Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE 1 . 1 Explain to Thabo and Nandipha what the current legal status of their marriage is . Also discuss the options available

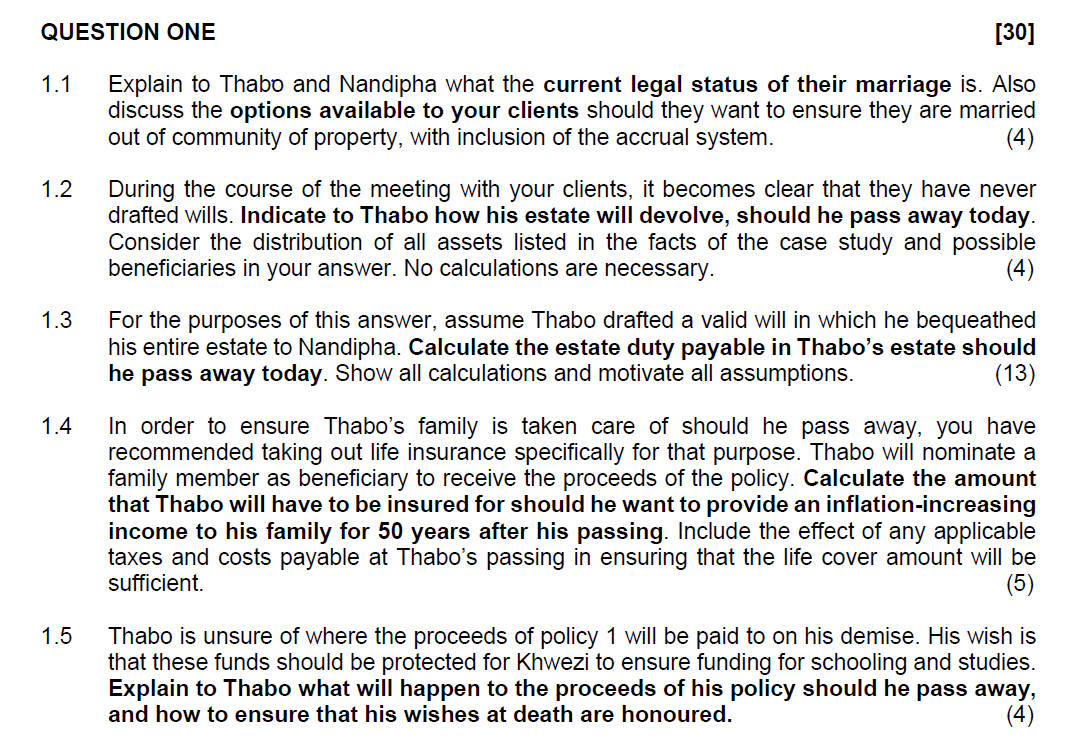

QUESTION ONE

Explain to Thabo and Nandipha what the current legal status of their marriage is Also

discuss the options available to your clients should they want to ensure they are married

out of community of property, with inclusion of the accrual system.

During the course of the meeting with your clients, it becomes clear that they have never

drafted wills. Indicate to Thabo how his estate will devolve, should he pass away today.

Consider the distribution of all assets listed in the facts of the case study and possible

beneficiaries in your answer. No calculations are necessary.

For the purposes of this answer, assume Thabo drafted a valid will in which he bequeathed

his entire estate to Nandipha. Calculate the estate duty payable in Thabo's estate should

he pass away today. Show all calculations and motivate all assumptions.

In order to ensure Thabo's family is taken care of should he pass away, you have

recommended taking out life insurance specifically for that purpose. Thabo will nominate a

family member as beneficiary to receive the proceeds of the policy. Calculate the amount

that Thabo will have to be insured for should he want to provide an inflationincreasing

income to his family for years after his passing. Include the effect of any applicable

taxes and costs payable at Thabo's passing in ensuring that the life cover amount will be

sufficient.

Thabo is unsure of where the proceeds of policy will be paid to on his demise. His wish is

that these funds should be protected for Khwezi to ensure funding for schooling and studies.

Explain to Thabo what will happen to the proceeds of his policy should he pass away,

and how to ensure that his wishes at death are honoured.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started