Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE [25] 1.1 Analyse the various considerations in choosing the means of financing a project. 1.2 Evaluate the significance of financial gearing and insolvency

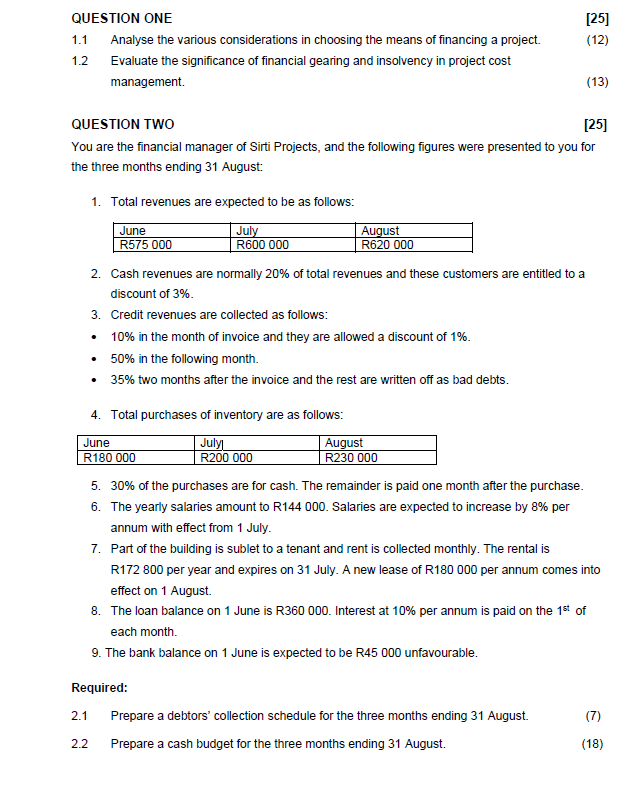

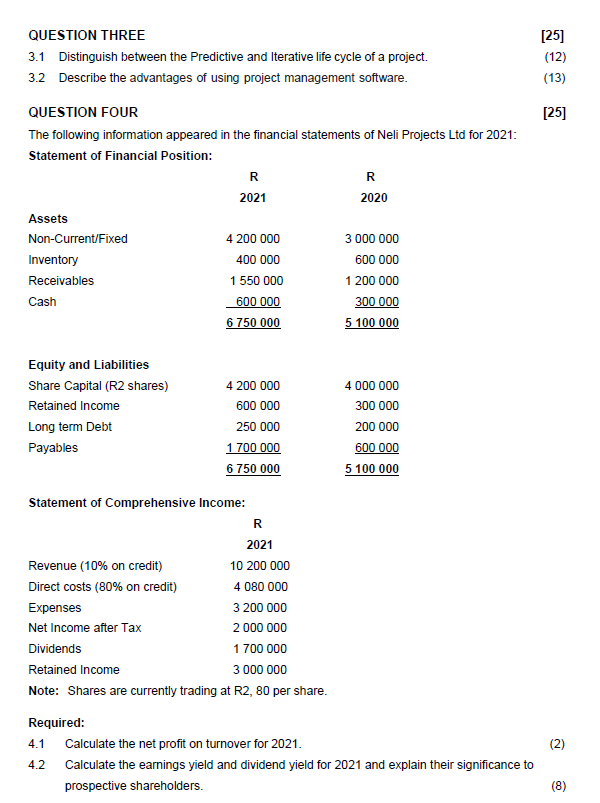

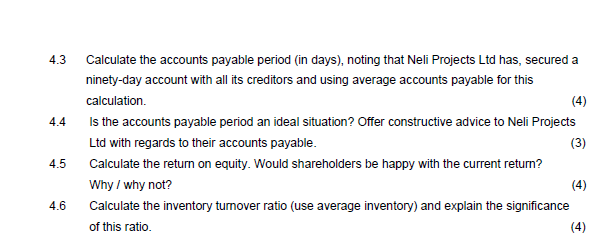

QUESTION ONE [25] 1.1 Analyse the various considerations in choosing the means of financing a project. 1.2 Evaluate the significance of financial gearing and insolvency in project cost management. QUESTION TWO [25] You are the financial manager of Sirti Projects, and the following figures were presented to you for the three months ending 31 August: 1. Total revenues are expected to be as follows: 2. Cash revenues are normally 20% of total revenues and these customers are entitled to a discount of 3%. 3. Credit revenues are collected as follows: - 10% in the month of invoice and they are allowed a discount of 1%. - 50% in the following month. - 35% two months after the invoice and the rest are written off as bad debts. 4. Total purchases of inventory are as follows: 5. 30% of the purchases are for cash. The remainder is paid one month after the purchase. 6. The yearly salaries amount to R144 000 . Salaries are expected to increase by 8% per annum with effect from 1 July. 7. Part of the building is sublet to a tenant and rent is collected monthly. The rental is R172 800 per year and expires on 31 July. A new lease of R180 000 per annum comes into effect on 1 August. 8. The loan balance on 1 June is R360 000. Interest at 10% per annum is paid on the 1st of each month. 9. The bank balance on 1 June is expected to be R45 000 unfavourable. Required: 2.1 Prepare a debtors' collection schedule for the three months ending 31 August. 2.2 Prepare a cash budget for the three months ending 31 August. QUESTION THREE [25] 3.1 Distinguish between the Predictive and Iterative life cycle of a project. 3.2 Describe the advantages of using project management software. (13) QUESTION FOUR [25] The following information appeared in the financial statements of Neli Projects Ltd for 2021: Statement of Financial Position: Statement of Comprehensive Income: Note: Shares are currently trading at R2, 80 per share. Required: 4.1 Calculate the net profit on turnover for 2021. (5) 4.2 Calculate the earnings yield and dividend yield for 2021 and explain their significance to prospective shareholders. (8) 4.3 Calculate the accounts payable period (in days), noting that Neli Projects Ltd has, secured a ninety-day account with all its creditors and using average accounts payable for this calculation. 4.4 Is the accounts payable period an ideal situation? Offer constructive advice to Neli Projects Ltd with regards to their accounts payable. 