Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE Lafarge is a French industrial company specializing in three major products: cement, construction aggregates, and concrete. Lafarge Zambia operates 2 integrated cement plants

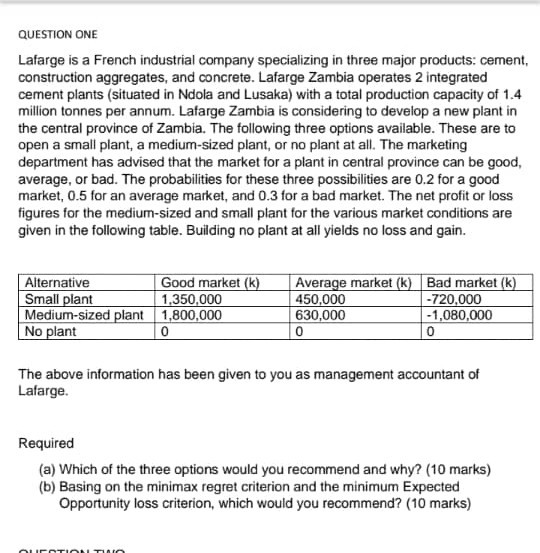

QUESTION ONE Lafarge is a French industrial company specializing in three major products: cement, construction aggregates, and concrete. Lafarge Zambia operates 2 integrated cement plants (situated in Ndola and Lusaka) with a total production capacity of 1.4 million tonnes per annum. Lafarge Zambia is considering to develop a new plant in the central province of Zambia. The following three options available. These are to open a small plant, a medium-sized plant, or no plant at all. The marketing department has advised that the market for a plant in central province can be good, average, or bad. The probabilities for these three possibilities are 0.2 for a good market, 0.5 for an average market, and 0.3 for a bad market. The net profit or loss figures for the medium-sized and small plant for the various market conditions are given in the following table. Building no plant at all yields no loss and gain. Alternative Good market (k) Small plant 1,350,000 Medium-sized plant 1,800,000 No plant 0 Average market (k) Bad market (k) 450,000 -720,000 630,000 -1,080,000 0 0 The above information has been given to you as management accountant of Lafarge. Required (a) Which of the three options would you recommend and why? (10 marks) (b) Basing on the minimax regret criterion and the minimum Expected Opportunity loss criterion, which would you recommend? (10 marks) ALIPOTION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started