Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question One (a) You are a small time investor with concerns about agency problems. State briefly, with reasons, why you are likely to or not

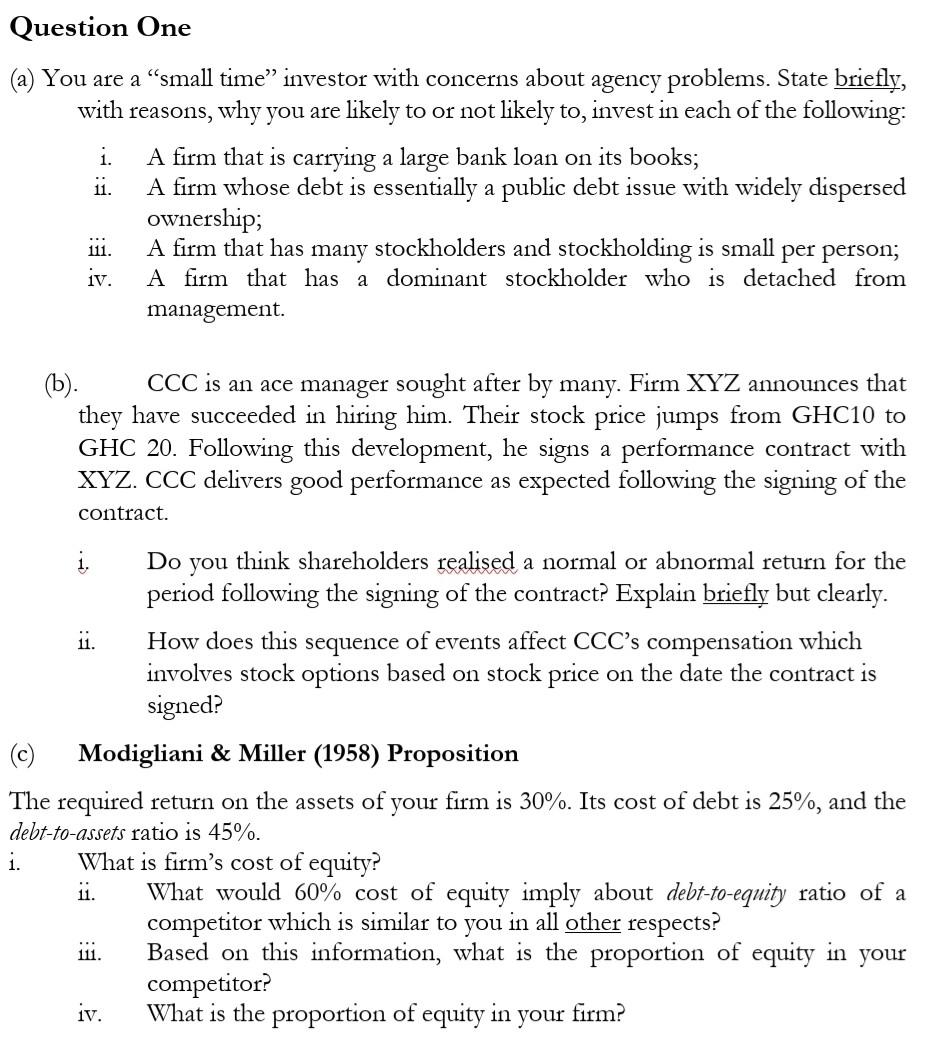

Question One (a) You are a small time investor with concerns about agency problems. State briefly, with reasons, why you are likely to or not likely to invest in each of the following: i. A firm that is carrying a large bank loan on its books; . A firm whose debt is essentially a public debt issue with widely dispersed ownership; 11. A firm that has many stockholders and stockholding is small per person; A firm that has a dominant stockholder who is detached from management. 1V. (b). CCC is an ace manager sought after by many. Firm XYZ announces that they have succeeded in hiring him. Their stock price jumps from GHC10 to GHC 20. Following this development, he signs a performance contract with XYZ. CCC delivers good performance as expected following the signing of the contract. 11. i. Do you think shareholders realised a normal or abnormal return for the period following the signing of the contract? Explain briefly but clearly. How does this sequence of events affect CCC's compensation which involves stock options based on stock price on the date the contract is signed? Modigliani & Miller (1958) Proposition The required return on the assets of your firm is 30%. Its cost of debt is 25%, and the debt-to-assets ratio is 45%. What is firm's cost of equity? What would 60% cost of equity imply about debt-to-equity ratio of a competitor which is similar to you in all other respects? Based on this information, what is the proportion of equity in your competitor? iv. What is the proportion of equity in your firm? 1. 11. 111. Question One (a) You are a small time investor with concerns about agency problems. State briefly, with reasons, why you are likely to or not likely to invest in each of the following: i. A firm that is carrying a large bank loan on its books; . A firm whose debt is essentially a public debt issue with widely dispersed ownership; 11. A firm that has many stockholders and stockholding is small per person; A firm that has a dominant stockholder who is detached from management. 1V. (b). CCC is an ace manager sought after by many. Firm XYZ announces that they have succeeded in hiring him. Their stock price jumps from GHC10 to GHC 20. Following this development, he signs a performance contract with XYZ. CCC delivers good performance as expected following the signing of the contract. 11. i. Do you think shareholders realised a normal or abnormal return for the period following the signing of the contract? Explain briefly but clearly. How does this sequence of events affect CCC's compensation which involves stock options based on stock price on the date the contract is signed? Modigliani & Miller (1958) Proposition The required return on the assets of your firm is 30%. Its cost of debt is 25%, and the debt-to-assets ratio is 45%. What is firm's cost of equity? What would 60% cost of equity imply about debt-to-equity ratio of a competitor which is similar to you in all other respects? Based on this information, what is the proportion of equity in your competitor? iv. What is the proportion of equity in your firm? 1. 11. 111

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started