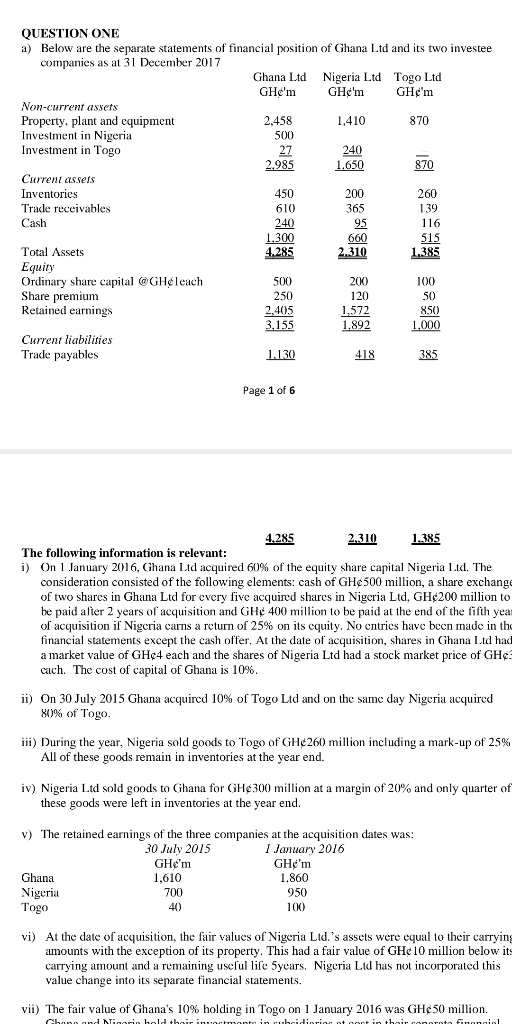

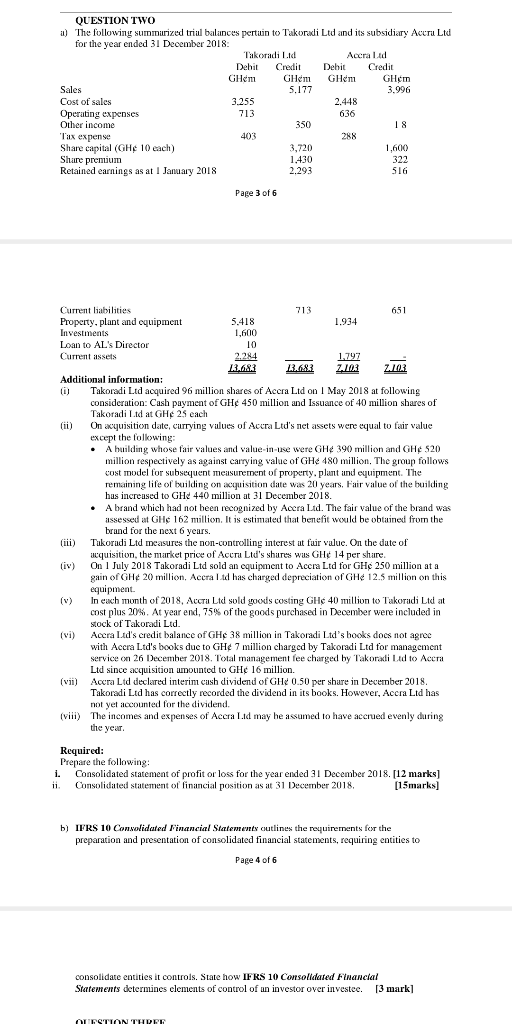

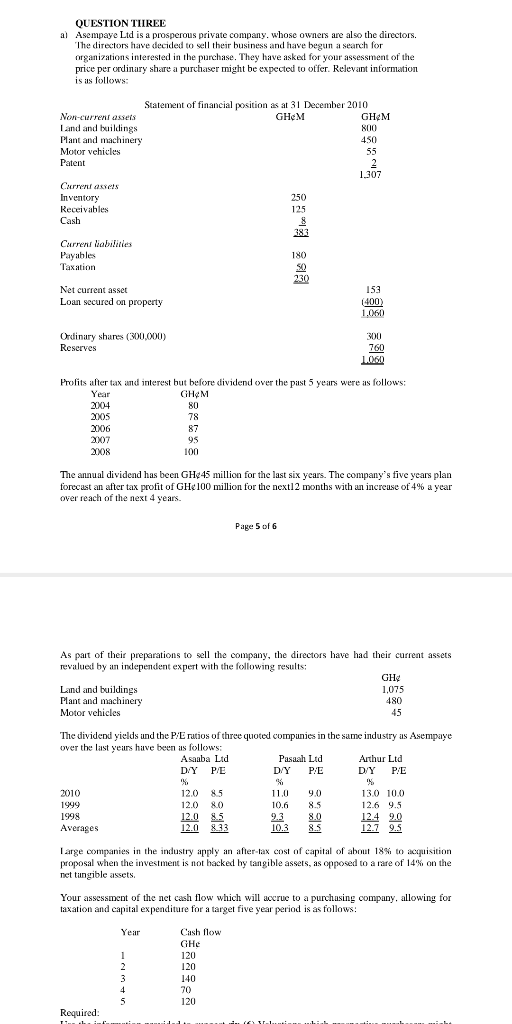

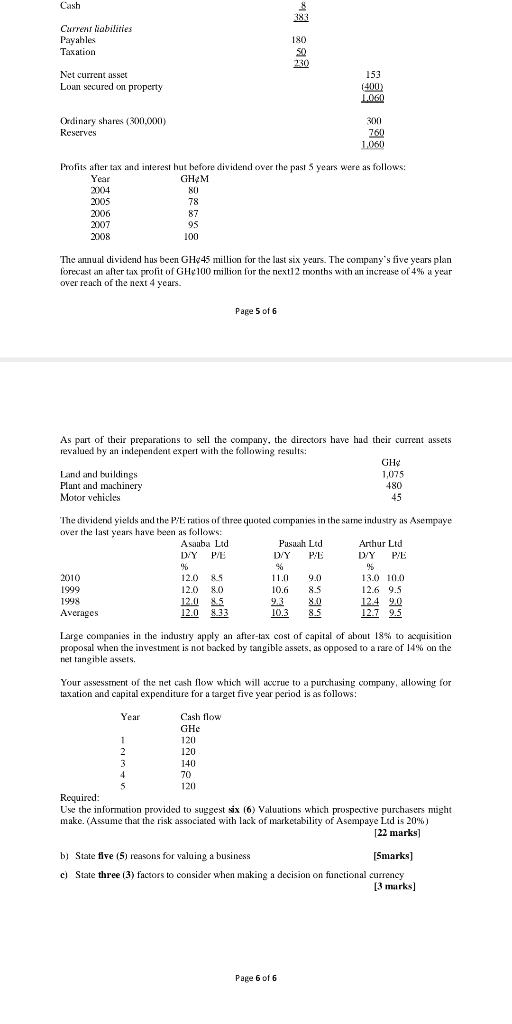

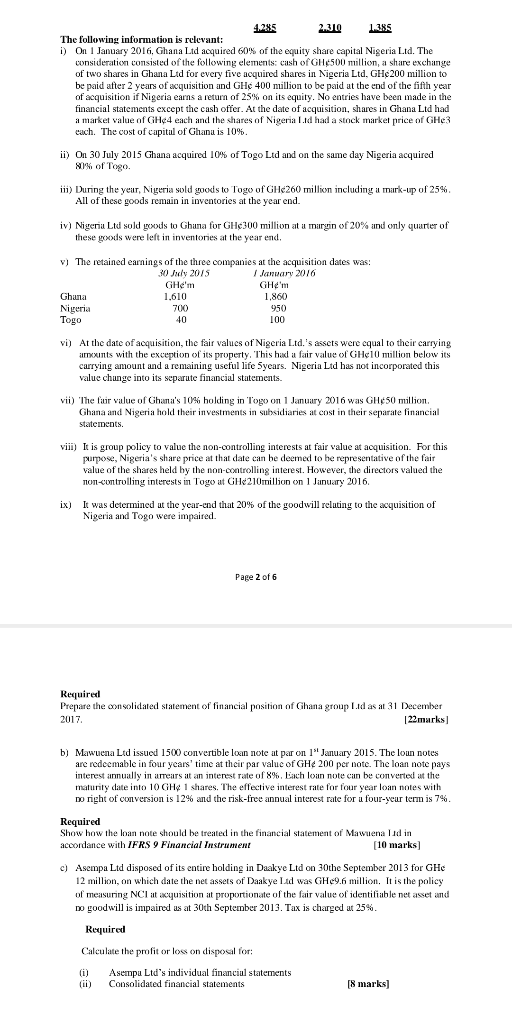

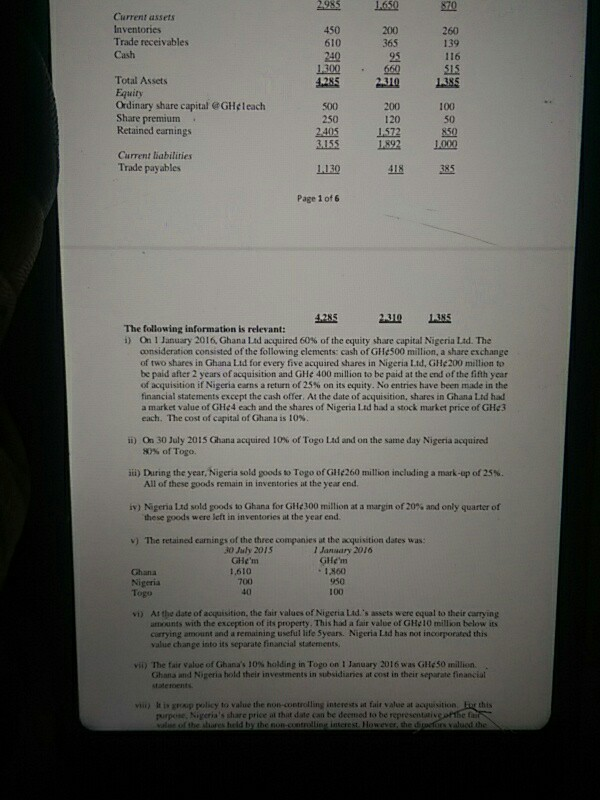

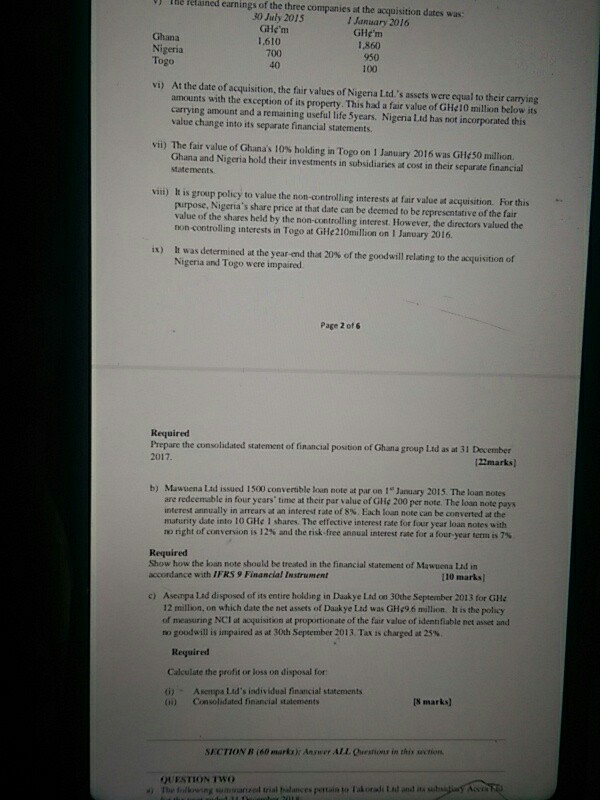

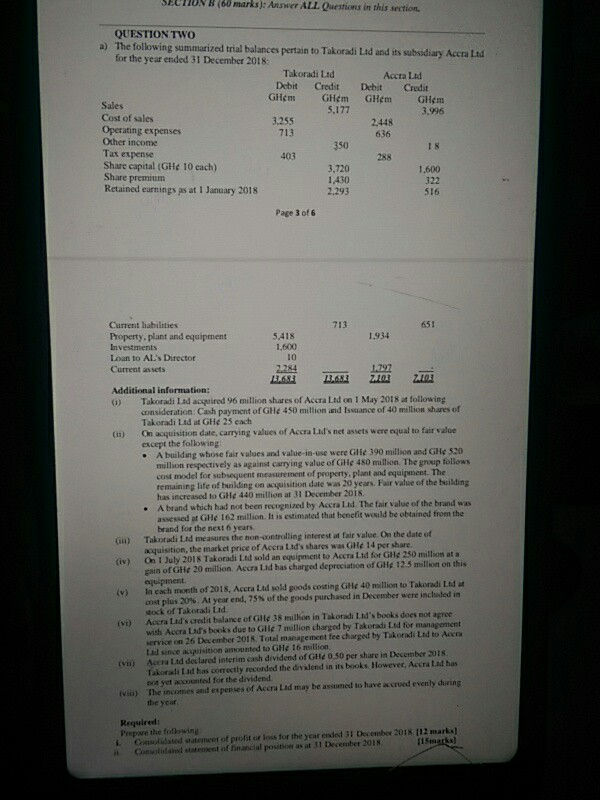

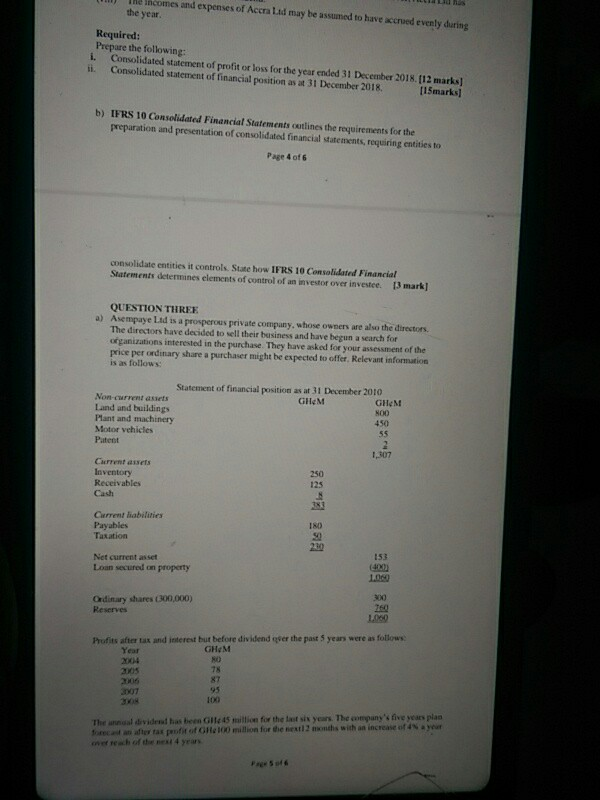

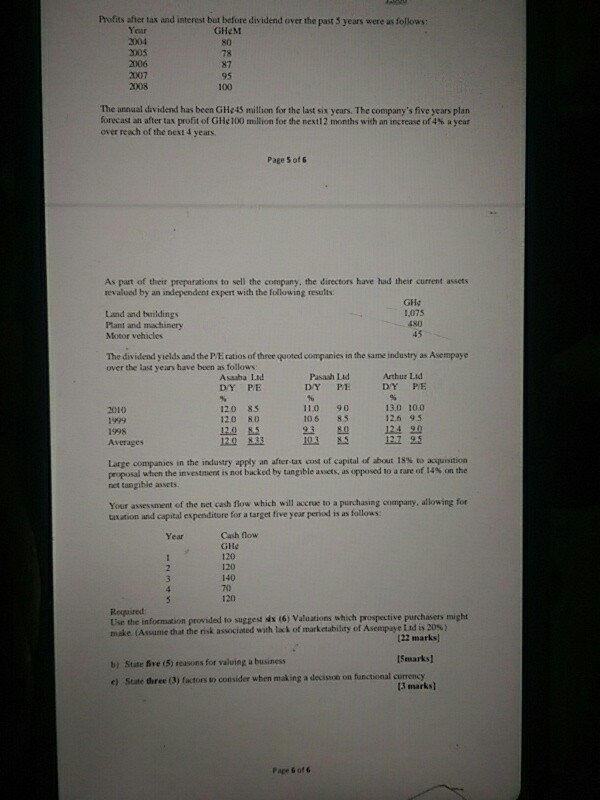

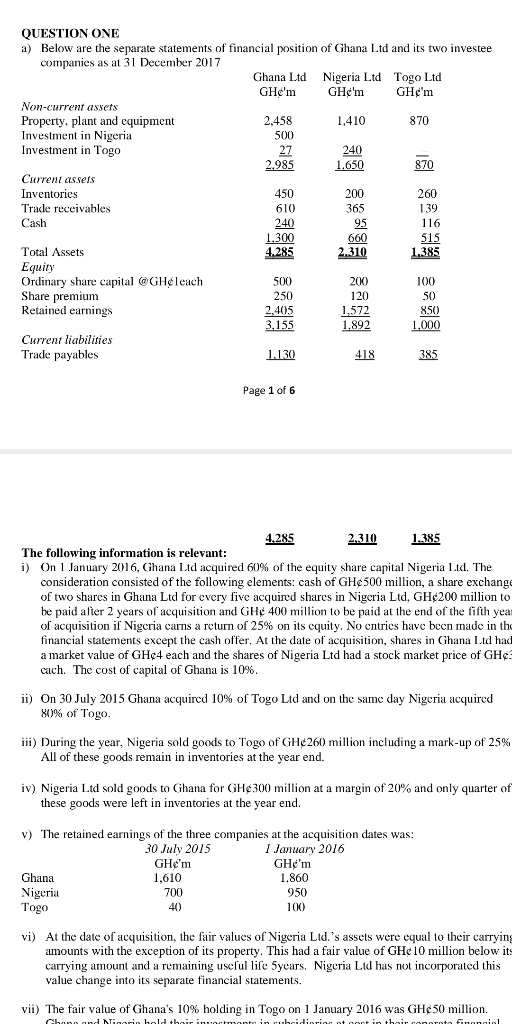

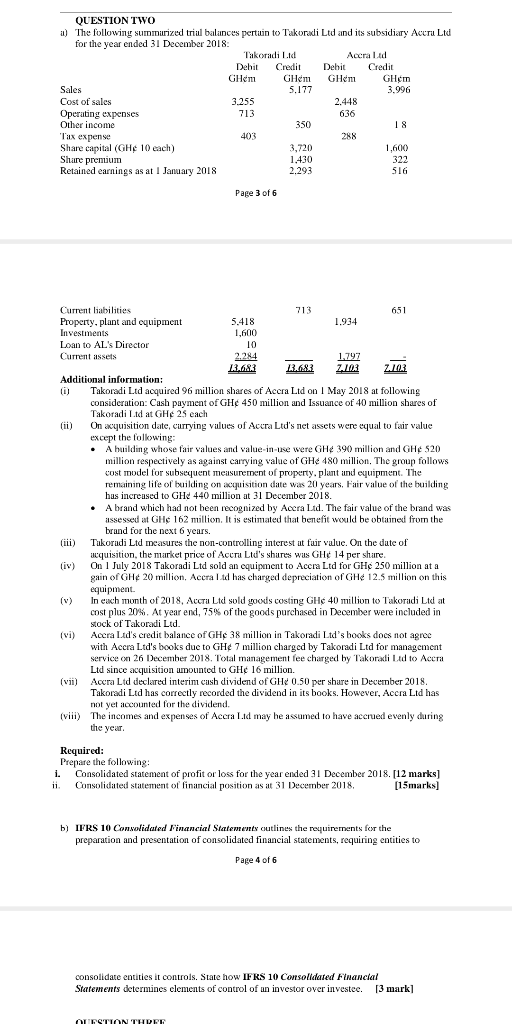

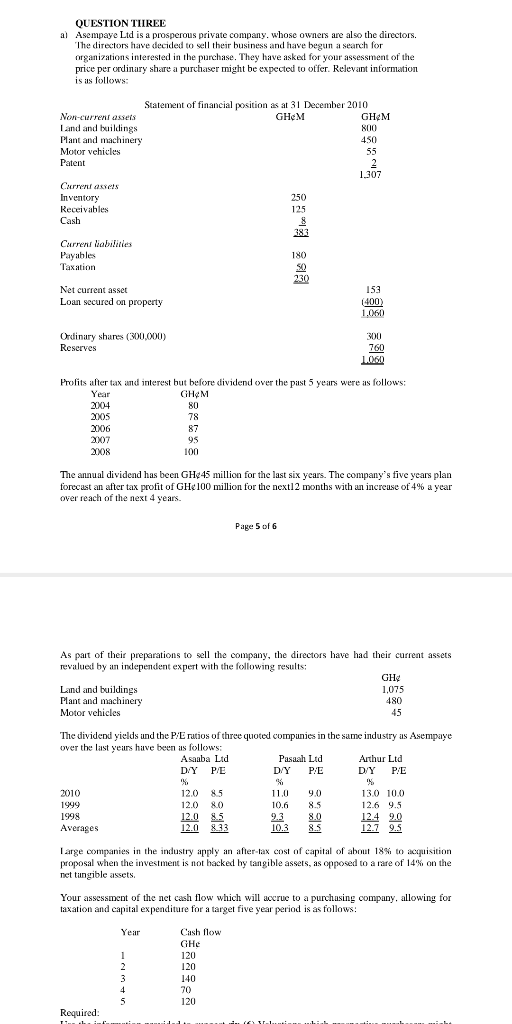

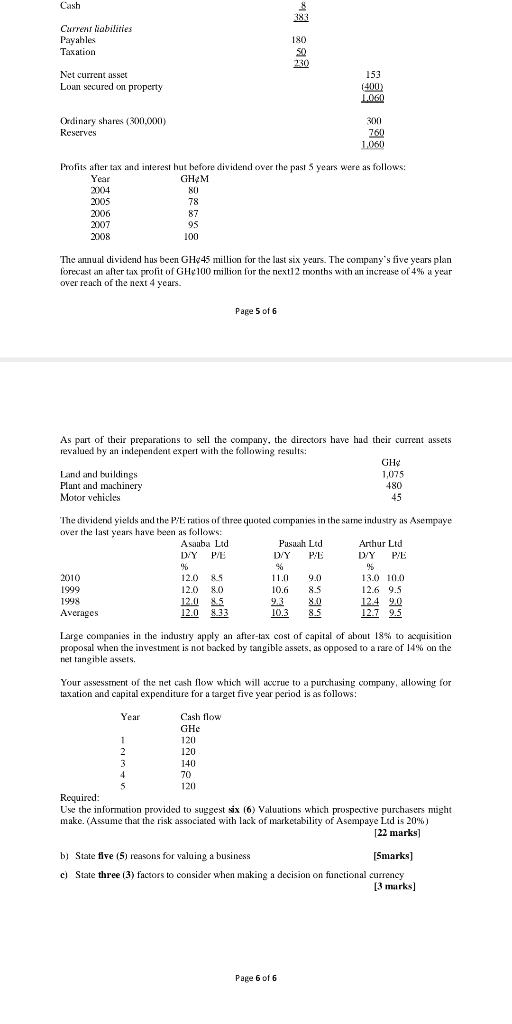

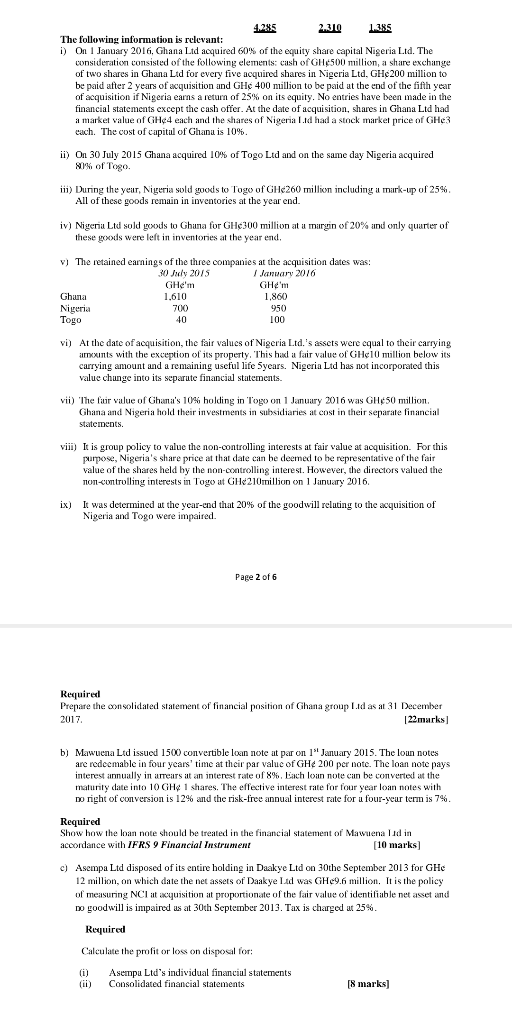

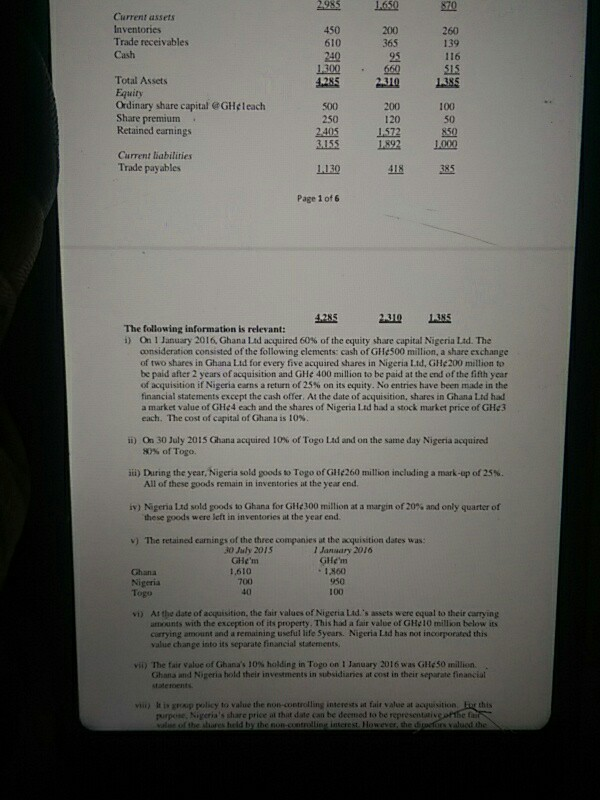

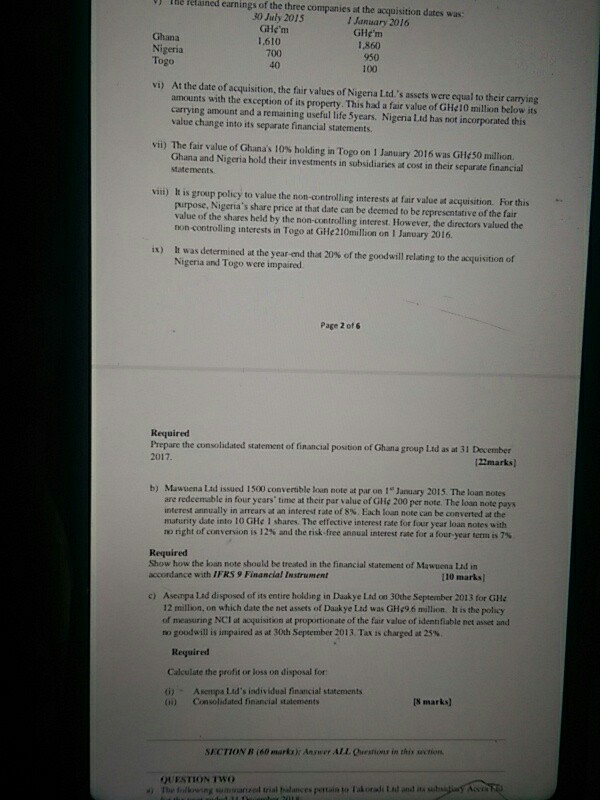

