Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE (7.5 Marks) Cost of Capital Analysis Nthanda Corporation Plans to embark into a New Market in Botswana. The risk profile in Botswana is

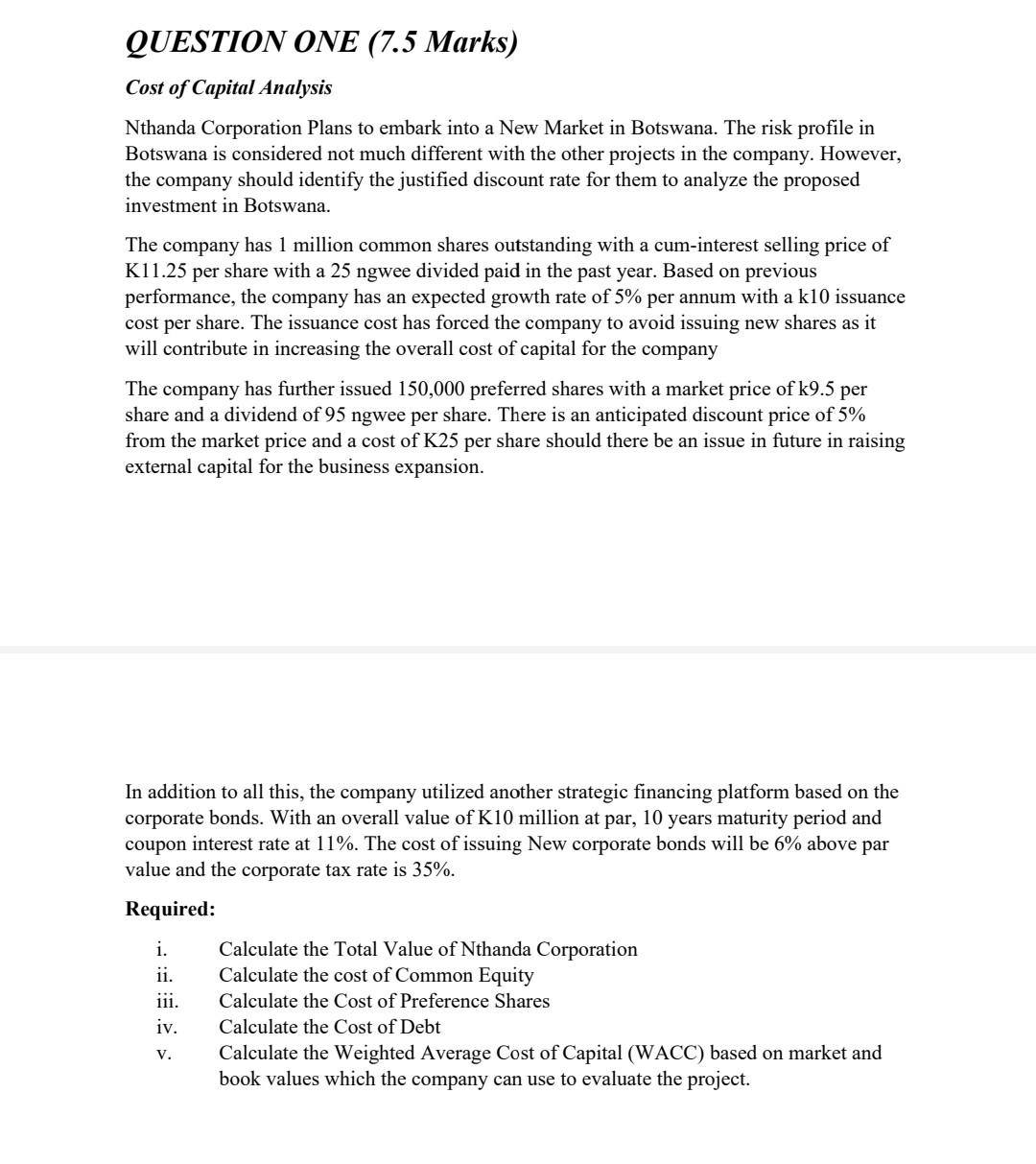

QUESTION ONE (7.5 Marks) Cost of Capital Analysis Nthanda Corporation Plans to embark into a New Market in Botswana. The risk profile in Botswana is considered not much different with the other projects in the company. However, the company should identify the justified discount rate for them to analyze the proposed investment in Botswana. The company has 1 million common shares outstanding with a cum-interest selling price of K11.25 per share with a 25 ngwee divided paid in the past year. Based on previous performance, the company has an expected growth rate of 5% per annum with a k10 issuance cost per share. The issuance cost has forced the company to avoid issuing new shares as it will contribute in increasing the overall cost of capital for the company The company has further issued 150,000 preferred shares with a market price of k9.5 per share and a dividend of 95 ngwee per share. There is an anticipated discount price of 5% from the market price and a cost of K25 per share should there be an issue in future in raising external capital for the business expansion. In addition to all this, the company utilized another strategic financing platform based on the corporate bonds. With an overall value of K10 million at par, 10 years maturity period and coupon interest rate at 11%. The cost of issuing New corporate bonds will be 6% above par value and the corporate tax rate is 35%. Required: i. . 111. iv. Calculate the Total Value of Nthanda Corporation Calculate the cost of Common Equity Calculate the Cost of Preference Shares Calculate the Cost of Debt Calculate the Weighted Average Cost of Capital (WACC) based on market and book values which the company can use to evaluate the project. V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started