Answered step by step

Verified Expert Solution

Question

1 Approved Answer

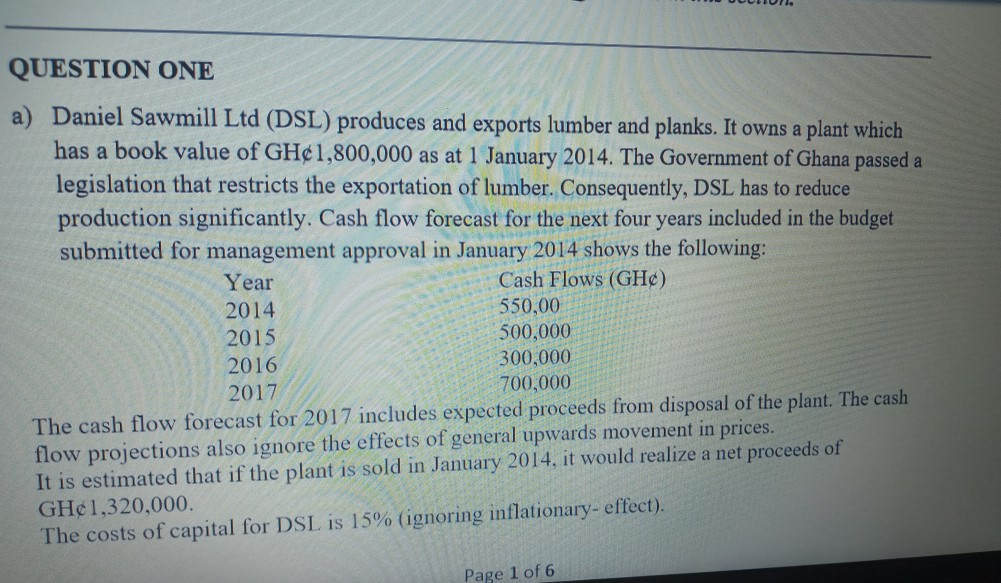

QUESTION ONE a) Daniel Sawmill Ltd (DSL) produces and exports lumber and planks. It owns a plant which has a book value of GH1,800,000 as

QUESTION ONE a) Daniel Sawmill Ltd (DSL) produces and exports lumber and planks. It owns a plant which has a book value of GH1,800,000 as at 1 January 2014. The Government of Ghana passed a legislation that restricts the exportation of lumber. Consequently, DSL has to reduce production significantly. Cash flow forecast for the next four years included in the budget submitted for management approval in January 2014 shows the following: Year Cash Flows (GHC) 2014 550,00 2015 500,000 2016 300,000 2017 700,000 The cash flow forecast for 2017 includes expected proceeds from disposal of the plant. The cash flow projections also ignore the effects of general upwards movement in prices. It is estimated that if the plant is sold in January 2014, it would realize a net proceeds of GH1,320,000. The costs of capital for DSL is 15% (ignoring inflationary-effect). Page 1 of 6 QUESTION ONE a) Daniel Sawmill Ltd (DSL) produces and exports lumber and planks. It owns a plant which has a book value of GH1,800,000 as at 1 January 2014. The Government of Ghana passed a legislation that restricts the exportation of lumber. Consequently, DSL has to reduce production significantly. Cash flow forecast for the next four years included in the budget submitted for management approval in January 2014 shows the following: Year Cash Flows (GHC) 2014 550,00 2015 500,000 2016 300,000 2017 700,000 The cash flow forecast for 2017 includes expected proceeds from disposal of the plant. The cash flow projections also ignore the effects of general upwards movement in prices. It is estimated that if the plant is sold in January 2014, it would realize a net proceeds of GH1,320,000. The costs of capital for DSL is 15% (ignoring inflationary-effect). Page 1 of 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started