4.5 Calculate the return on equity. Would shareholders be happy with the current return? Why / why not? 4.6 Calculate the inventory turnover ratio (use average inventory) and explain the significance of this ratio. (4) QUESTION ONE [25] 1.1 Analyse the various considerations in choosing the means of financing a project. 1.2 Evaluate the significance of financial gearing and insolvency in project cost management. QUESTION TWO [25] You are the financial manager of Sirti Projects, and the following figures were presented to you for the three months ending 31 August: 1. Total revenues are expected to be as follows: 2. Cash revenues are normally 20% of total revenues and these customers are entitled to a discount of 3%. 3. Credit revenues are collected as follows: - 10% in the month of invoice and they are allowed a discount of 1%. - 50% in the following month. - 35% two months after the invoice and the rest are written off as bad debts. 4. Total purchases of inventory are as follows: 5. 30% of the purchases are for cash. The remainder is paid one month after the purchase. 6. The yearly salaries amount to R144 000 . Salaries are expected to increase by 8% per annum with effect from 1 July. 7. Part of the building is sublet to a tenant and rent is collected monthly. The rental is R172 800 per year and expires on 31 July. A new lease of R180 000 per annum comes into effect on 1 August. 8. The loan balance on 1 June is R360 000. Interest at 10% per annum is paid on the 1st of each month. 9. The bank balance on 1 June is expected to be R45 000 unfavourable. Required: 2.1 Prepare a debtors' collection schedule for the three months ending 31 August. 2.2 Prepare a cash budget for the three months ending 31 August. QUESTION THREE [25] 3.1 Distinguish between the Predictive and Iterative life cycle of a project. 3.2 Describe the advantages of using project management software. (13) QUESTION FOUR [25] The following information appeared in the financial statements of Neli Projects Ltd for 2021: Statement of Financial Position: Statement of Comprehensive Income: Note: Shares are currently trading at R2, 80 per share. Required: 4.1 Calculate the net profit on turnover for 2021. (5) 4.2 Calculate the earnings yield and dividend yield for 2021 and explain their significance to prospective shareholders. (8) 4.3 Calculate the accounts payable period (in days), noting that Neli Projects Ltd has, secured a ninety-day account with all its creditors and using average accounts payable for this calculation. 4.4 Is the accounts payable period an ideal situation? Offer constructive advice to Neli Projects Ltd with regards to their accounts payable. 4.5 Calculate the return on equity. Would shareholders be happy with the current return? Why / why not? 4.6 Calculate the inventory turnover ratio (use average inventory) and explain the significance of this ratio. (4)

