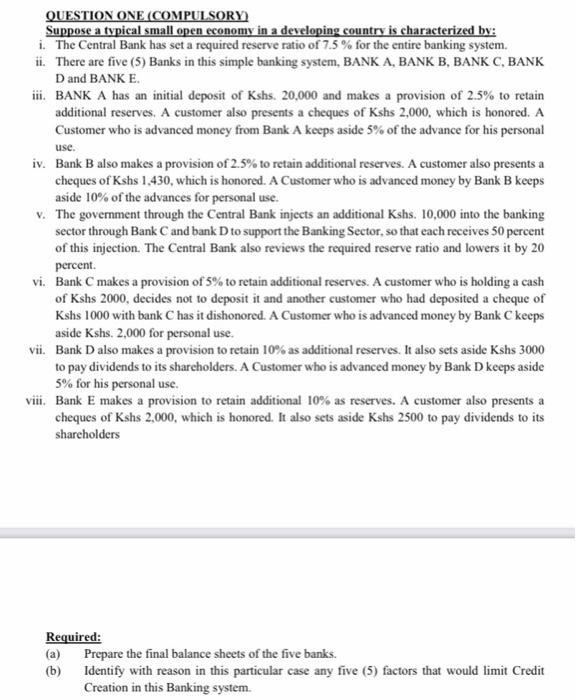

QUESTION ONE (COMPULSORY) Suppose a typical small open economy in a developing country is characterized by: i. The Central Bank has set a required reserve ratio of 7.5 % for the entire banking system. ii. There are five (5) Banks in this simple banking system, BANK A, BANK B, BANK C, BANK Dand BANKE. . BANK A has an initial deposit of Kshs. 20,000 and makes a provision of 2.5% to retain additional reserves. A customer also presents a cheques of Kshs 2,000, which is honored. A Customer who is advanced money from Bank A keeps aside 5% of the advance for his personal use. iv. Bank B also makes a provision of 2.5% to retain additional reserves. A customer also presents a cheques of Kshs 1,430, which is honored. A Customer who is advanced money by Bank B keeps aside 10% of the advances for personal use. V. The government through the Central Bank injects an additional Kshs. 10,000 into the banking sector through Bank C and bank D to support the Banking Sector, so that each receives 50 percent of this injection. The Central Bank also reviews the required reserve ratio and lowers it by 20 percent vi. Bank C makes a provision of 5% to retain additional reserves. A customer who is holding a cash of Kshs 2000, decides not to deposit it and another customer who had deposited a cheque of Kshs 1000 with bank C has it dishonored. A Customer who is advanced money by Bank C keeps aside Kshs. 2,000 for personal use. vii. Bank D also makes a provision to retain 10% as additional reserves. It also sets aside Kshs 3000 to pay dividends to its shareholders. A Customer who is advanced money by Bank D keeps aside 5% for his personal use. viii. Bank E makes a provision to retain additional 10% as reserves. A customer also presents a cheques of Kshs 2,000, which is honored. It also sets aside Kshs 2500 to pay dividends to its shareholders Required: (a) Prepare the final balance sheets of the five banks. (b) Identify with reason in this particular case any five (5) factors that would limit Credit Creation in this Banking system. QUESTION ONE (COMPULSORY) Suppose a typical small open economy in a developing country is characterized by: i. The Central Bank has set a required reserve ratio of 7.5 % for the entire banking system. ii. There are five (5) Banks in this simple banking system, BANK A, BANK B, BANK C, BANK Dand BANKE. . BANK A has an initial deposit of Kshs. 20,000 and makes a provision of 2.5% to retain additional reserves. A customer also presents a cheques of Kshs 2,000, which is honored. A Customer who is advanced money from Bank A keeps aside 5% of the advance for his personal use. iv. Bank B also makes a provision of 2.5% to retain additional reserves. A customer also presents a cheques of Kshs 1,430, which is honored. A Customer who is advanced money by Bank B keeps aside 10% of the advances for personal use. V. The government through the Central Bank injects an additional Kshs. 10,000 into the banking sector through Bank C and bank D to support the Banking Sector, so that each receives 50 percent of this injection. The Central Bank also reviews the required reserve ratio and lowers it by 20 percent vi. Bank C makes a provision of 5% to retain additional reserves. A customer who is holding a cash of Kshs 2000, decides not to deposit it and another customer who had deposited a cheque of Kshs 1000 with bank C has it dishonored. A Customer who is advanced money by Bank C keeps aside Kshs. 2,000 for personal use. vii. Bank D also makes a provision to retain 10% as additional reserves. It also sets aside Kshs 3000 to pay dividends to its shareholders. A Customer who is advanced money by Bank D keeps aside 5% for his personal use. viii. Bank E makes a provision to retain additional 10% as reserves. A customer also presents a cheques of Kshs 2,000, which is honored. It also sets aside Kshs 2500 to pay dividends to its shareholders Required: (a) Prepare the final balance sheets of the five banks. (b) Identify with reason in this particular case any five (5) factors that would limit Credit Creation in this Banking system