Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE a) Your firm has been retained as the auditors of Solo Ltd., a retailer of books, music media and computer software. As

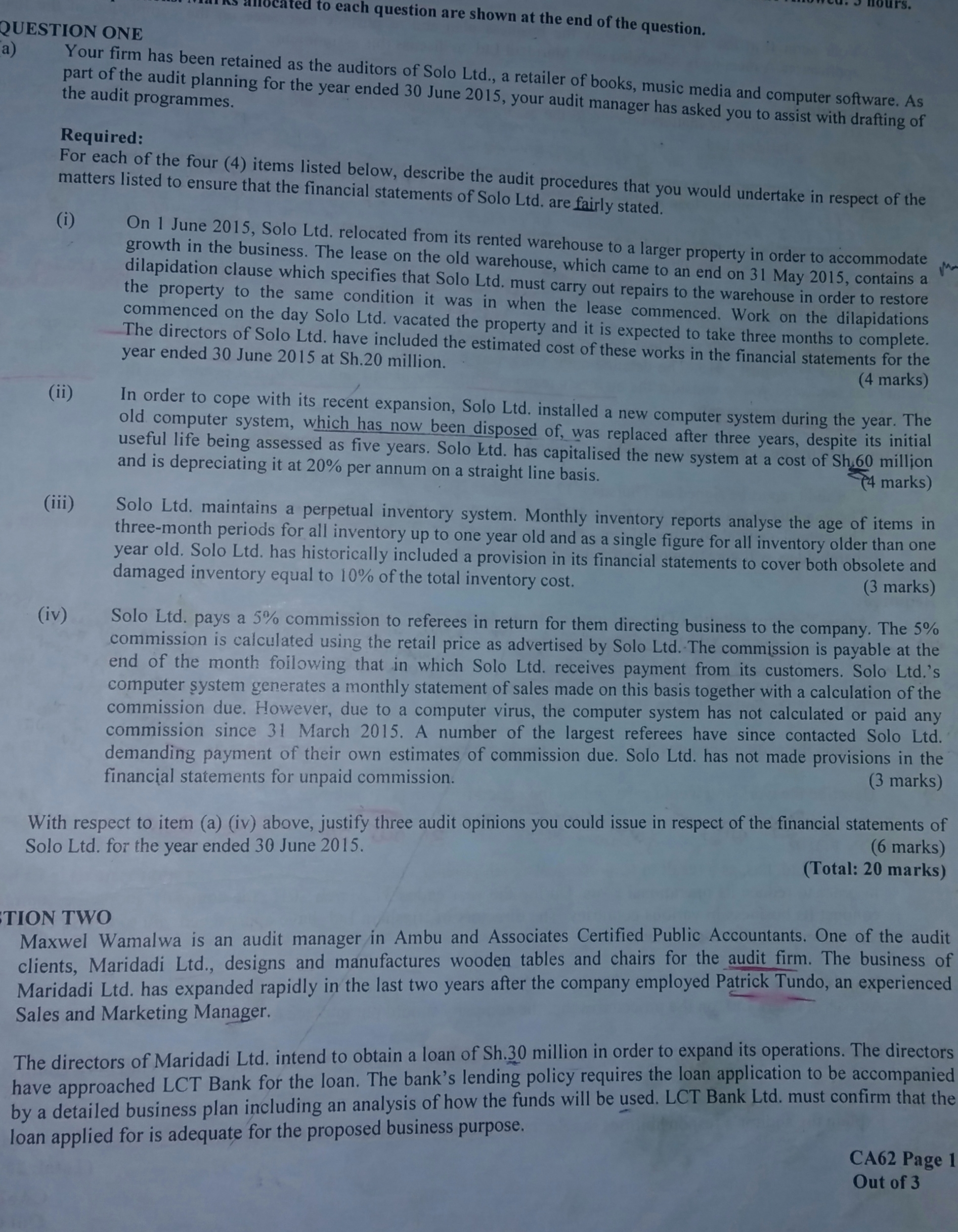

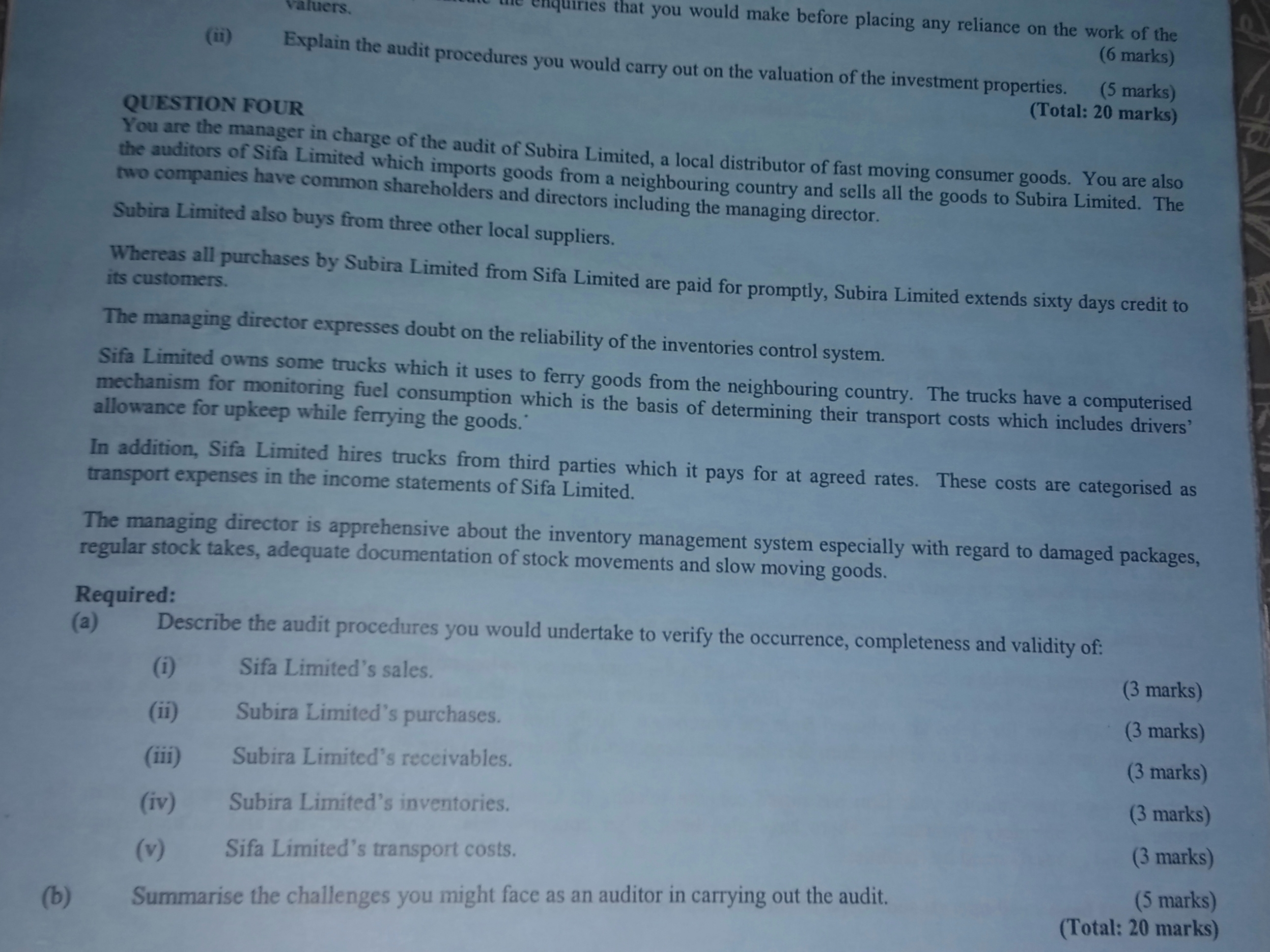

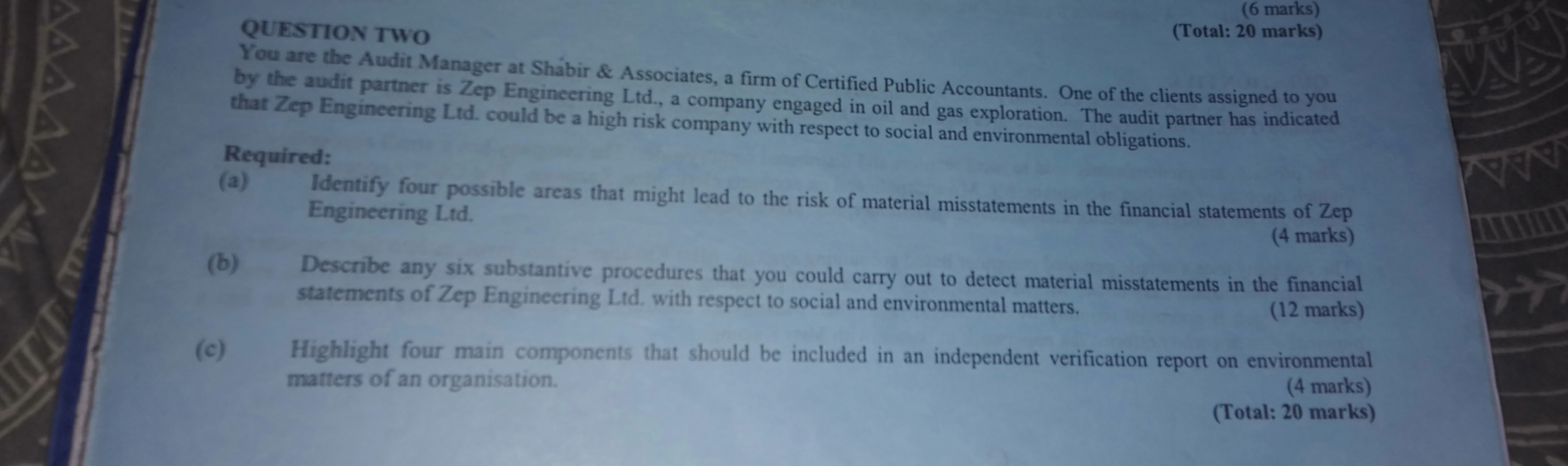

QUESTION ONE a) Your firm has been retained as the auditors of Solo Ltd., a retailer of books, music media and computer software. As part of the audit planning for the year ended 30 June 2015, your audit manager has asked you to assist with drafting of the audit programmes. Required: For each of the four (4) items listed below, describe the audit procedures that you would undertake in respect of the matters listed to ensure that the financial statements of Solo Ltd. are fairly stated. (i) (ii) to each question are shown at the end of the question. (iii) (iv) Ma On 1 June 2015, Solo Ltd. relocated from its rented warehouse to a larger property in order to accommodate growth in the business. The lease on the old warehouse, which came to an end on 31 May 2015, contains a dilapidation clause which specifies that Solo Ltd. must carry out repairs to the warehouse in order to restore the property to the same condition it was in when the lease commenced. Work on the dilapidations commenced on the day Solo Ltd. vacated the property and it is expected to take three months to complete. The directors of Solo Ltd. have included the estimated cost of these works in the financial statements for the year ended 30 June 2015 at Sh.20 million. (4 marks) In order to cope with its recent expansion, Solo Ltd. installed a new computer system during the year. The old computer system, which has now been disposed of, was replaced after three years, despite its initial useful life being assessed as five years. Solo Ltd. has capitalised the new system at a cost of Sh.60 million and is depreciating it at 20% per annum on a straight line basis. 