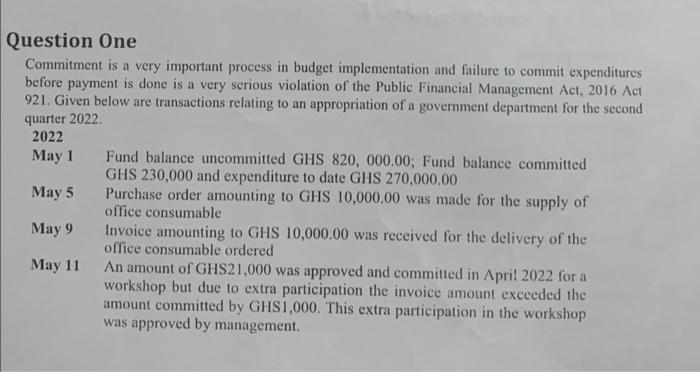

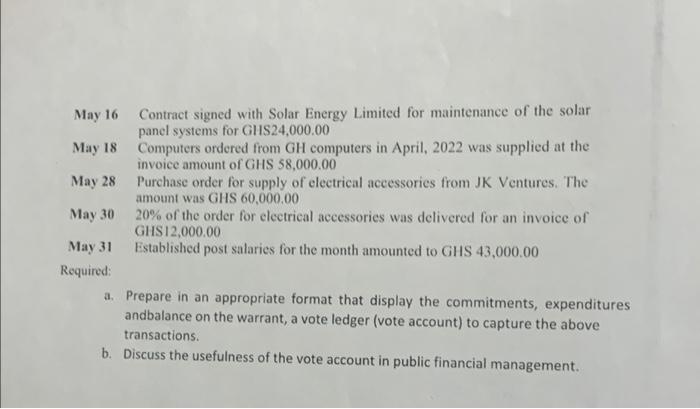

Question One Commitment is a very important process in budget implementation and failure to commit expenditures before payment is done is a very scrious violation of the Public Financial Management Act, 2016 Act 921. Given below are transactions relating to an appropriation of a government department for the second quarter 2022. 2022May1FundbalanceuncommittedGHS820,000.00;FundbalancecommittedGHS230,000andexpendituretodateGHS270,000,00May5PurchaseorderamountingtoGHS10,000.00wasmadeforthesupplyofofficeconsumableMay9InvoiceamountingtoGHS10,000.00wasreceivedforthedeliveryoftheofficeconsumableorderedMay11AnamountofGHS21,000wasapprovedandcommittedinApril2022fora workshop but due to extra participation the invoice amount exceeded the amount committed by GHS 1,000 . This extra participation in the workshop was approved by management. May 16 Contract signed with Solar Energy Limited for maintenance of the solar panel systems for GHS24,000.00 May 18 Computers ordered from GH computers in April, 2022 was supplied at the invoice amount of GHS 58,000.00 May 28 Purchase order for supply of electrical accessorics from JK Ventures. The amount was GHS 60,000.00 May 3020% of the order for electrical accessories was delivered for an invoice of GHS12,000.00 May 31 Established post salaries for the month amounted to GHS 43,000.00 Required: a. Prepare in an appropriate format that display the commitments, expenditures andbalance on the warrant, a vote ledger (vote account) to capture the above transactions. b. Discuss the usefulness of the vote account in public financial management. Question One Commitment is a very important process in budget implementation and failure to commit expenditures before payment is done is a very scrious violation of the Public Financial Management Act, 2016 Act 921. Given below are transactions relating to an appropriation of a government department for the second quarter 2022. 2022May1FundbalanceuncommittedGHS820,000.00;FundbalancecommittedGHS230,000andexpendituretodateGHS270,000,00May5PurchaseorderamountingtoGHS10,000.00wasmadeforthesupplyofofficeconsumableMay9InvoiceamountingtoGHS10,000.00wasreceivedforthedeliveryoftheofficeconsumableorderedMay11AnamountofGHS21,000wasapprovedandcommittedinApril2022fora workshop but due to extra participation the invoice amount exceeded the amount committed by GHS 1,000 . This extra participation in the workshop was approved by management. May 16 Contract signed with Solar Energy Limited for maintenance of the solar panel systems for GHS24,000.00 May 18 Computers ordered from GH computers in April, 2022 was supplied at the invoice amount of GHS 58,000.00 May 28 Purchase order for supply of electrical accessorics from JK Ventures. The amount was GHS 60,000.00 May 3020% of the order for electrical accessories was delivered for an invoice of GHS12,000.00 May 31 Established post salaries for the month amounted to GHS 43,000.00 Required: a. Prepare in an appropriate format that display the commitments, expenditures andbalance on the warrant, a vote ledger (vote account) to capture the above transactions. b. Discuss the usefulness of the vote account in public financial management