Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question One () Explain what is meant by an excessively volatile market? 2 Marks] ( Describe how you would test a market is excessively volaille

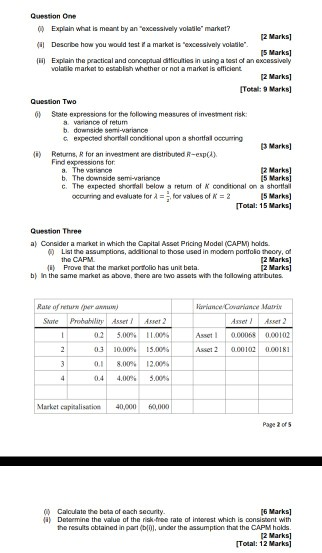

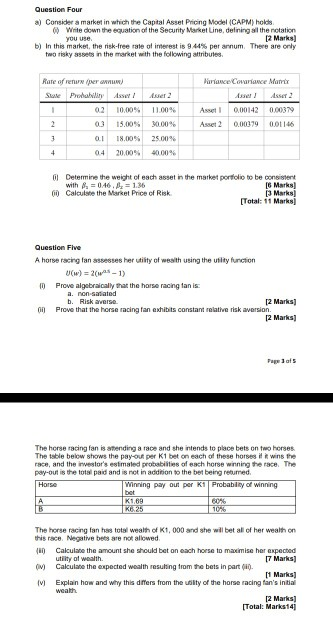

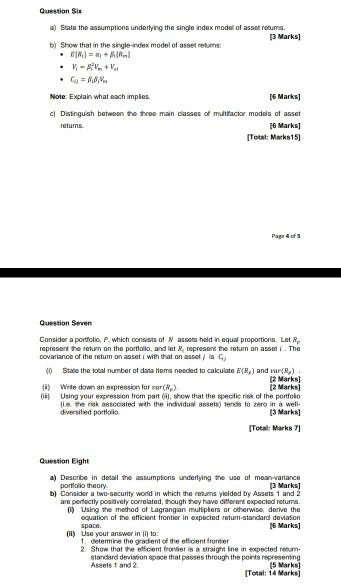

Question One () Explain what is meant by an excessively volatile market? 2 Marks] ( Describe how you would test a market is "excessively volaille 15 Marks] un Explain the practical and conceptual difficulties in using a test of an excessively volatile market to establish whether or not a market is efficient 12 Marks] Total: Marks) Question Two 6) Srate expressions for the following measures of investment risk: 8 variance of retum b. downside semi-variance expected short all conditional upon a shortal occurring Marks] (0) Returns, R for an investment are distributed R-esp ) Find expressions for a. The variance 12 Marks] b. The downside semi-variance is Marksj C. The expected shortfall below a return of X conditional on a short occurring and evaluate for for values of R2 5 Marks [Total: 15 Marks] Question Three a) Consider a market in which the Capital Asset Pricing Model (CAPM holds 0) List the assumption, additional to those used in modem portfolio Theory, of the CAPM. 2 Marks () Prove that the market portfolio has unit beta. 2 Marks] b) in the same market as above, there are two assets with the following atibutes. Rate of State Asser 2 Varian Cowrie Matrix Asse Asser 2 Asset 0.0006 0.00102 MT Poll das 025 .00 0 10.00 0 .1 8.00% 04 4.00% 11.00 15.00 2 Asset 2 00102 0.00181 3 12.00 5.00% Market capitalisatie 40.000 60,000 00 Calou at the bota of each security. 16 Marks] f) Determine the value of the risk tree rate of interest which is consistent with the results obtained in part (0, under the assumption that the CAPM holds 2 Marks [Total: 12 Marksj Question Four a) Consider a market in which the Capital Asset Pricing Model (CAPM) holds Write down the equation of the Security Market Line, defining all the notation you use. [2 Marks b) In this market, the risk-free rate of interest is 944% per annum There are only to risky s et in the market with the following attributes Parae Covariance Mami Rare orre r ) SwPubliser 02 10,00% 03 15,00% ser 100% Axel 0,00142 000379 20,00% Asset 2 0.00199 001146 25.00% 0.1 04 18.00 20.00% 4000% Determine the weight of each asset in the market portfolio to be consistent with 046 = 1.36 18 Marks 00 Calculate the Market Price of Risk 13 Marksi Total: 11 Marks Question Five A horse racing fan assesses her utility of wealth using the utility function U(w) = 2(04-1) 10 Prove algebraically that the horse racing tanis a. non satiated b. Risk averse 12 Marks] on Prove that the horse racing an exhibits constant relative risk aversion 2 Marks The horse racing fan is attending a race and she intends to place bets on two horses The table below shows the pay-out per K1 bet on each of these horses i wins the race, and the investor's estimated probabilities of each horse winning the race. The pay-out is the total paid and is not in addition to the bet being returned. Winning pay out per K1Probability of winning The horse racing fan has total wealth of K1,000 and she will be all of her wealth on this race. Negative bets are not allowed un Calculate the amount she should be on each horse to maximise her expected utility of wealth 17 Marks] (v) Calculate the expected wealth resulting from the bets in part ). [1 Marks] Explain how and why this differs from the uilty of the horse racing tan's initial wealth [2 Marks] [Total: Marks14 Question Six a) State the assumptions underlying the single index model of asset robums. 13 Marks] b) Show that in the single-index model of asset retums: DINAR v. + C ., Note: Explain what each imples. [6 Marks] cl Distinguish between the three main classes of multifactor models of asset 16 Marks] Total Marks 151 Page 4 of 5 Question Seven Consider a portfolio, P. which consists of assets held in equal proportions. Let R represent the return on the portiollo, and liat represent the return on asset. The covariance of the return on asset with that on asset is 30 State the total number of data items needed to calculate E(R) and warf). 12 Marks] ) Write down an expression for Rp). 12 Marks] 00) Using your expression from part 00. show that the specific risk of the portfolio fie the risk associated with the individus assets) tends to zero in a well- diversified portioli 13 Marks] [Total: Marks 71 Question Eight a) Describe in detail the assumptions underlying the use of mean variance 13 Marks] b) Consider a two-security world in which the returns yielded by Assets 1 and 2 are perfectly positively correlated, though they have dont expected returns e method of Lngranglan muliplers or otherwise, dorive the equation of the efficient frontier in expected return standard deviation 16 Marks] C) Use your answer in 10 to: 1. determine the gradient of the licent frontier 2 Show that the cent fronder is a straight line in expected return standard devions that passes through the points representing Assets 1 and 2 15 Marks Total: 14 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started