QUESTION ONE [25] 1.1 Analyse the various considerations in choosing the means of financing a project. 1.2 Evaluate the significance of financial gearing and insolvency in project cost management. QUESTION TWO [25] You are the financial manager of Sirti Projects, and the following figures were presented to you for the three months ending 31 August: 1. Total revenues are expected to be as follows: 2. Cash revenues are normally 20% of total revenues and these customers are entitled to a discount of 3%. 3. Credit revenues are collected as follows: - 10% in the month of invoice and they are allowed a discount of 1%. - 50% in the following month. - 35% two months after the invoice and the rest are written off as bad debts. 4. Total purchases of inventory are as follows: 5. 30% of the purchases are for cash. The remainder is paid one month after the purchase. 6. The yearly salaries amount to R144 000 . Salaries are expected to increase by 8% per annum with effect from 1 July. 7. Part of the building is sublet to a tenant and rent is collected monthly. The rental is R172 800 per year and expires on 31 July. A new lease of R180 000 per annum comes into effect on 1 August. 8. The loan balance on 1 June is R360 000. Interest at 10% per annum is paid on the 1st of each month. 9. The bank balance on 1 June is expected to be R45 000 unfavourable. Required: 2.1 Prepare a debtors' collection schedule for the three months ending 31 August. 2.2 Prepare a cash budget for the three months ending 31 August. QUESTION THREE [25] 3.1 Distinguish between the Predictive and Iterative life cycle of a project. 3.2 Describe the advantages of using project management software. (13) QUESTION FOUR [25] The following information appeared in the financial statements of Neli Projects Ltd for 2021: Statement of Financial Position: Statement of Comprehensive Income: Note: Shares are currently trading at R2, 80 per share. Required: 4.1 Calculate the net profit on turnover for 2021. (5) 4.2 Calculate the earnings yield and dividend yield for 2021 and explain their significance to prospective shareholders. (8) 4.3 Calculate the accounts payable period (in days), noting that Neli Projects Ltd has, secured a ninety-day account with all its creditors and using average accounts payable for this calculation. 4.4 Is the accounts payable period an ideal situation? Offer constructive advice to Neli Projects Ltd with regards to their accounts payable. 4.5 Calculate the return on equity. Would shareholders be happy with the current return? Why / why not? 4.6 Calculate the inventory turnover ratio (use average inventory) and explain the significance of this ratio. (4) QUESTION ONE [25] 1.1 Analyse the various considerations in choosing the means of financing a project. 1.2 Evaluate the significance of financial gearing and insolvency in project cost management. QUESTION TWO [25] You are the financial manager of Sirti Projects, and the following figures were presented to you for the three months ending 31 August: 1. Total revenues are expected to be as follows: 2. Cash revenues are normally 20% of total revenues and these customers are entitled to a discount of 3%. 3. Credit revenues are collected as follows: - 10% in the month of invoice and they are allowed a discount of 1%. - 50% in the following month. - 35% two months after the invoice and the rest are written off as bad debts. 4. Total purchases of inventory are as follows: 5. 30% of the purchases are for cash. The remainder is paid one month after the purchase. 6. The yearly salaries amount to R144 000 . Salaries are expected to increase by 8% per annum with effect from 1 July. 7. Part of the building is sublet to a tenant and rent is collected monthly. The rental is R172 800 per year and expires on 31 July. A new lease of R180 000 per annum comes into effect on 1 August. 8. The loan balance on 1 June is R360 000. Interest at 10% per annum is paid on the 1st of each month. 9. The bank balance on 1 June is expected to be R45 000 unfavourable. Required: 2.1 Prepare a debtors' collection schedule for the three months ending 31 August. 2.2 Prepare a cash budget for the three months ending 31 August. QUESTION THREE [25] 3.1 Distinguish between the Predictive and Iterative life cycle of a project. 3.2 Describe the advantages of using project management software. (13) QUESTION FOUR [25] The following information appeared in the financial statements of Neli Projects Ltd for 2021: Statement of Financial Position: Statement of Comprehensive Income: Note: Shares are currently trading at R2, 80 per share. Required: 4.1 Calculate the net profit on turnover for 2021. (5) 4.2 Calculate the earnings yield and dividend yield for 2021 and explain their significance to prospective shareholders. (8) 4.3 Calculate the accounts payable period (in days), noting that Neli Projects Ltd has, secured a ninety-day account with all its creditors and using average accounts payable for this calculation. 4.4 Is the accounts payable period an ideal situation? Offer constructive advice to Neli Projects Ltd with regards to their accounts payable. 4.5 Calculate the return on equity. Would shareholders be happy with the current return? Why / why not? 4.6 Calculate the inventory turnover ratio (use average inventory) and explain the significance of this ratio. (4) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started