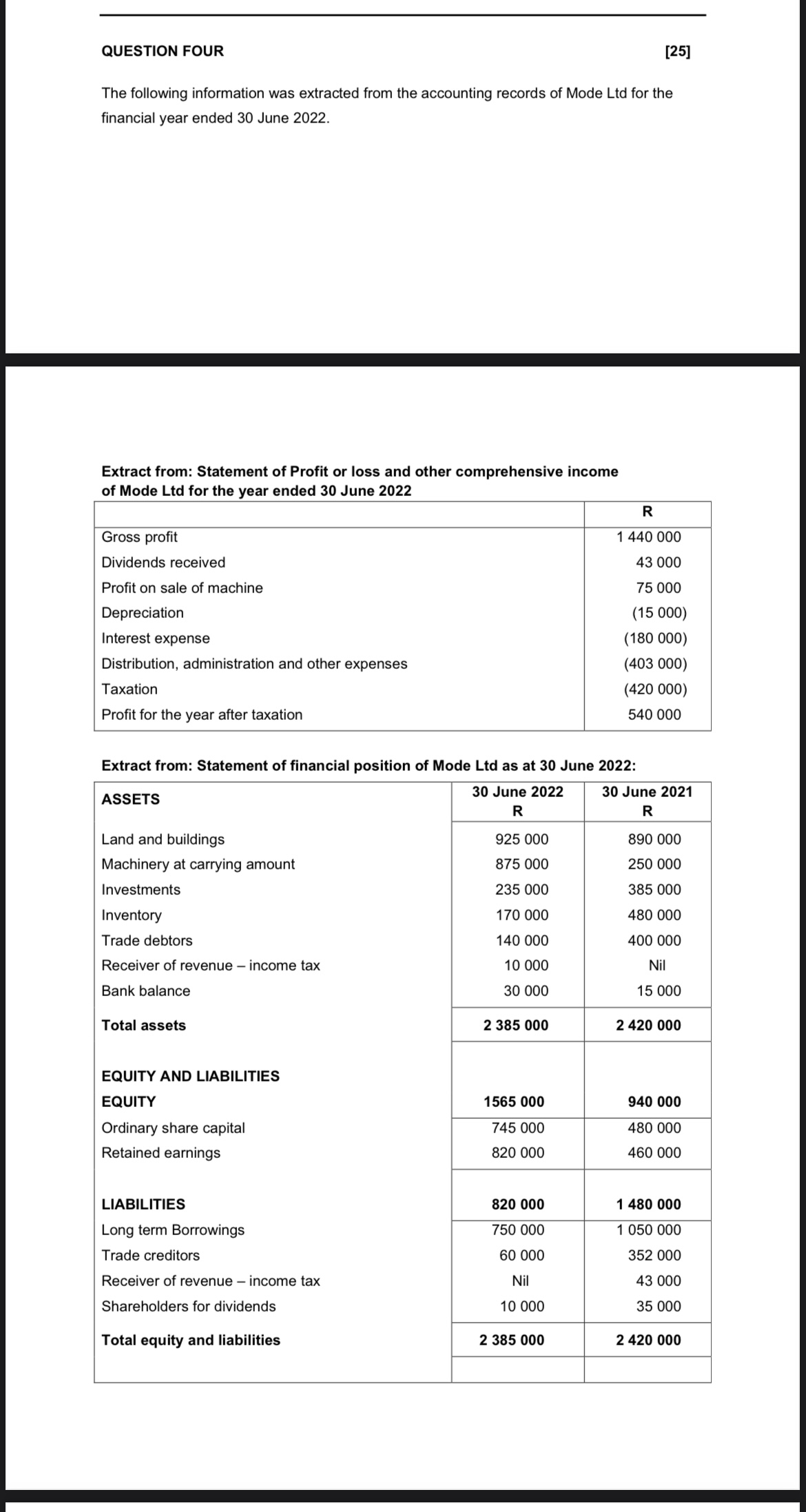

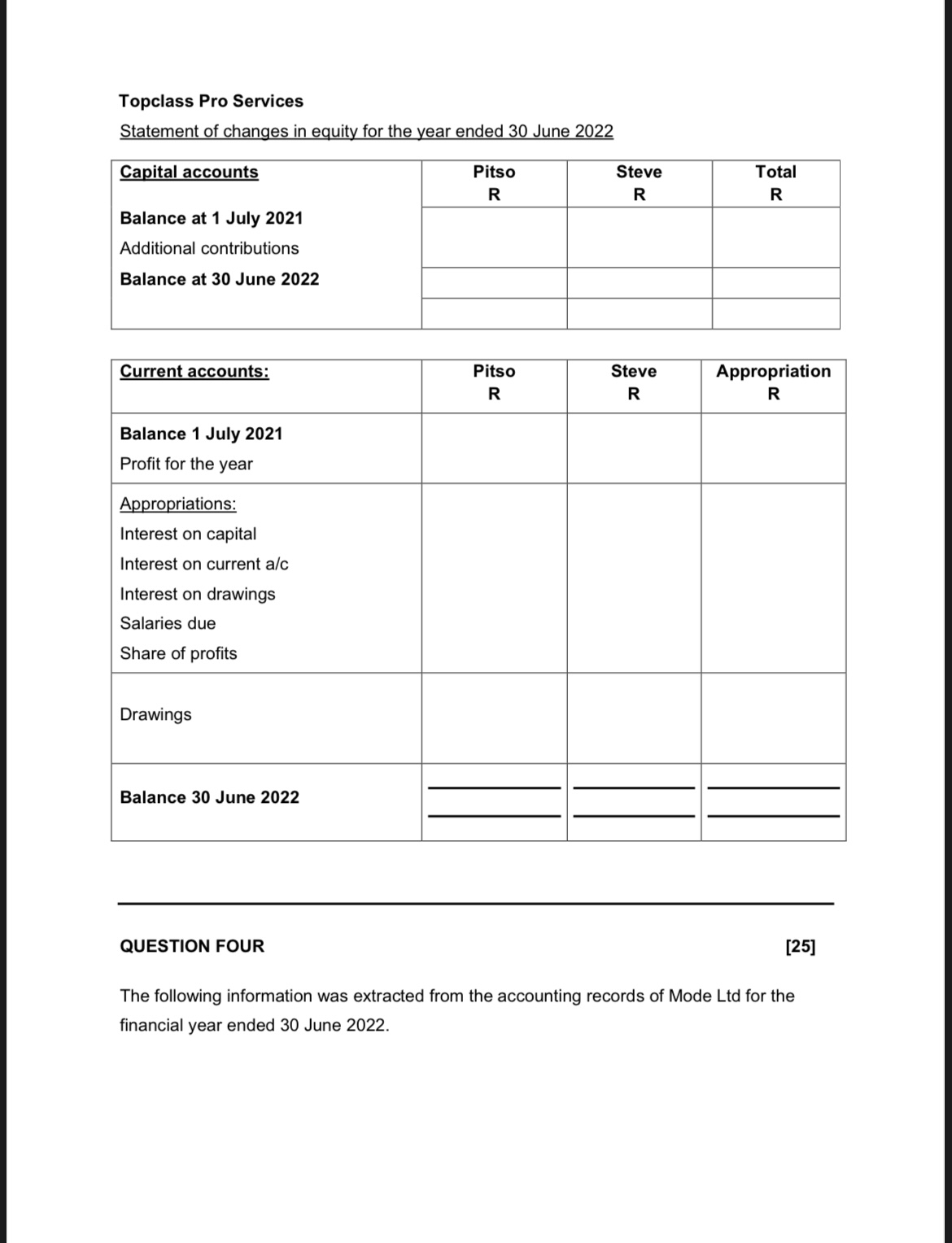

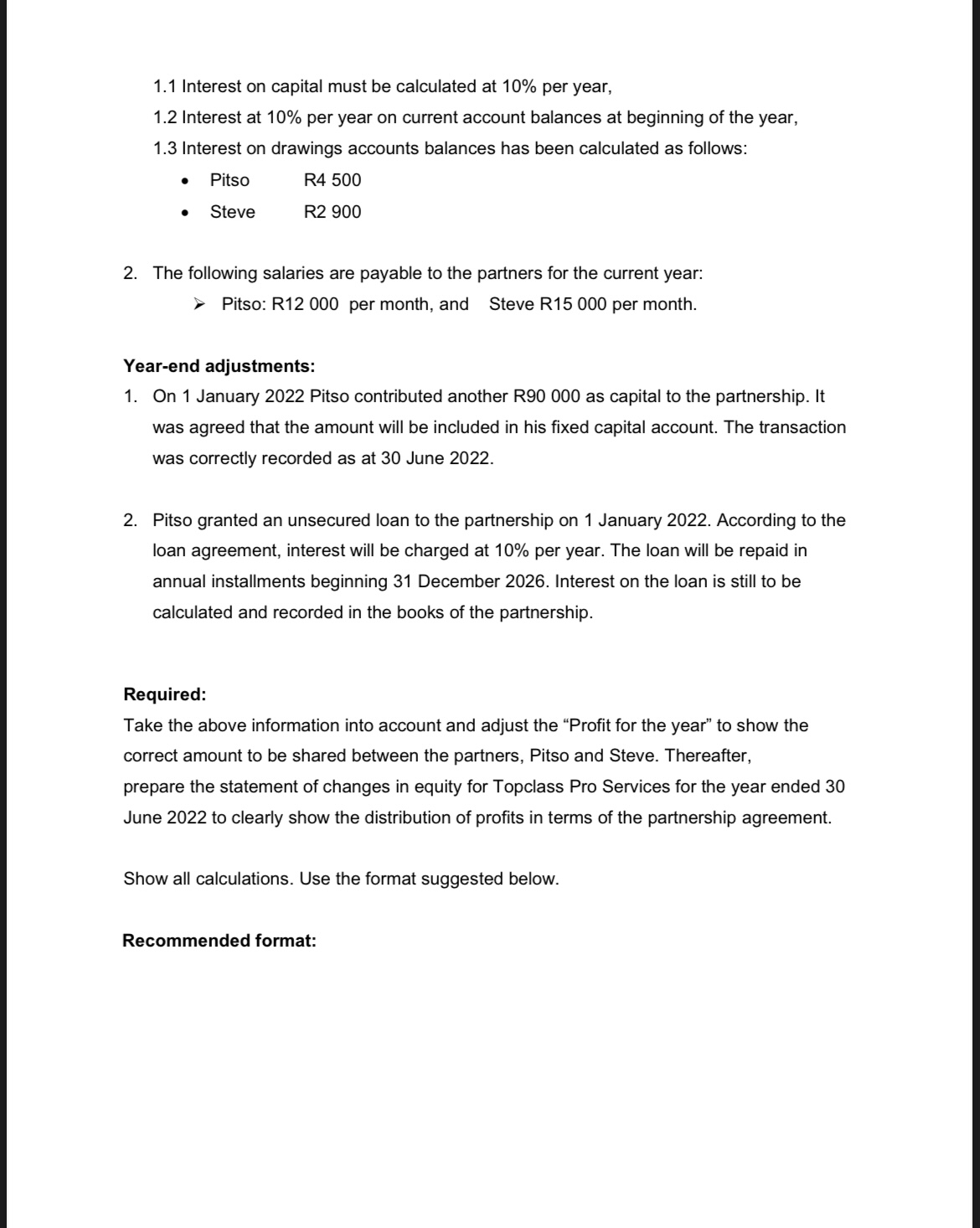

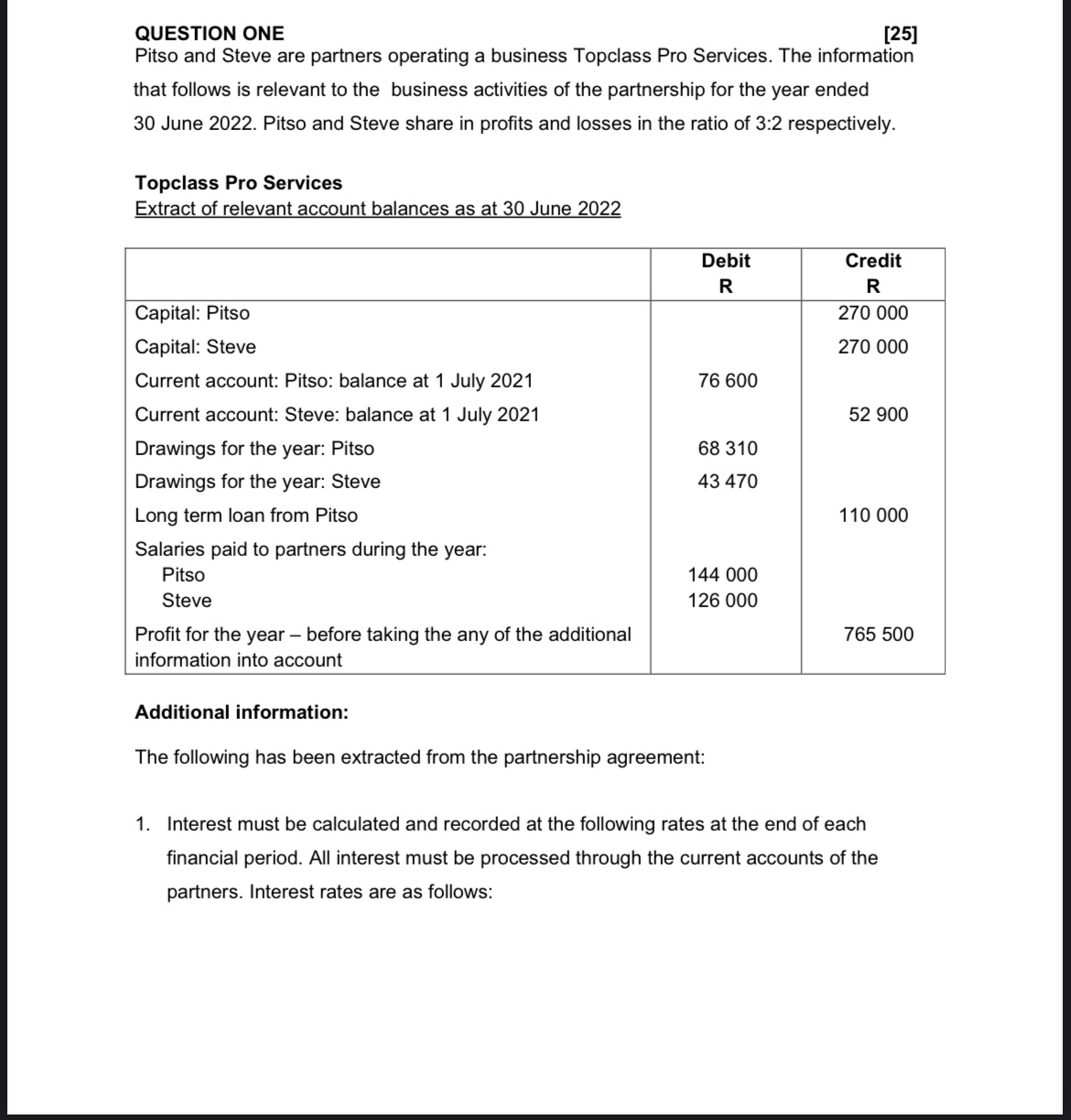

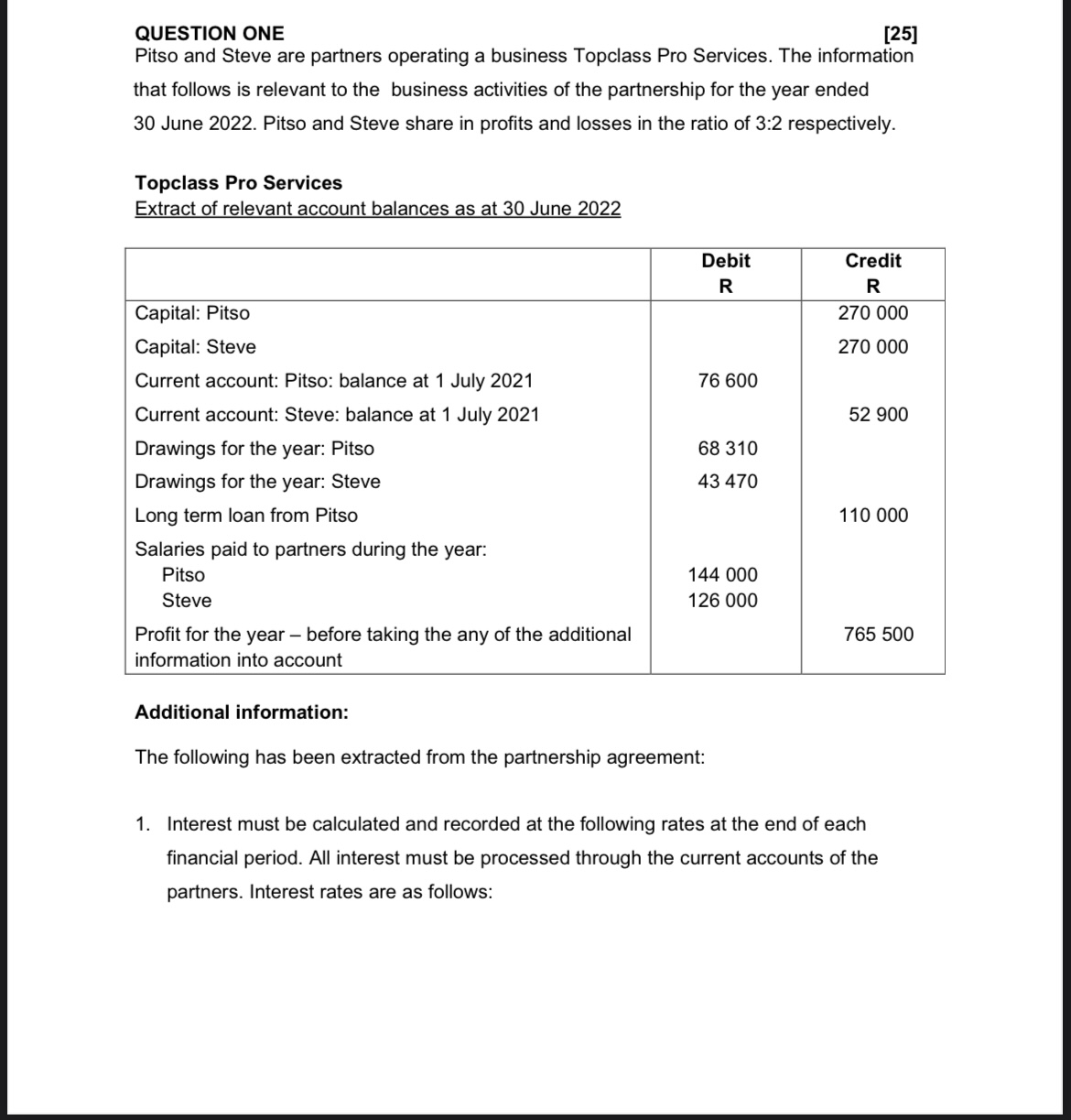

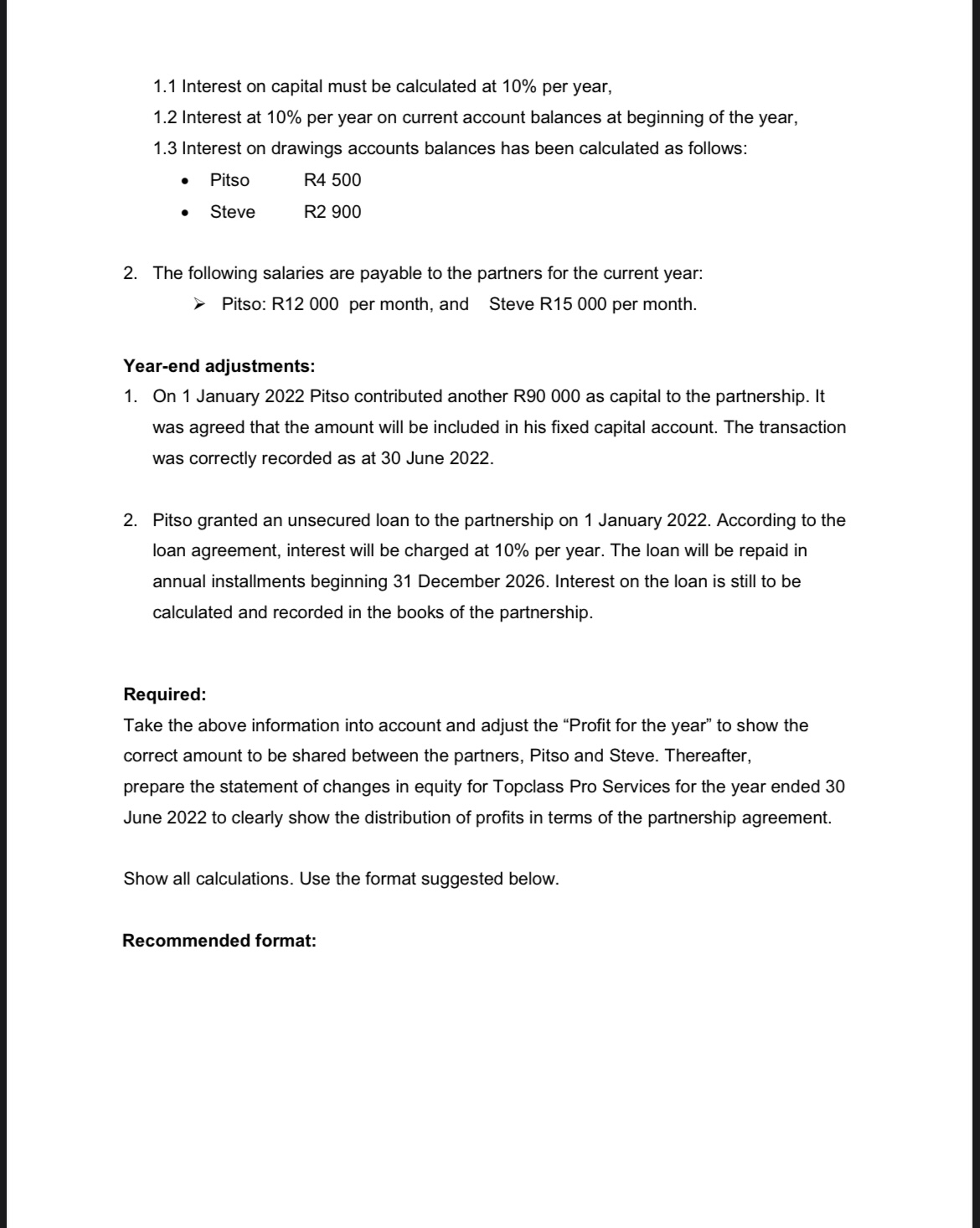

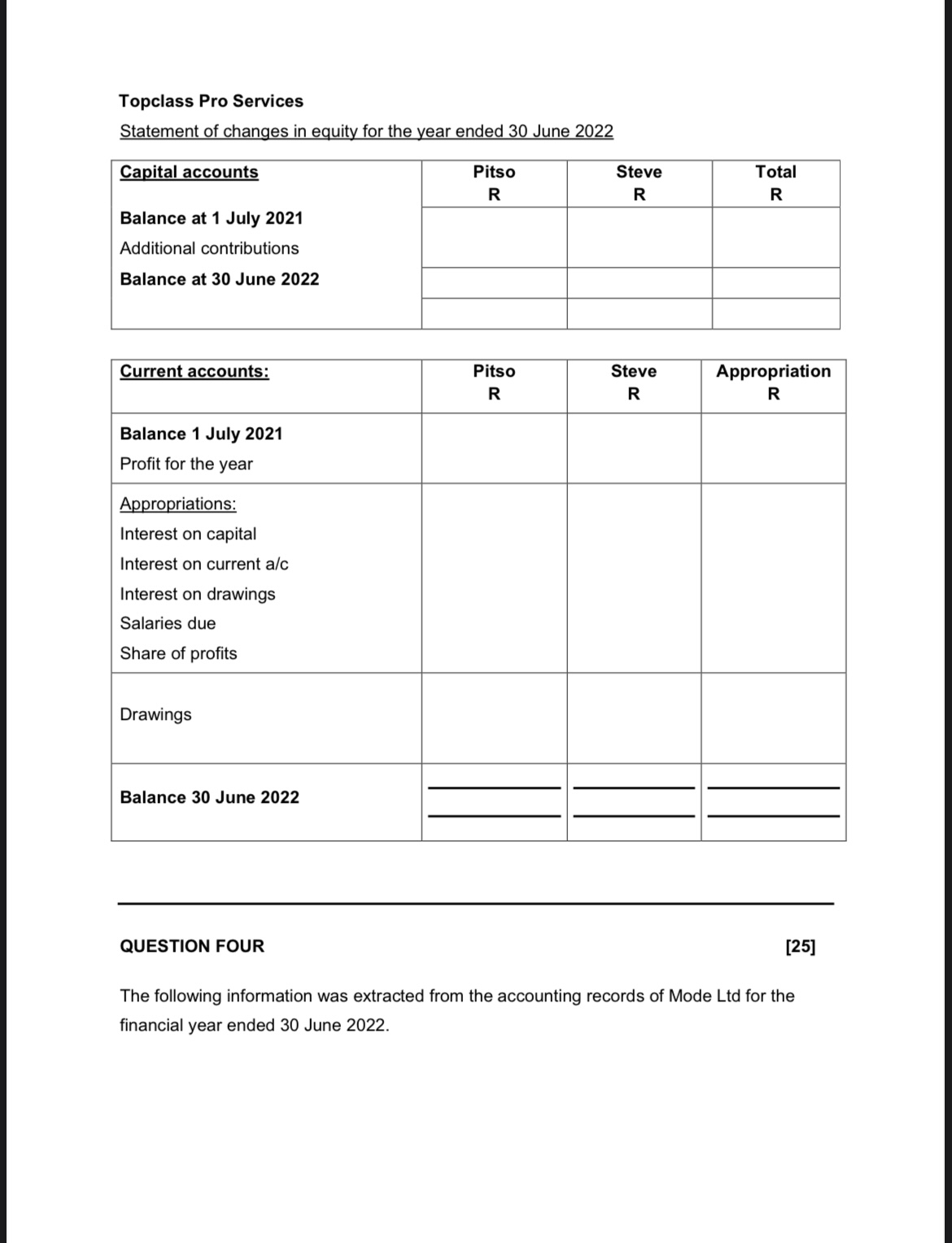

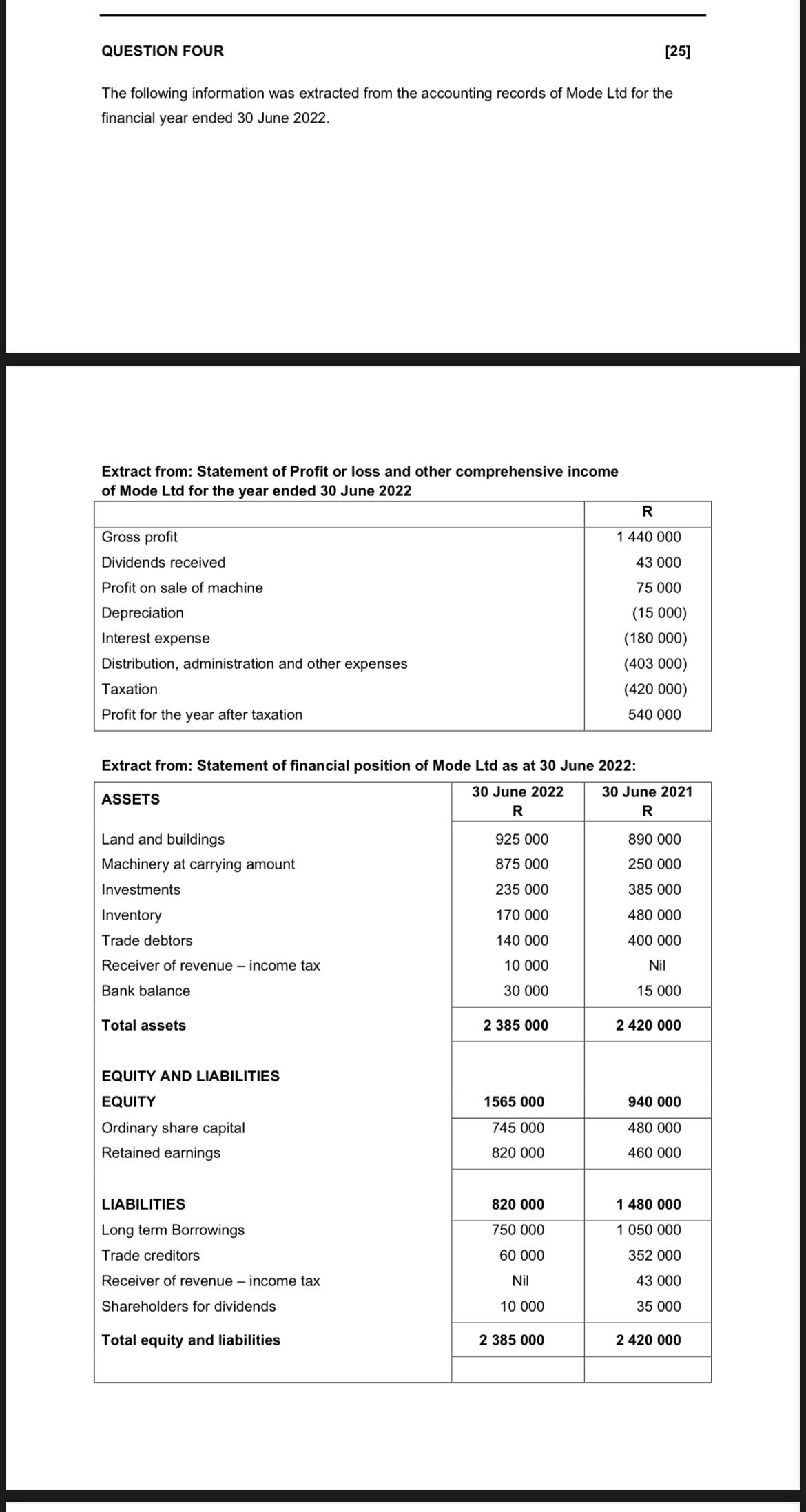

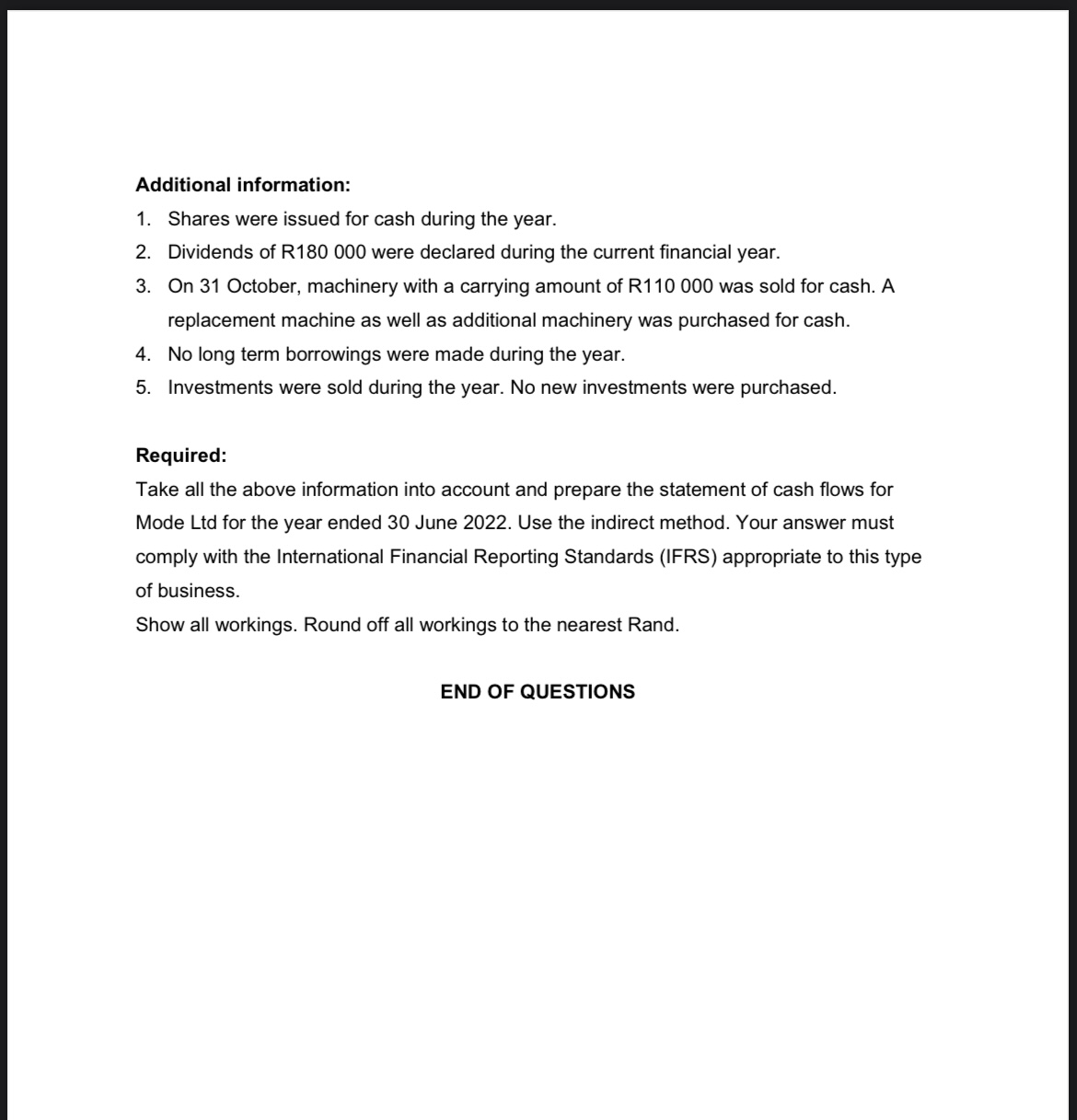

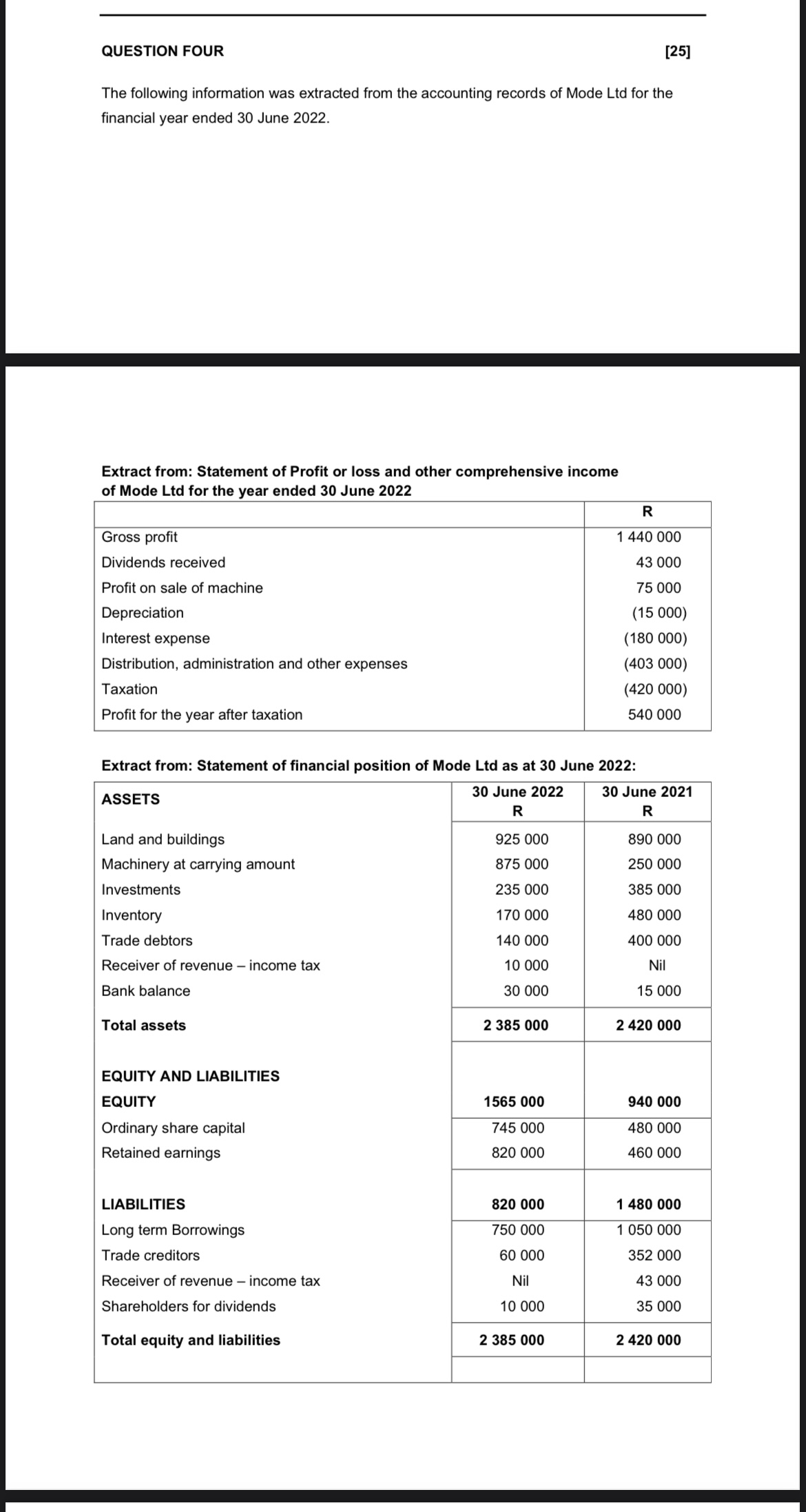

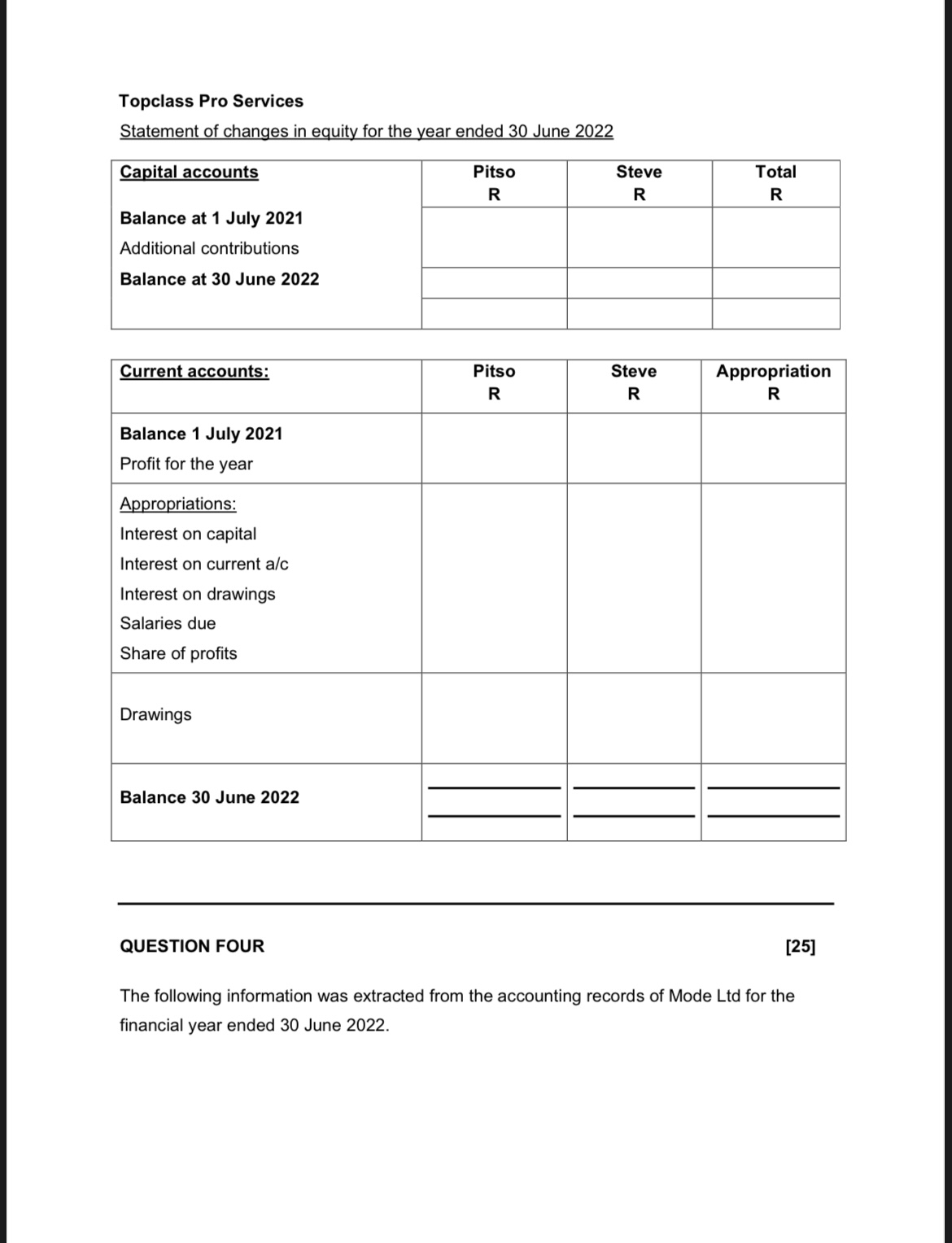

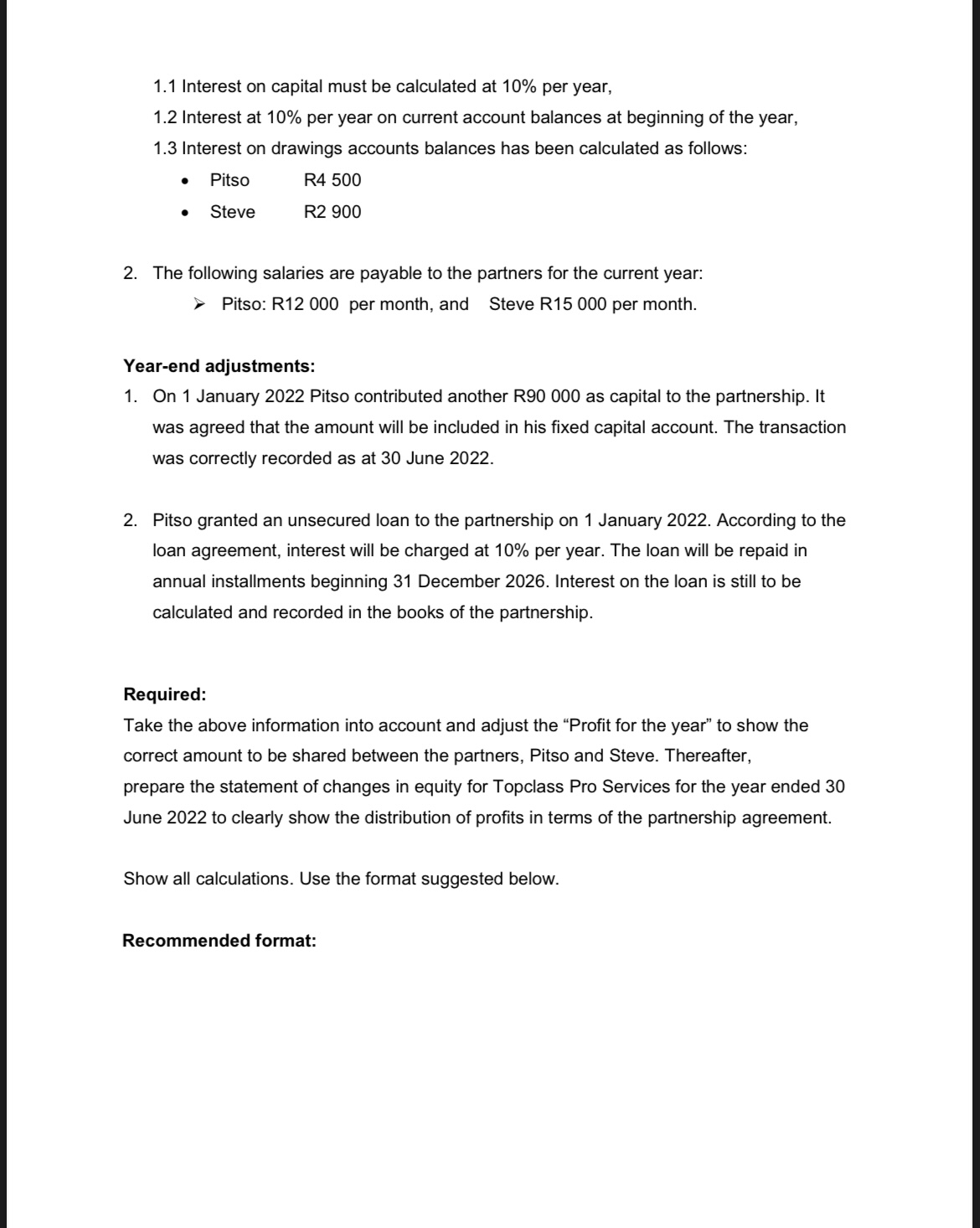

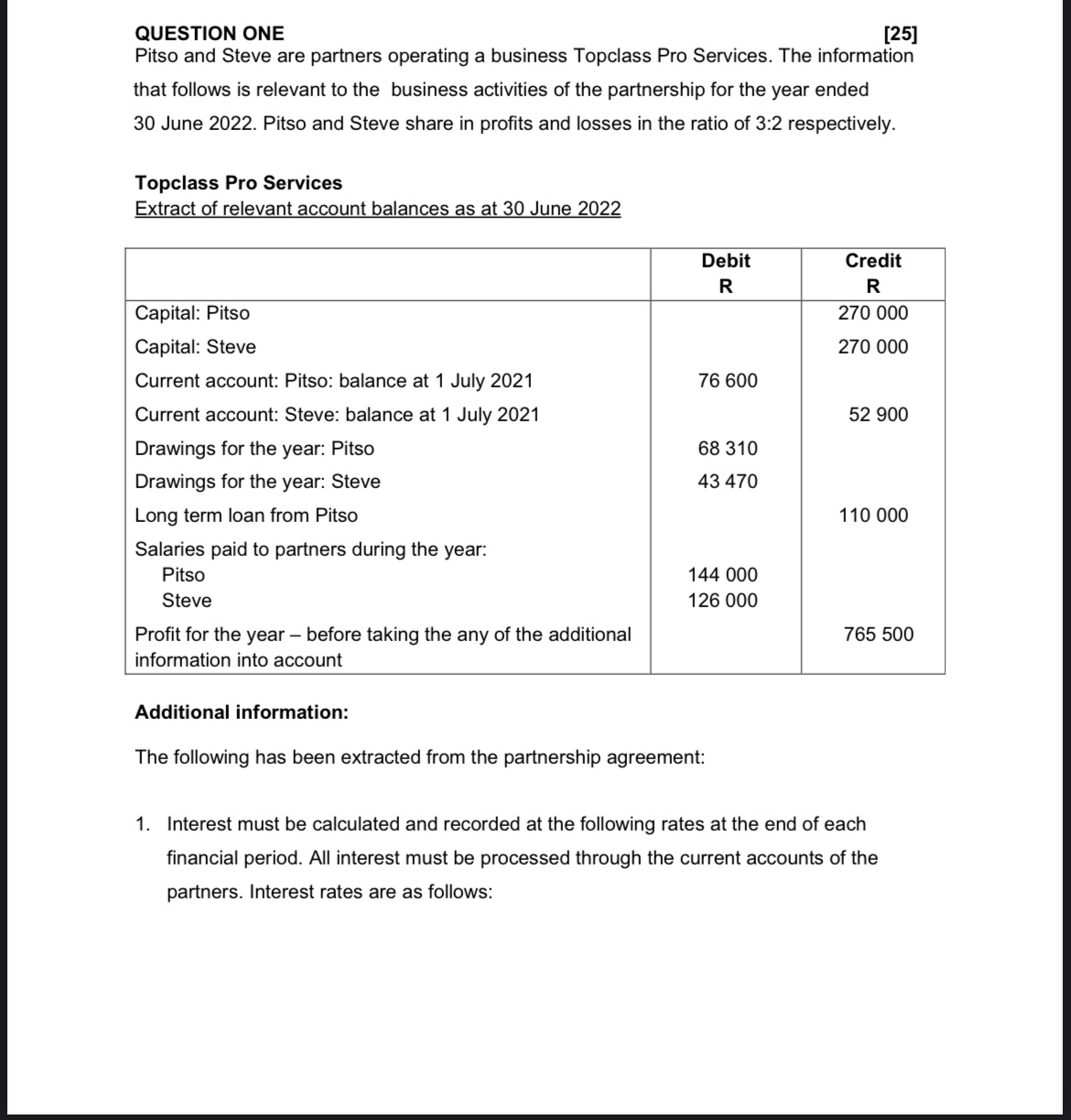

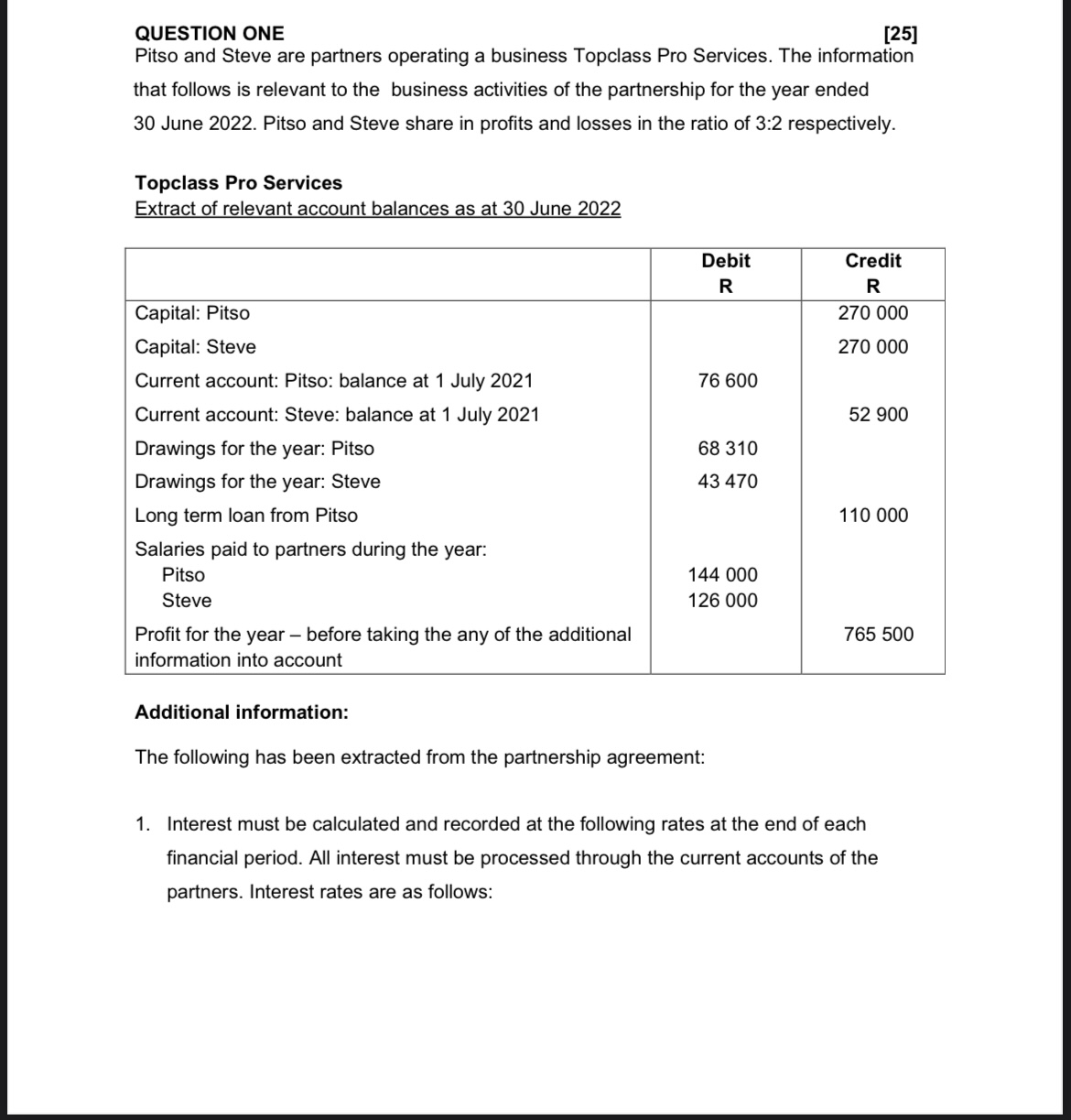

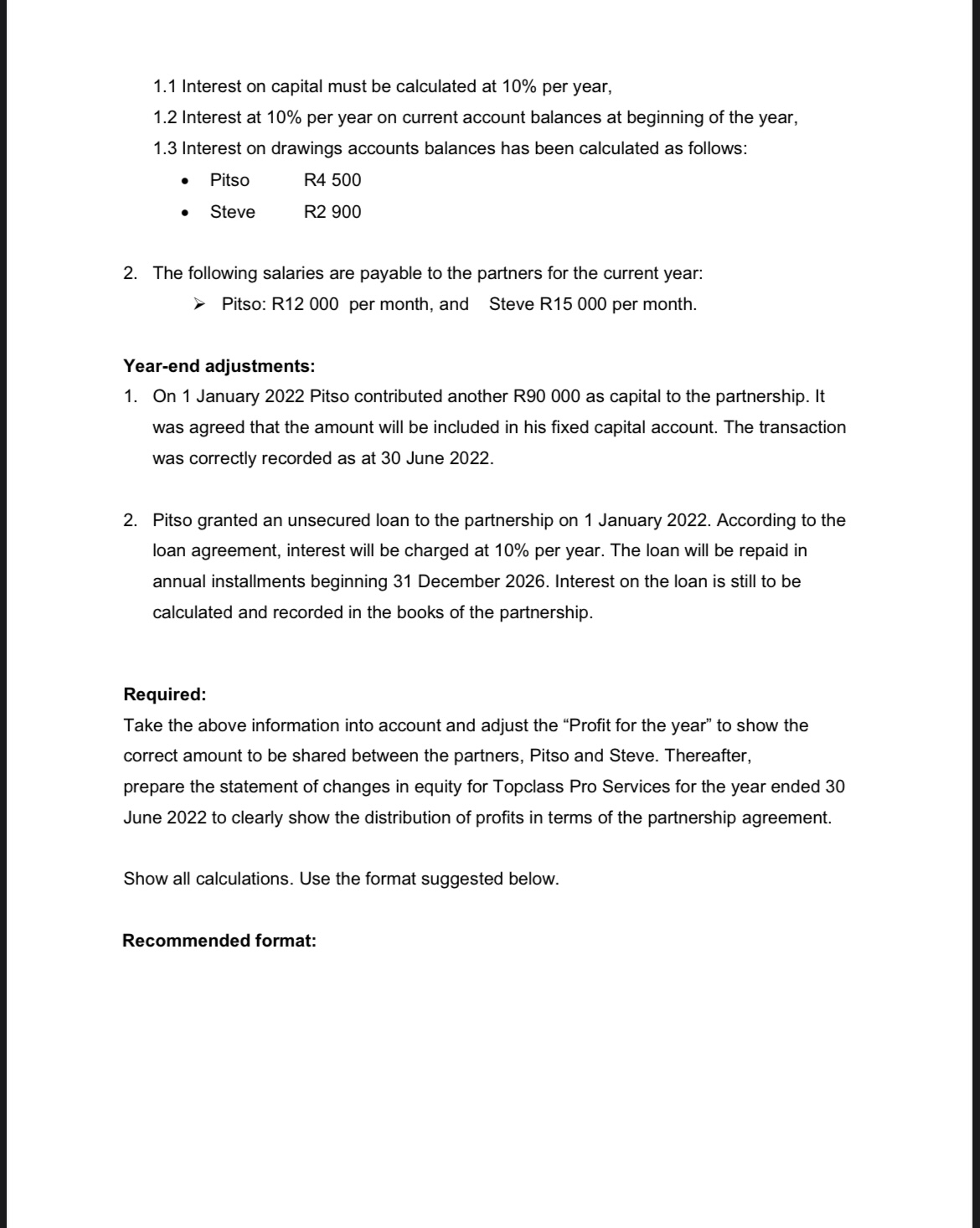

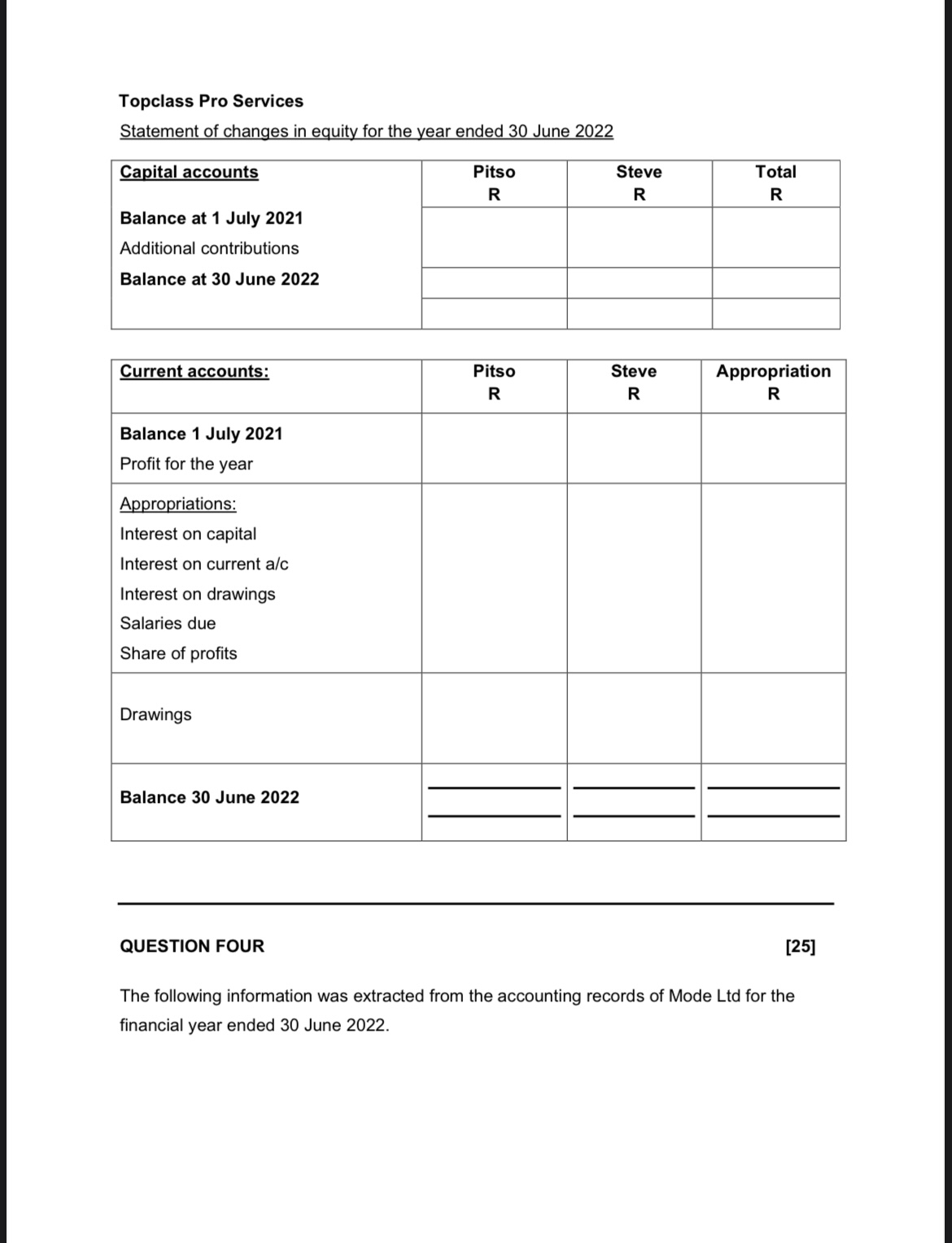

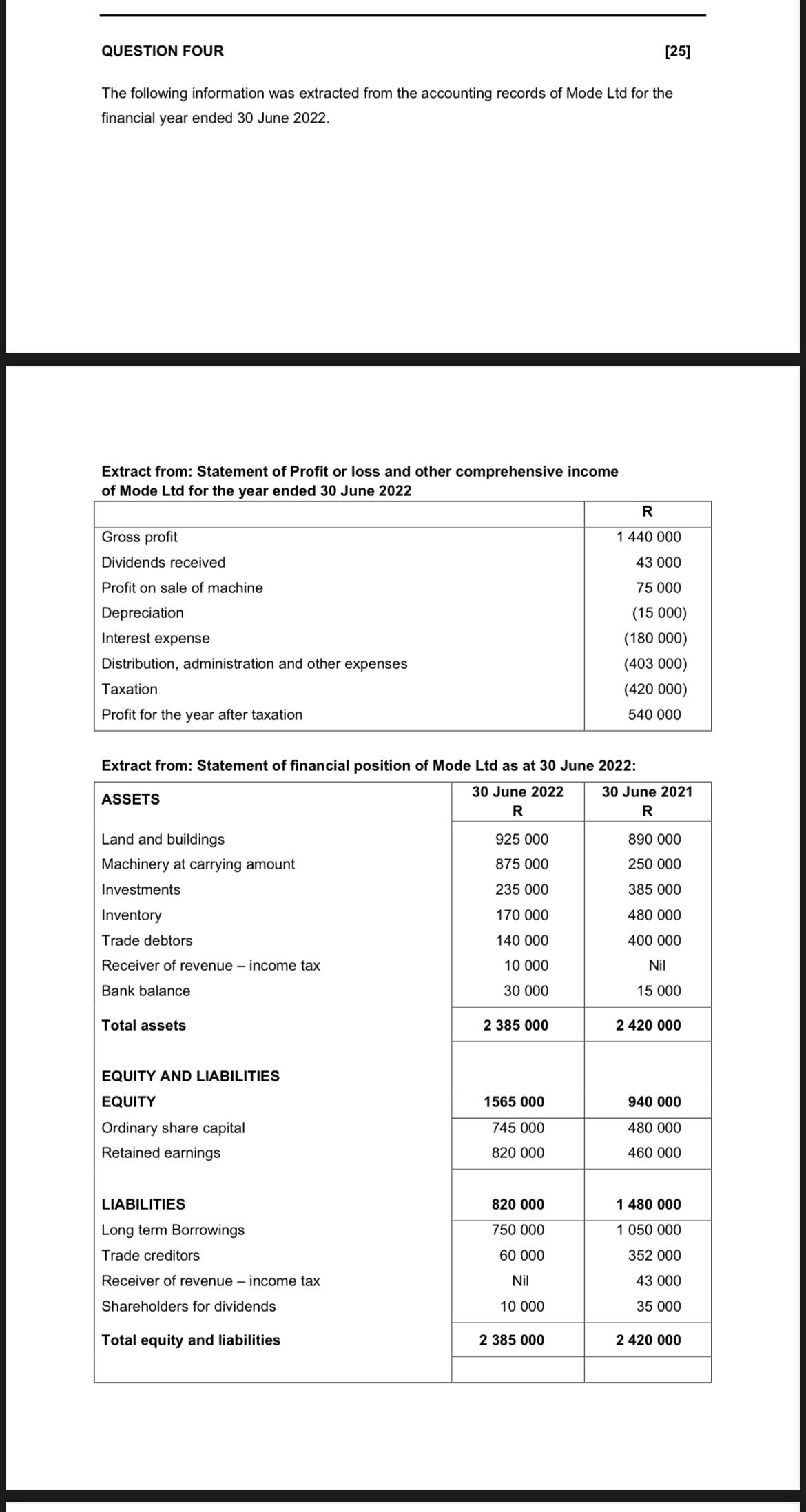

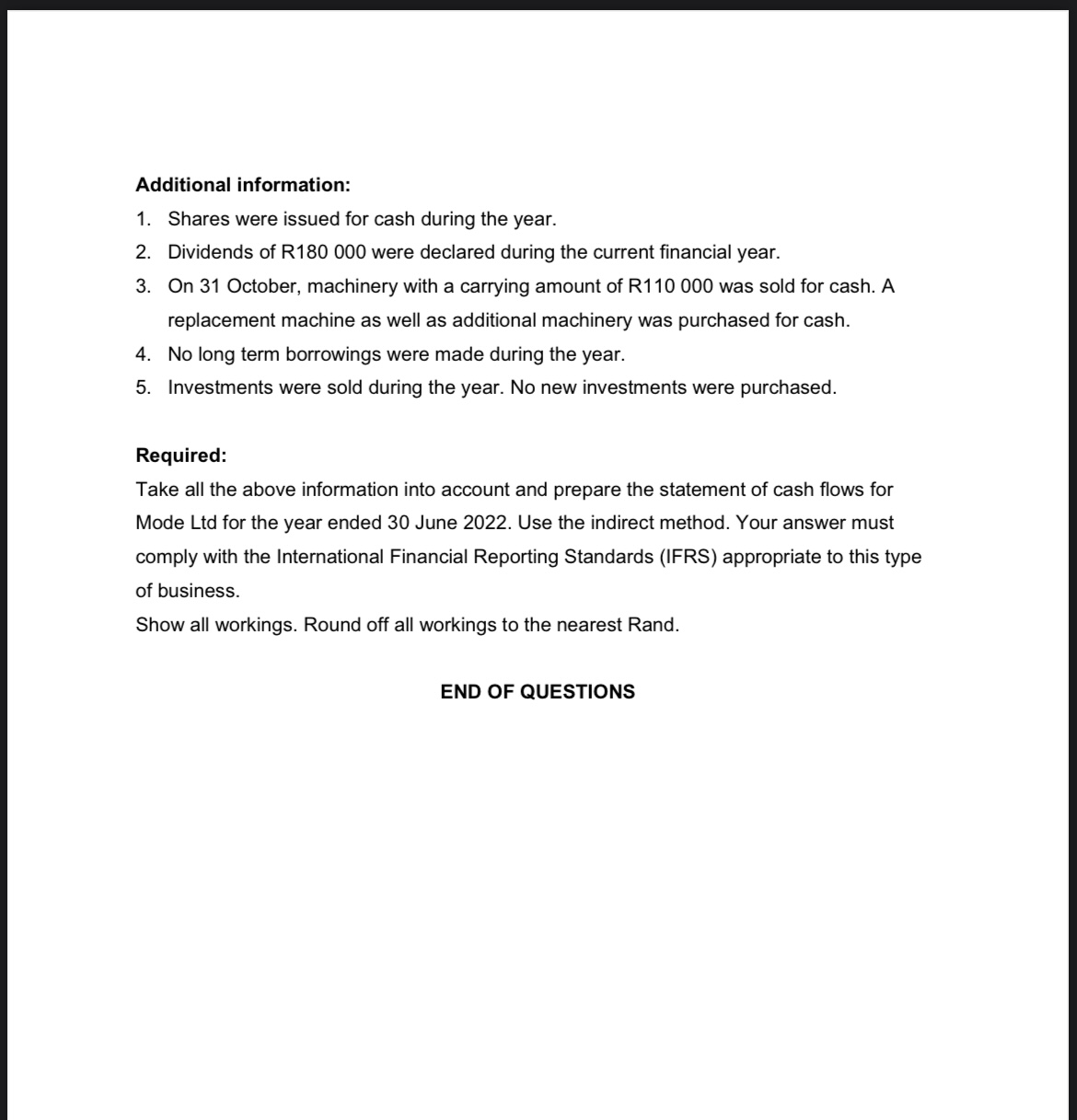

QUESTION ONE [25] Pitso and Steve are partners operating a business Topclass Pro Services. The information that follows is relevant to the business activities of the partnership for the year ended 30 June 2022. Pitso and Steve share in profits and losses in the ratio of 3:2 respectively. Topclass Pro Services Extract of relevant account balances as at 30 June 2022 Additional information: The following has been extracted from the partnership agreement: 1. Interest must be calculated and recorded at the following rates at the end of each financial period. All interest must be processed through the current accounts of the partners. Interest rates are as follows: The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. Extract from: Statement of Profit or loss and