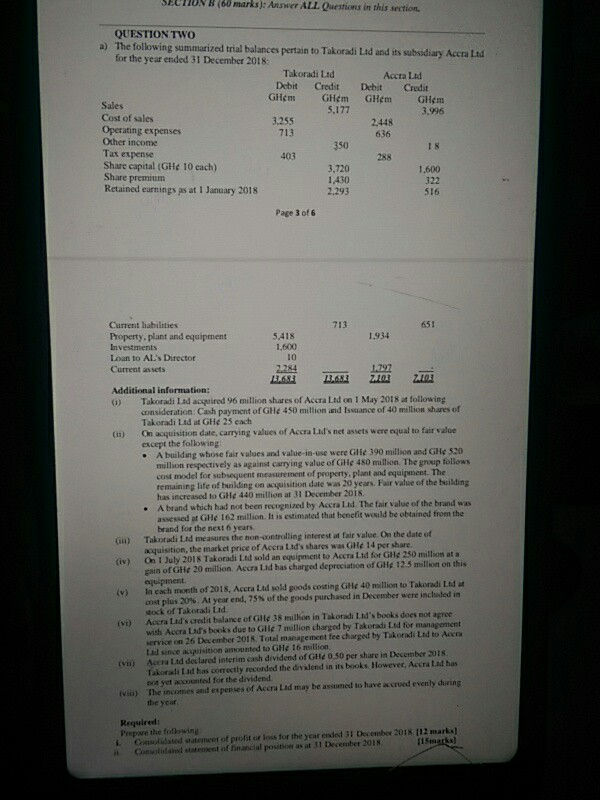

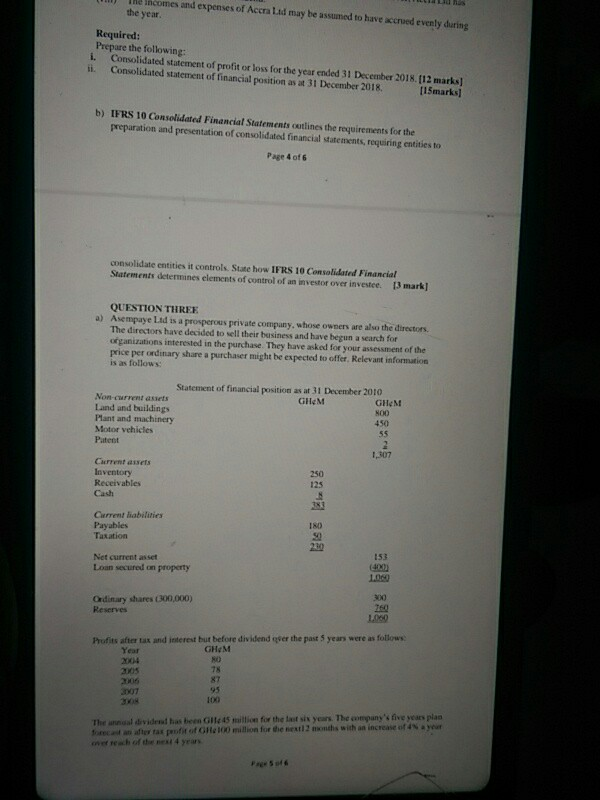

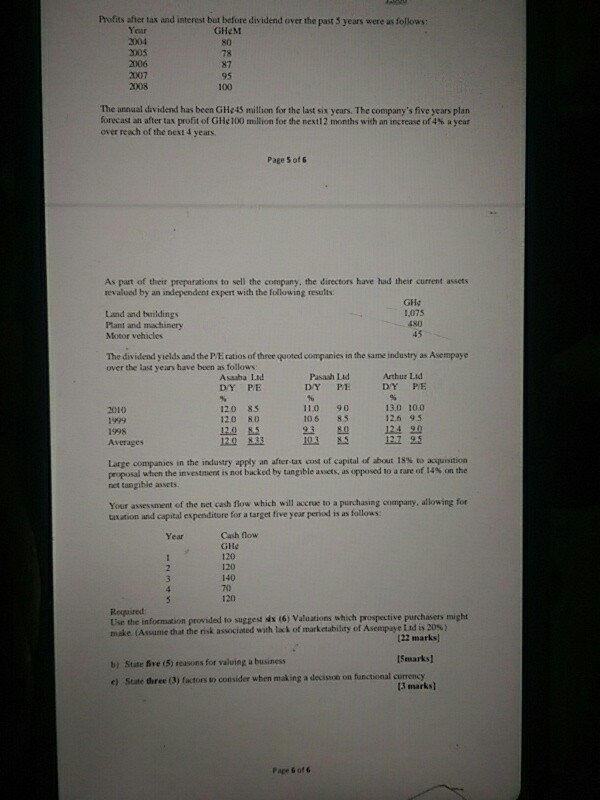

QUESTION ONE a) Below are the separate statements of financial position of Ghana Ltd and its two investee companies as at 31 December 2017 Ghana Ltd Nigeria Ltd Togo Ltd GHe'm GH'm GH'm Non-current assets Property, plant and equipment 2,458 1.410 870 Investment in Nigeria 500 Investment in Togo 27 240 2.985 1.650 870 Curreni assets Inventories 450 200 260 Trade receivables 610 365 139 Cash 240 95 116 1,300 660 515 Total Assets 4.285 2.310 1,385 Equity Ordinary share capital @GH@leach 500 200) 100 Share premium 250 120 50 Retained earnings 2,405 1.572 850) 3.155 1.892 1,000 