Answered step by step

Verified Expert Solution

Question

1 Approved Answer

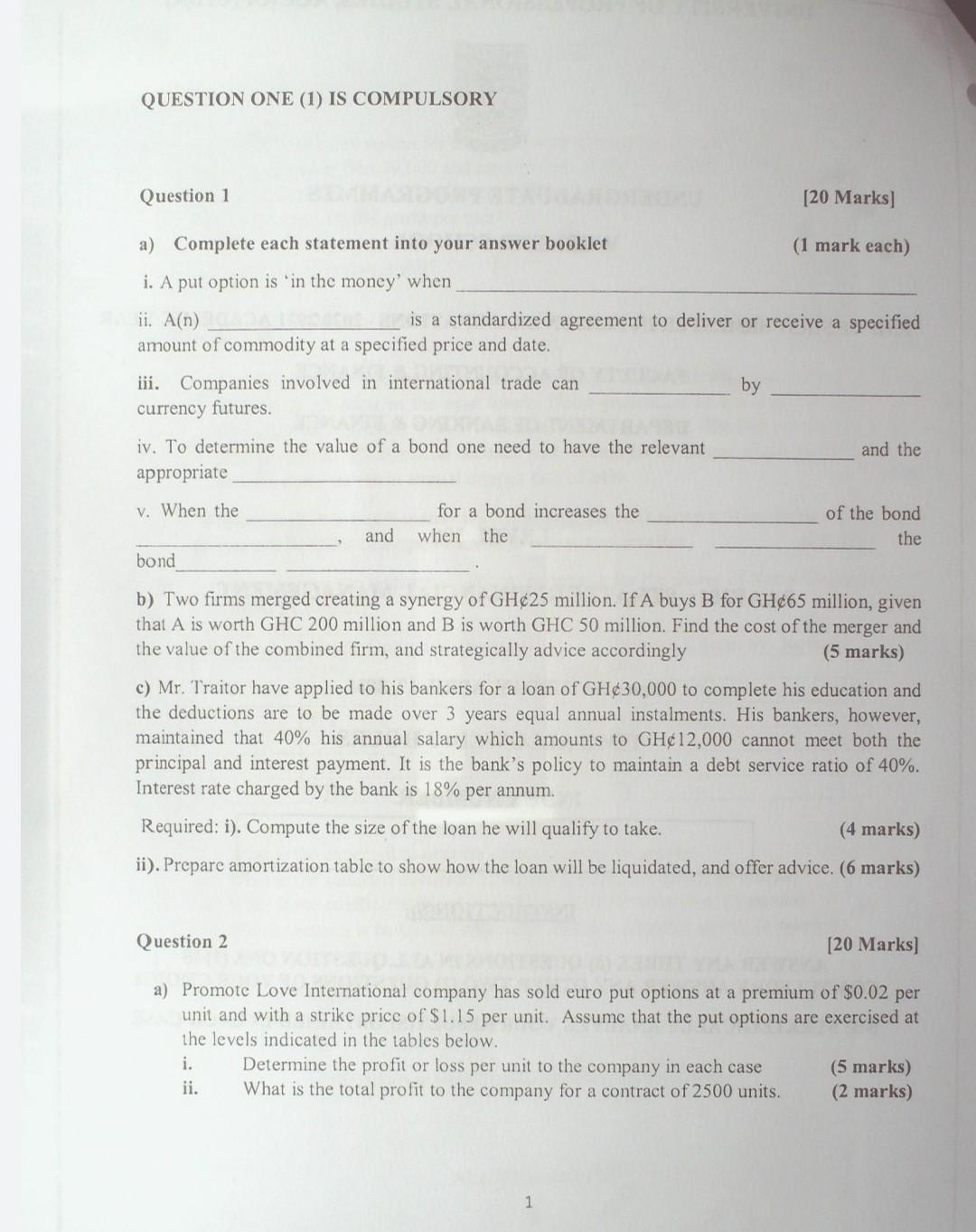

QUESTION ONE (1) IS COMPULSORY Question 1 [20 Marks) a) Complete each statement into your answer booklet (1 mark each) i. A put option is

QUESTION ONE (1) IS COMPULSORY Question 1 [20 Marks) a) Complete each statement into your answer booklet (1 mark each) i. A put option is in the money' when ii. A(n) is a standardized agreement to deliver or receive a specified amount of commodity at a specified price and date. iii. Companies involved in international trade can by currency futures. and the iv. To determine the value of a bond one need to have the relevant appropriate V. When the for a bond increases the when the of the bond the and bond b) Two firms merged creating a synergy of GH25 million. If A buys B for GH65 million, given that A is worth GHC 200 million and B is worth GHC 50 million. Find the cost of the merger and the value of the combined firm, and strategically advice accordingly (5 marks) c) Mr. Traitor have applied to his bankers for a loan of GH30,000 to complete his education and the deductions are to be made over 3 years equal annual instalments. His bankers, however, maintained that 40% his annual salary which amounts to GH12,000 cannot meet both the principal and interest payment. It is the bank's policy to maintain a debt service ratio of 40%. Interest rate charged by the bank is 18% per annum. Required: i). Compute the size of the loan he will qualify to take. (4 marks) ii). Prepare amortization table to show how the loan will be liquidated, and offer advice. (6 marks) Question 2 [20 Marks) a) Promote Love International company has sold euro put options at a premium of $0.02 per unit and with a strike price of $1.15 per unit. Assume that the put options are exercised at the levels indicated in the tables below. i. Determine the profit or loss per unit to the company in each case (5 marks) ii. What is the total profit to the company for a contract of 2500 units. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started