Answered step by step

Verified Expert Solution

Question

1 Approved Answer

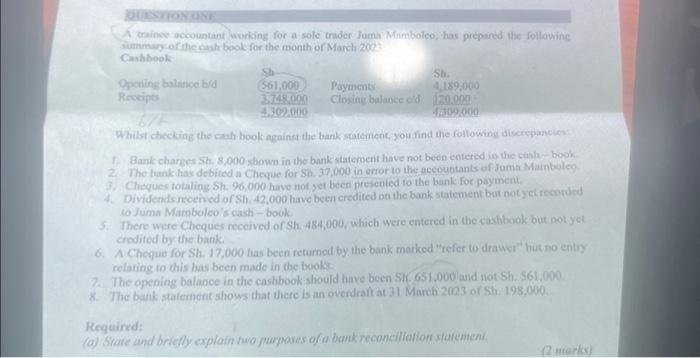

QUESTION ONE A trainee accountant working for a sole trader Juma Mamboleo, has prepared the following summary of the cash book for the month of

QUESTION ONE A trainee accountant working for a sole trader Juma Mamboleo, has prepared the following summary of the cash book for the month of March 2023 Cashbook Opening balance b/d Receipts Sh (561,000 3.748.000 4.309.000 Sh. Payments 4.189,000 Closing balance c/d 120.000 4.309.000 Whilst checking the cash book against the bank statement, you find the following discrepancies: 1. Bank charges Sh. 8,000 shown in the bank statement have not been entered in the cash-book. 2. The bank has debited a Cheque for Sh. 37,000 in error to the accountants of Juma Mamboleo. 3. Cheques totaling Sh. 96,000 have not yet been presented to the bank for payment. 4. Dividends received of Sh. 42,000 have been credited on the bank statement but not yet recorded to Juma Mamboleo's cash - book. 5. There were Cheques received of Sh. 484,000, which were entered in the cashbook but not yet credited by the bank. 6. A Cheque for Sh. 17,000 has been returned by the bank marked "refer to drawer" but no entry relating to this has been made in the books. 7. The opening balance in the cashbook should have been Sh. 651,000 and not Sh. 561,000. 8. The bank statement shows that there is an overdraft at 31 March 2023 of Sh. 198,000. Required: (a) State and briefly explain two purposes of a bank reconciliation statement. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started