other comprehensive income of Mode Ltd for the year ended 30 June 2022 Extract from: Statement of financial position of Mode Ltd as at 30 June 2022: Topclass Pro Services Statement of changes in equity for the year ended 30 June 2022 QUESTION FOUR [25] The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. Topclass Pro Services Statement of changes in equity for the year ended 30 June 2022 QUESTION FOUR [25] The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. QUESTION ONE [25] Pitso and Steve are partners operating a business Topclass Pro Services. The information that follows is relevant to the business activities of the partnership for the year ended 30 June 2022. Pitso and Steve share in profits and losses in the ratio of 3:2 respectively. Topclass Pro Services Extract of relevant account balances as at 30 June 2022 Additional information: The following has been extracted from the partnership agreement: 1. Interest must be calculated and recorded at the following rates at the end of each financial period. All interest must be processed through the current accounts of the partners. Interest rates are as follows: Additional information: 1. Shares were issued for cash during the year. 2. Dividends of R180 000 were declared during the current financial year. 3. On 31 October, machinery with a carrying amount of R110 000 was sold for cash. A replacement machine as well as additional machinery was purchased for cash. 4. No long term borrowings were made during the year. 5. Investments were sold during the year. No new investments were purchased. Required: Take all the above information into account and prepare the statement of cash flows for Mode Ltd for the year ended 30 June 2022. Use the indirect method. Your answer must comply with the International Financial Reporting Standards (IFRS) appropriate to this type of business. Show all workings. Round off all workings to the nearest Rand. The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. Extract from: Statement of Profit or loss and other comprehensive income of Mode Ltd for the year ended 30 June 2022 Extract from: Statement of financial position of Mode Ltd as at 30 June 2022: 1.1 Interest on capital must be calculated at 10% per year, 1.2 Interest at 10% per year on current account balances at beginning of the year, 1.3 Interest on drawings accounts balances has been calculated as follows: - Pitso R4500 - Steve R2 900 2. The following salaries are payable to the partners for the current year: > Pitso: R12 000 per month, and Steve R15 000 per month. Year-end adjustments: 1. On 1 January 2022 Pitso contributed another R90 000 as capital to the partnership. It was agreed that the amount will be included in his fixed capital account. The transaction was correctly recorded as at 30 June 2022 . 2. Pitso granted an unsecured loan to the partnership on 1 January 2022. According to the loan agreement, interest will be charged at 10% per year. The loan will be repaid in annual installments beginning 31 December 2026. Interest on the loan is still to