Answered step by step

Verified Expert Solution

Question

1 Approved Answer

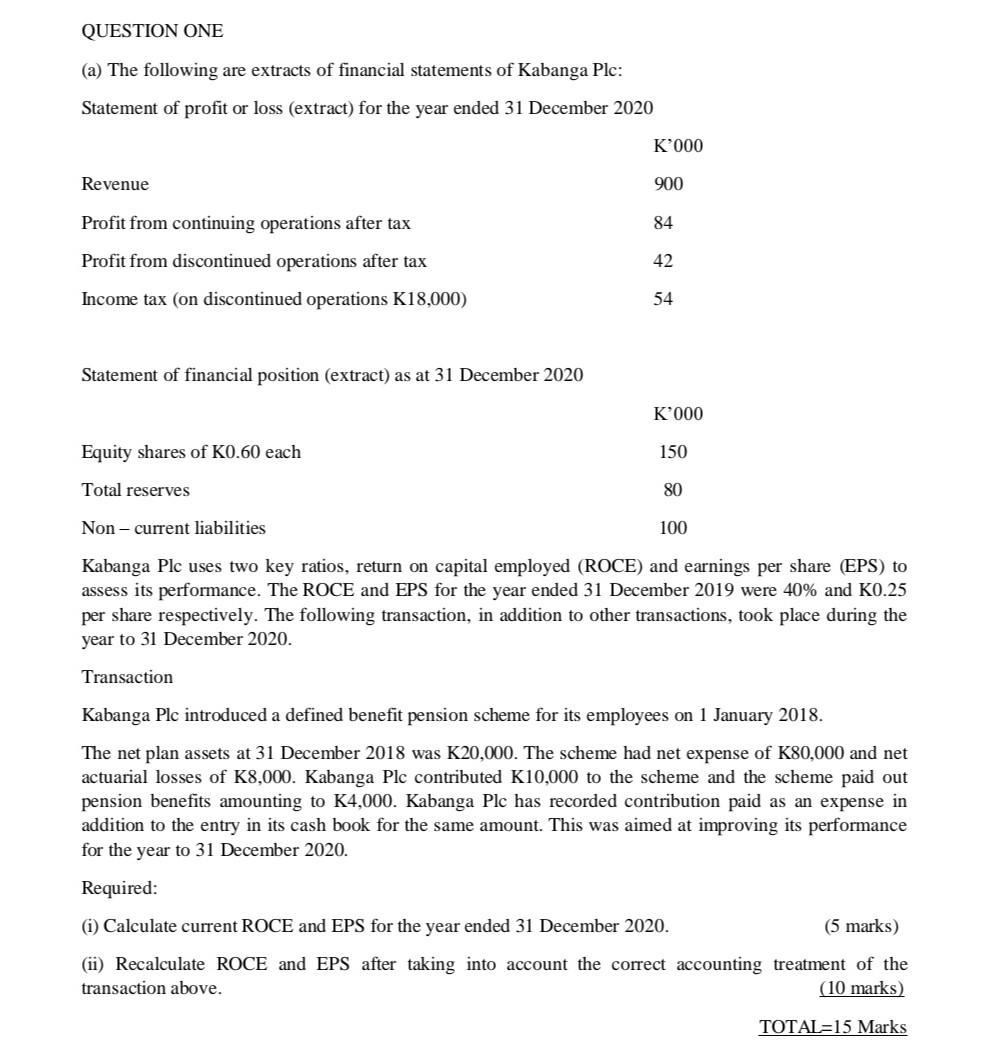

QUESTION ONE (a) The following are extracts of financial statements of Kabanga Plc: Statement of profit or loss (extract) for the year ended 31 December

QUESTION ONE (a) The following are extracts of financial statements of Kabanga Plc: Statement of profit or loss (extract) for the year ended 31 December 2020 Statement of financial position (extract) as at 31 December 2020 K000 Equity shares of K0.60 each 150 Total reserves 80 Non - current liabilities 100 Kabanga Plc uses two key ratios, return on capital employed (ROCE) and earnings per share (EPS) to assess its performance. The ROCE and EPS for the year ended 31 December 2019 were 40% and K0.25 per share respectively. The following transaction, in addition to other transactions, took place during the year to 31 December 2020. Transaction Kabanga Plc introduced a defined benefit pension scheme for its employees on 1 January 2018. The net plan assets at 31 December 2018 was K20,000. The scheme had net expense of K80,000 and net actuarial losses of K8,000. Kabanga Plc contributed K10,000 to the scheme and the scheme paid out pension benefits amounting to K4,000. Kabanga Plc has recorded contribution paid as an expense in addition to the entry in its cash book for the same amount. This was aimed at improving its performance for the year to 31 December 2020. Required: (i) Calculate current ROCE and EPS for the year ended 31 December 2020. (5 marks) (ii) Recalculate ROCE and EPS after taking into account the correct accounting treatment of the transaction above. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started