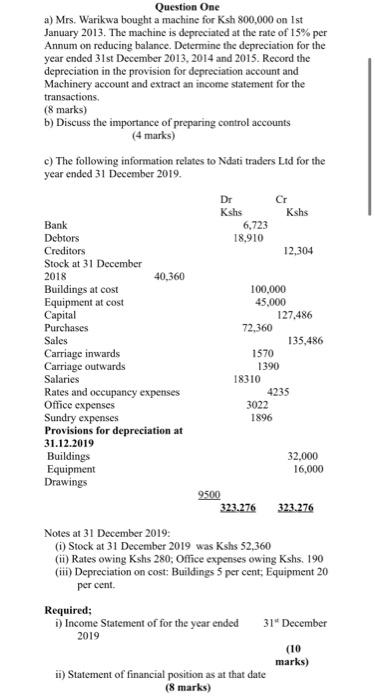

Question One a) Mrs. Warikwa bought a machine for Ksh 800,000 on Ist January 2013. The machine is depreciated at the rate of 15% per Annum on reducing balance. Determine the depreciation for the year ended 31st December 2013, 2014 and 2015. Record the depreciation in the provision for depreciation account and Machinery account and extract an income statement for the transactions, (8 marks) b) Discuss the importance of preparing control accounts (4 marks) c) The following information relates to Ndati traders Ltd for the year ended 31 December 2019. Dr Cr Kshs Kshs Bank 6,723 Debtors 18,910 Creditors 12,304 Stock at 31 December 2018 40,360 Buildings at cost 100,000 Equipment at cost 45,000 Capital 127.486 Purchases 72,360 Sales 135,486 Carriage inwards 1570 Carriage outwards 1390 Salaries 18310 Rates and occupancy expenses 4235 Office expenses 3022 Sundry expenses 1896 Provisions for depreciation at 31.12.2019 Buildings 32,000 Equipment 16,000 Drawings 9500 323.276 323.276 Notes at 31 December 2019: (i) Stock at 31 December 2019 was Kshs 52,360 (ii) Rates owing Kshs 280; Office expenses owing Kshs. 190 (i) Depreciation on cost: Buildings 5 per cent; Equipment 20 per cent. Required; i) Income Statement of for the year ended 31* December 2019 (10 marks) i) Statement of financial position as at that date (8 marks) Question One a) Mrs. Warikwa bought a machine for Ksh 800.000 on 1st January 2013. The machine is depreciated at the rate of 15% per Annum on reducing balance. Determine the depreciation for the year ended 31st December 2013, 2014 and 2015. Record the depreciation in the provision for depreciation account and Machinery account and extract an income statement for the transactions. (8 marks) b) Discuss the importance of preparing control accounts (4 marks) c) The following information relates to Ndati traders Lid for the year ended 31 December 2019, Dr Cr Kshs Kshs Bank 6,723 Debtors 18.910 Creditors 12,304 Stock at 31 December 2018 40.360 Buildings at cost 100,000 Equipment at cost 45,000 Capital 127,486 Purchases 72,360 Sales 135,486 Carriage inwards 1570 Carriage outwards 1390 Salaries 18310 Rates and occupancy expenses 4235 Office expenses 3022 Sundry expenses 1896 Provisions for depreciation at 31.12.2019 Buildings 32,000 Equipment 16,000 Drawings 9500 323.276 323.276 Notes at 31 December 2019: (1) Stock at 31 December 2019 was Kshs 52,360 (ii) Rates owing Kshs 280; Office expenses owing Kshs. 190 (ii) Depreciation on cost: Buildings 5 per cent; Equipment 20 per cent. Required; i) Income Statement of for the year ended 31 December 2019 (10 marks) ii) Statement of financial position as at that date (8 marks)