Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE (a) Sibongile is an Accountant with a manufacturing company. She has decided to retire on 31/12/2023 after successfully serving her three year

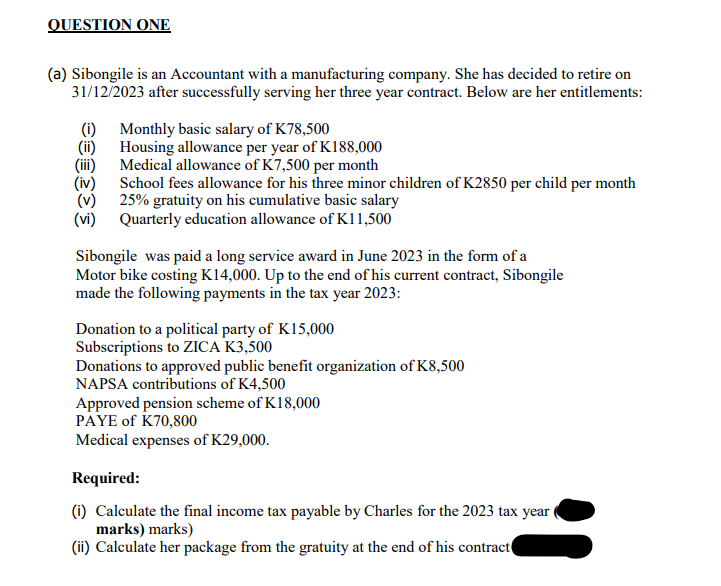

QUESTION ONE (a) Sibongile is an Accountant with a manufacturing company. She has decided to retire on 31/12/2023 after successfully serving her three year contract. Below are her entitlements: (i) Monthly basic salary of K78,500 (ii) Housing allowance per year of K188,000 (vi) Medical allowance of K7,500 per month School fees allowance for his three minor children of K2850 per child per month 25% gratuity on his cumulative basic salary Quarterly education allowance of K11,500 Sibongile was paid a long service award in June 2023 in the form of a Motor bike costing K14,000. Up to the end of his current contract, Sibongile made the following payments in the tax year 2023: Donation to a political party of K15,000 Subscriptions to ZICA K3,500 Donations to approved public benefit organization of K8,500 NAPSA contributions of K4,500 Approved pension scheme of K18,000 PAYE of K70,800 Medical expenses of K29,000. Required: (i) Calculate the final income tax payable by Charles for the 2023 tax year marks) marks) (ii) Calculate her package from the gratuity at the end of his contract

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started