4 marks) Solo Ltd. maintains a perpetual inventory system. Monthly inventory reports analyse the age of items in three-month periods for all inventory up to one year old and as a single figure for all inventory older than one year old. Solo Ltd. has historically included a provision in its financial statements to cover both obsolete and damaged inventory equal to 10% of the total inventory cost. (3 marks) Solo Ltd. pays a 5% commission to referees in return for them directing business to the company. The 5% commission is calculated using the retail price as advertised by Solo Ltd. The commission is payable at the end of the month foilowing that in which Solo Ltd. receives payment from its customers. Solo Ltd.'s computer system generates a monthly statement of sales made on this basis together with a calculation of the commission due. However, due to a computer virus, the computer system has not calculated or paid any commission since 31 March 2015. A number of the largest referees have since contacted Solo Ltd. demanding payment of their own estimates of commission due. Solo Ltd. has not made provisions in the financial statements for unpaid commission. (3 marks) With respect to item (a) (iv) above, justify three audit opinions you could issue in respect of the financial statements of Solo Ltd. for the year ended 30 June 2015. (6 marks) (Total: 20 marks) TION TWO Maxwel Wamalwa is an audit manager in Ambu and Associates Certified Public Accountants. One of the audit clients, Maridadi Ltd., designs and manufactures wooden tables and chairs for the audit firm. The business of Maridadi Ltd. has expanded rapidly in the last two years after the company employed Patrick Tundo, an experienced Sales