESTION ONE (30 MARKS) (a) Ghana Education Service (GES) has procured new textbooks for free distribution to basic schools in the country, on 20 November, 2020 -The total cost of the procurement was GHS1,000,000 consisting of the following Printing cost Customization of the books with the cresti of Ghana, Exchange rate difference Freights and carriage charge Launching of the textbooks GHS 820,000 GHS25,000 GHS 65.000 GHS 40,000 GHS 50,000 On 31" December, 2020 the inventory of the textbooks would be replaced at GHS920, 000 According to GES if they decide to sell the textbooks, it would have made an amount of GHS 1,200,000 net of estimated selling cost. The fair value of the books could be GHS 1,280,000 1. Written down inventory 2. Inventory (textbooks) distributed. REQUIRED In reference to IPSAS 12: Inventory: 1). Determine the cost of the inventory of the textbooks on 31 December, 2020 3marks (1). Determine the amount of inventory of textbooks to be recognized in the financial statements for 2020 financial year 3 marks (iii). Discuss how these should be recognized in the financial statements. 3. marks 3. marks (b). Ghana Communication Technology University (GCTU), a newly established public university has just entered into an agreement with a public sector estate developer USUYA Estate limited to provide residential accommodation for Senior members. In the arrangements the estate developer is required to wholly financed and construct 20 residential facilities at the university campus and the developer has the right to manage the residential facilities. The university will deduct the rental due from the salaries of the employees and pay 80% to the developer every month in compensation of his service. Page 2 whilst the remaining 20% goes to the University. The arrangements will last for 20 years upon which the residual assets will be handed to the University. The university management has tasked the finance directory to appraise itself with the new arrangements and account for it appropriately in the financial statements of the University. The head of finance of the university then inform one of his accountants who is in charge of the preparation of financial statements of the university to ensure that the arrangements is accounted in the financial statements as service concession in accordance with International Public Sector Accounting Standards (IPSAS). However, the Accountant expresses uncertain whether the arrangements qualifies as service concession arrangements under IPSAS. Required: (1) (ii) Justify to the Accountant that the arrangement in question constitute service concession arrangement under IPSAS 32. 6marks Explain how the University should recognize the resulting service concession Assets, Liability and revenue. 4 marks c). Financial reporting is carried out in compliance with the financial enactments and international public sector accounting standard (IPSAS). Required Explain the merits and demerits of the adoption of IPSAS as a framework for financial reporting in Ghana 8 marks

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

REQUIRED In reference to IPSAS 12 Inventory 1 Determine the cost of the inventory of the textbooks on 31 December 2000 3marks ANSWER According to GES the inventory of the textbooks would be replaced a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started