Answered step by step

Verified Expert Solution

Question

1 Approved Answer

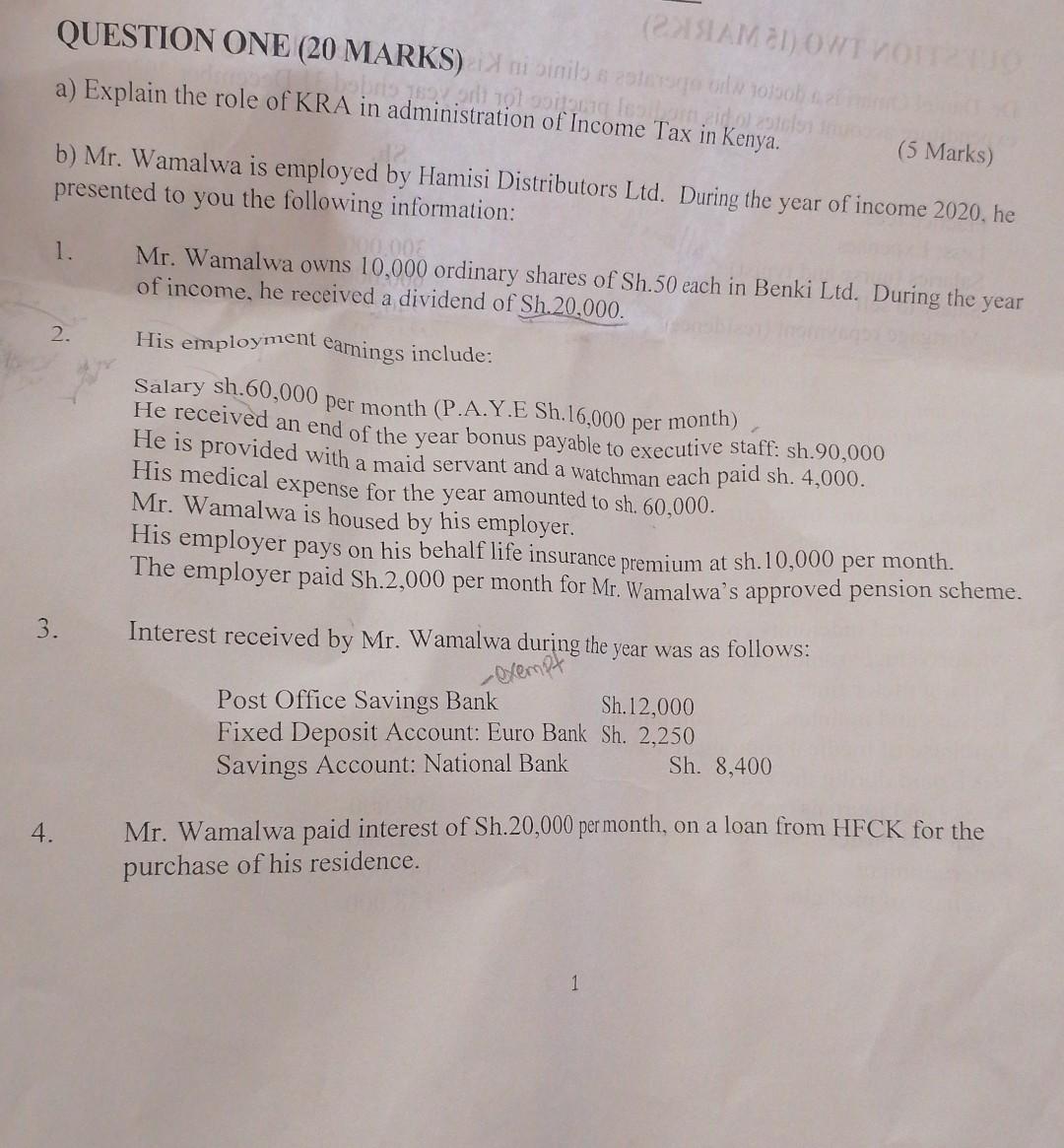

QUESTION ONE (20 MARKS) ni binilo a sterge ol s0150b 20 m a) Explain the role of KRA in administration of Income Tax in Kenya.

QUESTION ONE (20 MARKS) ni binilo a sterge ol s0150b 20 m a) Explain the role of KRA in administration of Income Tax in Kenya. bobris 1699 rt 10 ositorg festlom gidol zotolon nues 1. (5 Marks) b) Mr. Wamalwa is employed by Hamisi Distributors Ltd. During the year of income 2020, he presented to you the following information: 2. 4. 3. (21AM21) OWTI VOITZ1JO 000.008 Mr. Wamalwa owns 10,000 ordinary shares of Sh.50 each in Benki Ltd. During the year of income, he received a dividend of Sh.20.000. Lab His employment earnings include: Salary sh.60,000 per month (P.A.Y.E Sh.16,000 per month) He received an end of the year bonus payable to executive staff: sh.90,000 He is provided with a maid servant and a watchman each paid sh. 4,000. His medical expense for the year amounted to sh. 60,000. Mr. Wamalwa is housed by his employer. His employer pays on his behalf life insurance premium at sh.10,000 per month. The employer paid Sh.2,000 per month for Mr. Wamalwa's approved pension scheme. Interest received by Mr. Wamalwa during the year was as follows: -exempt Post Office Savings Bank Fixed Deposit Account: Euro Bank Savings Account: National Bank 1 Sh.12,000 Sh. 2,250 Sh. 8,400 Mr. Wamalwa paid interest of Sh.20,000 per month, on a loan from HFCK for the purchase of his residence

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started