Current liabilities Trade payables 1.130 418 385 Page 1 of 6 4.285 2.310 1.385 The following information is relevant: i) On 1 January 2016, Ghana Ltd acquired 60% of the equity share capital Nigeria Ltd. The consideration consisted of the following elements: cash of GH500 million, a share exchange of two shares in Ghana Ltd for every five acquired shares in Nigeria Ltd, GH200 million to be paid after 2 years of acquisition and GH 400 million to be paid at the end of the fifth year of acquisition if Nigeria carns a return of 25% on its cquity. No entries have been made in the financial statements except the cash offer. At the date of acquisition, shares in Ghana Ltd had a market value of GH4 each and the shares of Nigeria Ltd had a stock market price of GH cach. The cost of capital of Ghana is 10%. ii) On 30 July 2015 Ghana acquired 10% of Togo Ltd and on the same day Nigeria acquired 80% of Togo. iii) During the year, Nigeria sold goods to Togo of GH260 million including a mark-up of 25% All of these goods remain in inventories at the year end. iv) Nigeria Ltd sold goods to Ghana for GH 300 million at a margin of 20% and only quarter of these goods were left in inventories at the year end. v) The retained earnings of the three companies at the acquisition dates was: 30 July 2015 1 January 2016 GHe'm GHe'm Ghana 1,610 1.860 Nigeria 700 950 Togo 40 100 vi) At the date of acquisition, the fair