be calculated and recorded in the books of the partnership. Required: Take the above information into account and adjust the "Profit for the year" to show the correct amount to be shared between the partners, Pitso and Steve. Thereafter, prepare the statement of changes in equity for Topclass Pro Services for the year ended 30 June 2022 to clearly show the distribution of profits in terms of the partnership agreement. Show all calculations. Use the format suggested below. Recommended format: 1.1 Interest on capital must be calculated at 10% per year, 1.2 Interest at 10% per year on current account balances at beginning of the year, 1.3 Interest on drawings accounts balances has been calculated as follows: - Pitso R4500 - Steve R2 900 2. The following salaries are payable to the partners for the current year: > Pitso: R12 000 per month, and Steve R15 000 per month. Year-end adjustments: 1. On 1 January 2022 Pitso contributed another R90 000 as capital to the partnership. It was agreed that the amount will be included in his fixed capital account. The transaction was correctly recorded as at 30 June 2022 . 2. Pitso granted an unsecured loan to the partnership on 1 January 2022. According to the loan agreement, interest will be charged at 10% per year. The loan will be repaid in annual installments beginning 31 December 2026. Interest on the loan is still to be calculated and recorded in the books of the partnership. Required: Take the above information into account and adjust the "Profit for the year" to show the correct amount to be shared between the partners, Pitso and Steve. Thereafter, prepare the statement of changes in equity for Topclass Pro Services for the year ended 30 June 2022 to clearly show the distribution of profits in terms of the partnership agreement. Show all calculations. Use the format suggested below. Recommended format: QUESTION ONE [25] Pitso and Steve are partners operating a business Topclass Pro Services. The information that follows is relevant to the business activities of the partnership for the year ended 30 June 2022. Pitso and Steve share in profits and losses in the ratio of 3:2 respectively. Topclass Pro Services Extract of relevant account balances as at 30 June 2022 Additional information: The following has been extracted from the partnership agreement: 1. Interest must be calculated and recorded at the following rates at the end of each financial period. All interest must be processed through the current accounts of the partners. Interest rates are as follows: The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. Extract from: Statement of Profit or loss and other comprehensive income of Mode Ltd for the year ended 30 June 2022 Extract from: Statement of financial position of Mode Ltd as at 30 June 2022: Topclass Pro Services Statement of changes in equity for the year ended 30 June 2022 QUESTION FOUR [25] The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. Topclass Pro Services Statement of changes in equity for the year ended 30 June 2022 QUESTION FOUR [25] The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. QUESTION ONE [25] Pitso and Steve are partners operating a business Topclass Pro Services. The information that follows is relevant to the business activities of the partnership for the year ended 30 June 2022. Pitso and Steve share in profits and losses in the ratio of 3:2 respectively. Topclass Pro Services Extract of relevant account balances as at 30 June 2022 Additional information: The following has been extracted from the partnership agreement: 1. Interest must be calculated and recorded at the following rates at the end of each financial period. All interest must be processed through the current accounts of the partners. Interest rates are as follows: Additional information: 1. Shares were issued for cash during the year. 2. Dividends of R180 000 were declared during the current financial year. 3. On 31 October, machinery with a carrying amount of R110 000 was sold for cash. A replacement machine as well as additional machinery was purchased for cash. 4. No long term borrowings were made during the year. 5. Investments were sold during the year. No new investments were purchased. Required: Take all the above information into account and prepare the statement of cash flows for Mode Ltd for the year ended 30 June 2022. Use the indirect method. Your answer must comply with the International Financial Reporting Standards (IFRS) appropriate to this type of business. Show all workings. Round off all workings to the nearest Rand. The following information was extracted from the accounting records of Mode Ltd for the financial year ended 30 June 2022. Extract from: Statement of Profit or loss and other comprehensive income of Mode Ltd for the year ended 30 June 2022 Extract from: Statement of financial position of Mode Ltd as at 30 June 2022: 1.1 Interest on capital must be calculated at 10% per year, 1.2 Interest at 10% per year on current account balances at beginning of the year, 1.3 Interest on drawings accounts balances has been calculated as follows: - Pitso R4500 - Steve R2 900 2. The following salaries are payable to the partners for the current year: > Pitso: R12 000 per month, and Steve R15 000 per month. Year-end adjustments: 1. On 1 January 2022 Pitso contributed another R90 000 as capital to the partnership. It was agreed that the amount will be included in his fixed capital account. The transaction was correctly recorded as at 30 June 2022 . 2. Pitso granted an unsecured loan to the partnership on 1 January 2022. According to the loan agreement, interest will be charged at 10% per year. The loan will be repaid in annual installments beginning 31 December 2026. Interest on the loan is still to be calculated and recorded in the books of the partnership. Required: Take the above information into account and adjust the "Profit for the year" to show the correct amount to be shared between the partners, Pitso and Steve. Thereafter, prepare the statement of changes in equity for Topclass Pro Services for the year ended 30 June 2022 to clearly show the distribution of profits in terms of the partnership agreement. Show all calculations. Use the format suggested below. Recommended format: 1.1 Interest on capital must be calculated at 10% per year, 1.2 Interest at 10% per year on current account balances at beginning of the year, 1.3 Interest on drawings accounts balances has been calculated as follows: - Pitso R4500 - Steve R2 900 2. The following salaries are payable to the partners for the current year: > Pitso: R12 000 per month, and Steve R15 000 per month. Year-end adjustments: 1. On 1 January 2022 Pitso contributed another R90 000 as capital to the partnership. It was agreed that the amount will be included in his fixed capital account. The transaction was correctly recorded as at 30 June 2022 . 2. Pitso granted an unsecured loan to the partnership on 1 January 2022. According to the loan agreement, interest will be charged at 10% per year. The loan will be repaid in annual installments beginning 31 December 2026. Interest on the loan is still to be calculated and recorded in the books of the partnership. Required: Take the above information into account and adjust the "Profit for the year" to show the correct amount to be shared between the partners, Pitso and Steve. Thereafter, prepare the statement of changes in equity for Topclass Pro Services for the year ended 30 June 2022 to clearly show the distribution of profits in terms of the partnership agreement. Show all calculations. Use the format suggested below. Recommended format