and Marketing Manager. The directors of Maridadi Ltd. intend to obtain a loan of Sh.30 million in order to expand its operations. The directors have approached LCT Bank for the loan. The bank's lending policy requires the loan application to be accompanied by a detailed business plan including an analysis of how the funds will be used. LCT Bank Ltd. must confirm that the loan applied for is adequate for the proposed business purpose. CA62 Page 1 Out of 3 (b) valuers. that you would make before placing any reliance on the work of the (6 marks) QUESTION FOUR You are the manager in charge of the audit of Subira Limited, a local distributor of fast moving consumer goods. You are also the auditors of Sifa Limited which imports goods from a neighbouring country and sells all the goods to Subira Limited. The two companies have common shareholders and directors including the managing director. Subira Limited also buys from three other local suppliers. Explain the audit procedures you would carry out on the valuation of the investment properties. (5 marks) (Total: 20 marks) Whereas all purchases by Subira Limited from Sifa Limited are paid for promptly, Subira Limited extends sixty days credit to its customers. Required: (a) The managing director expresses doubt on the reliability of the inventories control system. Sifa Limited owns some trucks which it uses to ferry goods from the neighbouring country. The trucks have a computerised mechanism for monitoring fuel consumption which is the basis of determining their transport costs which includes drivers' allowance for upkeep while ferrying the goods. In addition, Sifa Limited hires trucks from third parties which it pays for at agreed rates. These costs are categorised as transport expenses in the income statements of Sifa Limited. The managing director is apprehensive