values of Nigeria Ltd.'s assets were equal to their carrying amounts with the exception of its property. This had a fair value of GH10 million below it carrying amount and a remaining useful life 5years. Nigeria Ltd has not incorporated this value change into its separate financial statements. vii) The fair value of Ghana's 10% holding in Togo on 1 January 2016 was GH50 million. CLASSNirin bold bairiomantis bridinio tri thirrt Finnail QUESTION TWO il) The following summarized trial balances pertuin to Takoradi Ltd and its subsidiary Aucru Ltd for the year ended 31 December 2018 Takoradi L.id Accrald Debit Credit Debit Credit GHm GHem GHem GHm Sales 5.177 3.996 Cost of sales 3.255 2.448 Operating expenses 713 636 Other income 350 Tax expense 403 288 Share capital (GHe 10 each) 3,720 1,600 Share premium 1.430 322 Retained earnings as at 1 January 2018 2.293 S16 Page 3 of 6 Current liabilities 713 651 Property, plant and equipment 5.418 1.934 Investments 1,600 Loan to AL's Director 10 Current assets 2.284 1.797 13.683 2.682 7.103 Additional information: 10) Takoradi Ltd acquired 96 million shares of Accra Ltd on May 2018 at following consideration: Cash payment of GH 450 million and Issuance of 40 million shares of Takoradi Lid at GHe 25 each (ii) On aquisition date, currying values of Accra Ltd's net assets were equal to fair value except the folkswing: A building whose fair values and value-in-use