Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE Assuming that you are watching a television programme dubbed Taxation; an essential fiscal policy tool for moblizing resources for socio-economic development that has

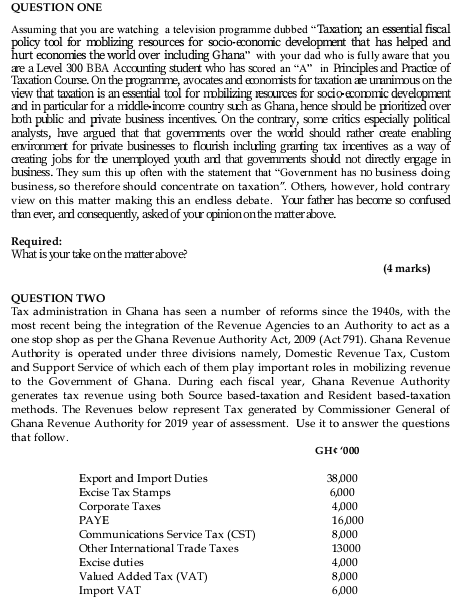

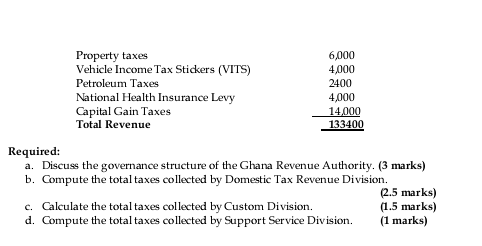

QUESTION ONE Assuming that you are watching a television programme dubbed "Taxation; an essential fiscal policy tool for moblizing resources for socio-economic development that has helped and hurt economies the world over including Ghana" with your dad who is fully aware that you are a Level 300 BBA Accounting student who has scored an "A" in Principles and Practice of Taxation Course. On the programme, avocates and onomists for taxation de unanimous on the view that taxation is an essential tool for mobilizing resources for socio commic development and in particular for a middle-income country such as Ghana, hence should be prioritized over both public and private business incentives. On the contrary, some critics especially political analysts, luve argued that that governments over the world should rather create enabling environment for private businesses to flourish including granting tax incentives as a way of creating jobs for the unemployed youth and that govements should not directly engage in business. They sum this up often with the statement that "Government has no business doing business, so therefore should concentrate on taxation". Others, however, hold contrary view on this matter making this an endless debate. Your father has become so confused than ever, and consequently, asked of your opinion on the matter above. Required: What is your take on the matter above? (4 marks) QUESTION TWO Tax administration in Ghana has seen a number of reforms since the 1940s, with the most recent being the integration of the Revenue Agencies to an Authority to act as a one stop shop as per the Ghana Revenue Authority Act, 2009 (Act 791). Ghana Revenue Authority is operated under three divisions namely, Domestic Revenue Tax, Custom and Support Service of which each of them play important roles in mobilizing revenue to the Government of Ghana. During each fiscal year, Ghana Revenue Authority generates tax revenue using both Source based-taxation and Resident based-taxation methods. The Revenues below represent Tax generated by Commissioner General of Ghana Revenue Authority for 2019 year of assessment. Use it to answer the questions that follow. GH '000 Export and Import Duties Excise Tax Stamps Corporate Taxes PAYE Communications Service Tax (CST) Other International Trade Taxes Excise duties Valued Added Tax (VAT) Import VAT 38,000 6,000 4,000 16,000 8,000 13000 4,000 8,000 6,000 Property taxes 6,000 Vehicle Income Tax Stickers (VITS) 4,000 Petroleum Taxes 2400 National Health Insurance Levy 4,000 Capital Gain Taxes 14,000 Total Revenue 133400 Required: a. Discuss the governance structure of the Ghana Revenue Authority. (3 marks) b. Compute the total taxes collected by Domestic Tax Revenue Division. (2.5 marks) c. Calculate the total taxes collected by Custom Division. (1.5 marks) d. Compute the total taxes collected by Support Service Division. (1 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started