about the inventory management system especially with regard to damaged packages, regular stock takes, adequate documentation of stock movements and slow moving goods. (1) (ii) (iii) (iv) Describe the audit procedures you would undertake to verify the occurrence, completeness and validity of: Sifa Limited's sales. Subira Limited's purchases. Subira Limited's receivables. Subira Limited's inventories. Sifa Limited's transport costs. Summarise the challenges you might face as an auditor in carrying out the audit. (3 marks) (3 marks) (3 marks) (3 marks) (3 marks) (5 marks) (Total: 20 marks) AAAAA TIL Required: QUESTION TWO You are the Audit Manager at Shabir & Associates, a firm of Certified Public Accountants. One of the clients assigned to you by the audit partner is Zep Engineering Ltd., a company engaged in oil and gas exploration. The audit partner has indicated that Zep Engineering Ltd. could be a high risk company with respect to social and environmental obligations. (c) la (b) (6 marks) (Total: 20 marks) Identify four possible areas that might lead to the risk of material misstatements in the financial statements of Zep Engineering Ltd. (4 marks) Describe any six substantive procedures that you could carry out to detect material misstatements in the financial statements of Zep Engineering Ltd. with respect to social and environmental matters. (12 marks) Highlight four main components that should be included in an independent verification report on environmental matters of an organisation. (4 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Audit Procedures for Solo Ltd i Relocation and Dilapidation Clause Review the lease agreement for the old warehouse and verify the existence and terms of the dilapidation clause Obtain a copy of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started