were GH4 390 million and GHE 520 million respectively as against carrying value of GHe 480 million. The group follows cost model for subsequent measurement of property, plant and equipment. The remaining life of building on acquisition date was 20 years, Fair value of the building has increased to GH 440 million at 31 December 2018. A brand which had not been recognized by Accra Ltd. The fair value of the brand was assessed at GH 162 million. It is estimated that benefit would be obtained from the brand for the next 6 years. Tukorudi Ltd measures the non-controlling interest at fair value. On the date of acquisition, the market price of Acuru Ltd's shures wus GH 14 per share (iv) On 1 July 2018 Takoradi Ltd sold an equipment to Accra Ltd for GH 250 million at a gain of GH 20 million, Accra td has charged depreciation of GHe 12.5 million on this equipment. In each month of 2018, Accra Ltd sold goods casting GH 40 million to Takoradi Ltd at cost plus 20%. At year end, 75% of the goods purchased in December were included in stock of Takoradi Ltd. (vi) Accra Lid's credit balance of GHe 38 million in Takoradi Ltd's books does not agree with Accra Ltd's books due to GH 7 million charged by Takoradi Ltd for management service on 26 December 2018. Total management fee charged by Takoradi Led to Accra Ltd since acquisition umounted to GH 16 million. (vii) Accra Ltd declared interim cash dividend of GH