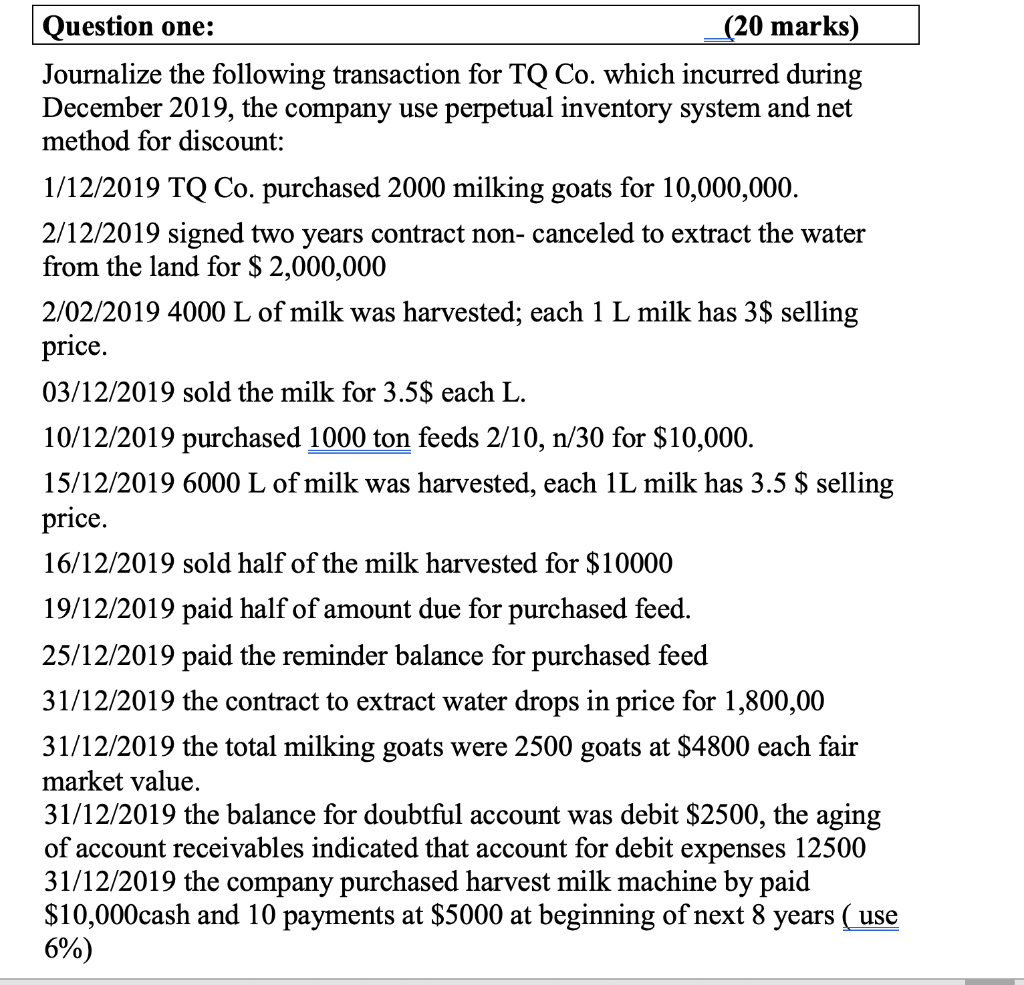

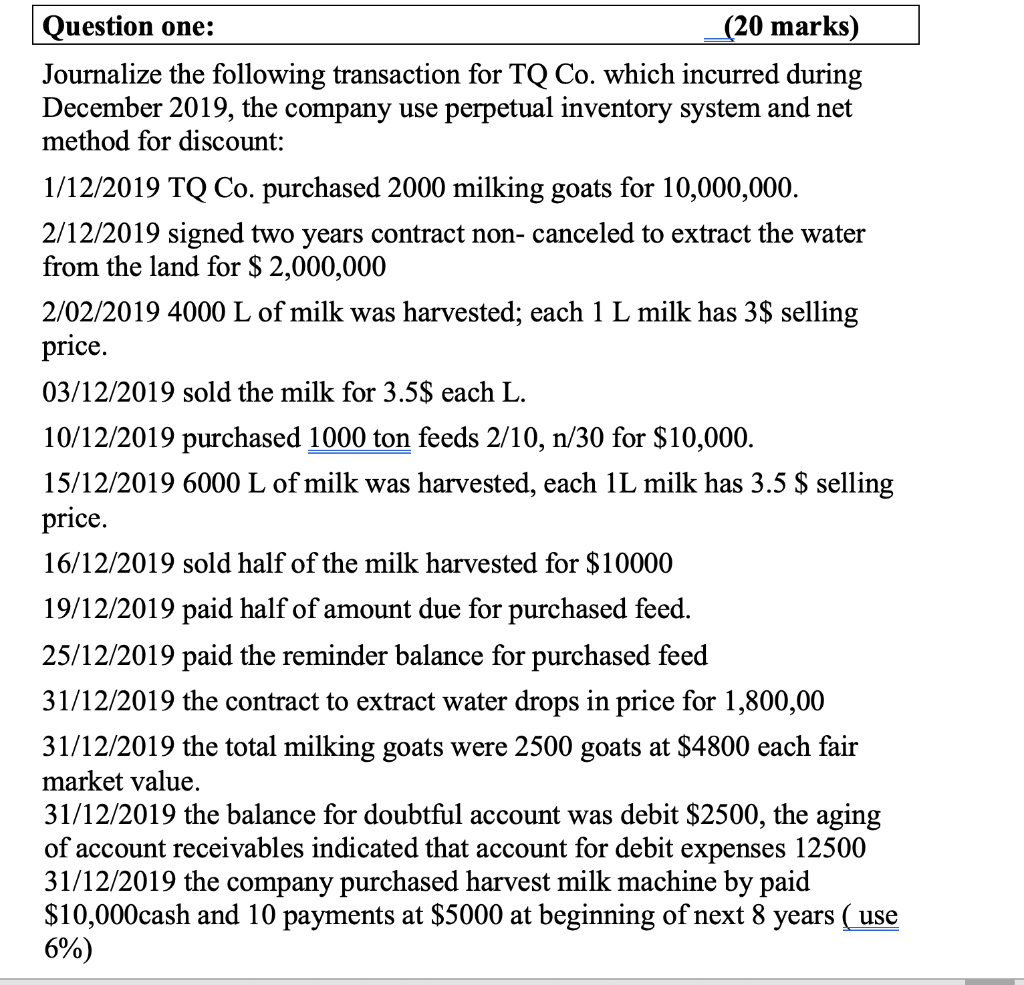

Question one: (20 marks) Journalize the following transaction for TQ Co. which incurred during December 2019, the company use perpetual inventory system and net method for discount: 1/12/2019 TQ Co. purchased 2000 milking goats for 10,000,000. 2/12/2019 signed two years contract non-canceled to extract the water from the land for $ 2,000,000 2/02/2019 4000 L of milk was harvested; each 1 L milk has 3$ selling price. 03/12/2019 sold the milk for 3.5$ each L. 10/12/2019 purchased 1000 ton feeds 2/10, n/30 for $10,000. 15/12/2019 6000 L of milk was harvested, each 1L milk has 3.5 $ selling price. 16/12/2019 sold half of the milk harvested for $10000 19/12/2019 paid half of amount due for purchased feed. 25/12/2019 paid the reminder balance for purchased feed 31/12/2019 the contract to extract water drops in price for 1,800,00 31/12/2019 the total milking goats were 2500 goats at $4800 each fair market value. 31/12/2019 the balance for doubtful account was debit $2500, the aging of account receivables indicated that account for debit expenses 12500 31/12/2019 the company purchased harvest milk machine by paid $10,000cash and 10 payments at $5000 at beginning of next 8 years ( use 6%) date Entry date Entry Question one: (20 marks) Journalize the following transaction for TQ Co. which incurred during December 2019, the company use perpetual inventory system and net method for discount: 1/12/2019 TQ Co. purchased 2000 milking goats for 10,000,000. 2/12/2019 signed two years contract non-canceled to extract the water from the land for $ 2,000,000 2/02/2019 4000 L of milk was harvested; each 1 L milk has 3$ selling price. 03/12/2019 sold the milk for 3.5$ each L. 10/12/2019 purchased 1000 ton feeds 2/10, n/30 for $10,000. 15/12/2019 6000 L of milk was harvested, each 1L milk has 3.5 $ selling price. 16/12/2019 sold half of the milk harvested for $10000 19/12/2019 paid half of amount due for purchased feed. 25/12/2019 paid the reminder balance for purchased feed 31/12/2019 the contract to extract water drops in price for 1,800,00 31/12/2019 the total milking goats were 2500 goats at $4800 each fair market value. 31/12/2019 the balance for doubtful account was debit $2500, the aging of account receivables indicated that account for debit expenses 12500 31/12/2019 the company purchased harvest milk machine by paid $10,000cash and 10 payments at $5000 at beginning of next 8 years ( use 6%) date Entry date Entry