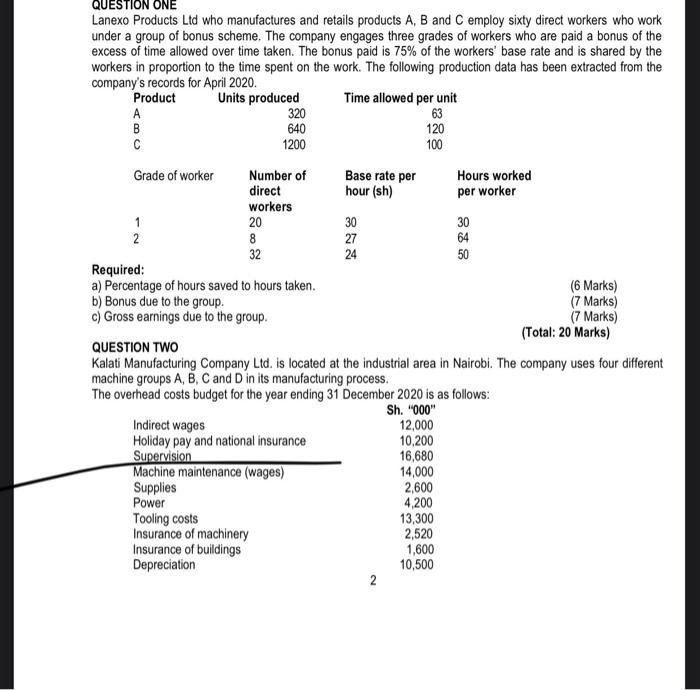

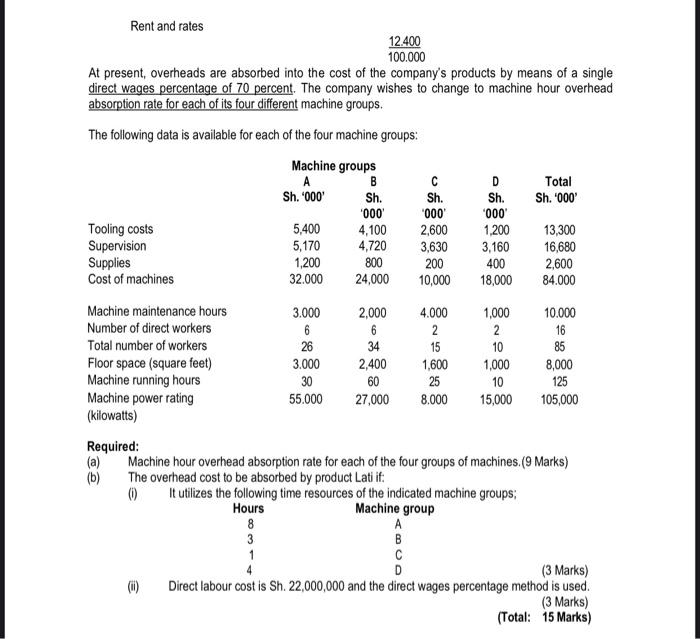

QUESTION ONE Lanexo Products Ltd who manufactures and retail products A, B and C employ sixty direct workers who work under a group of bonus scheme. The company engages three grades of workers who are paid a bonus of the excess of time allowed over time taken. The bonus paid is 75% of the workers' base rate and is shared by the workers in proportion to the time spent on the work. The following production data has been extracted from the company's records for April 2020. Product Units produced Time allowed per unit A 320 63 B 640 120 1200 100 Grade of worker Number of Base rate per Hours worked direct hour (sh) per worker workers 1 20 30 30 2 8 27 64 32 24 50 Required: a) Percentage of hours saved to hours taken. (6 Marks) b) Bonus due to the group (7 Marks) c) Gross earnings due to the group. (7 Marks) (Total: 20 Marks) QUESTION TWO Kalati Manufacturing Company Ltd. is located at the industrial area in Nairobi. The company uses four different machine groups A, B, C and Din its manufacturing process. The overhead costs budget for the year ending 31 December 2020 is as follows: Sh. "000" Indirect wages 12,000 Holiday pay and national insurance 10,200 Supervision 16,680 Machine maintenance (wages) 14,000 Supplies 2,600 Power 4,200 Tooling costs 13,300 Insurance of machinery 2,520 Insurance of buildings 1,600 Depreciation 10,500 2 000 Rent and rates 12.400 100.000 At present, overheads are absorbed into the cost of the company's products by means of a single direct wages percentage of 70 percent. The company wishes to change to machine hour overhead absorption rate for each of its four different machine groups. The following data is available for each of the four machine groups: Machine groups B D Total Sh. 6000 Sh. Sh. Sh. Sh. 5000 000 000 Tooling costs 5,400 4,100 2,600 1,200 13,300 Supervision 5,170 4,720 3,630 3,160 16,680 Supplies 1,200 200 400 2,600 Cost of machines 32.000 24,000 10,000 18,000 84.000 Machine maintenance hours 3.000 2,000 4.000 1,000 10.000 Number of direct workers 6 6 2 2 16 Total number of workers 26 34 15 10 85 Floor space (square feet) 3.000 2,400 1,600 1,000 8,000 Machine running hours 30 60 25 10 125 Machine power rating 55.000 27,000 8.000 15,000 105,000 (kilowatts) 800 Required: (a) Machine hour overhead absorption rate for each of the four groups of machines (9 Marks) (b) The overhead cost to be absorbed by product Lati it: 0 It utilizes the following time resources of the indicated machine groups: Hours Machine group 8 3 B 1 D (3 Marks) Direct labour cost is Sh.22,000,000 and the direct wages percentage method is used. (3 Marks) (Total: 15 Marks) QUESTION ONE Lanexo Products Ltd who manufactures and retail products A, B and C employ sixty direct workers who work under a group of bonus scheme. The company engages three grades of workers who are paid a bonus of the excess of time allowed over time taken. The bonus paid is 75% of the workers' base rate and is shared by the workers in proportion to the time spent on the work. The following production data has been extracted from the company's records for April 2020. Product Units produced Time allowed per unit A 320 63 B 640 120 1200 100 Grade of worker Number of Base rate per Hours worked direct hour (sh) per worker workers 1 20 30 30 2 8 27 64 32 24 50 Required: a) Percentage of hours saved to hours taken. (6 Marks) b) Bonus due to the group (7 Marks) c) Gross earnings due to the group. (7 Marks) (Total: 20 Marks) QUESTION TWO Kalati Manufacturing Company Ltd. is located at the industrial area in Nairobi. The company uses four different machine groups A, B, C and Din its manufacturing process. The overhead costs budget for the year ending 31 December 2020 is as follows: Sh. "000" Indirect wages 12,000 Holiday pay and national insurance 10,200 Supervision 16,680 Machine maintenance (wages) 14,000 Supplies 2,600 Power 4,200 Tooling costs 13,300 Insurance of machinery 2,520 Insurance of buildings 1,600 Depreciation 10,500 2 000 Rent and rates 12.400 100.000 At present, overheads are absorbed into the cost of the company's products by means of a single direct wages percentage of 70 percent. The company wishes to change to machine hour overhead absorption rate for each of its four different machine groups. The following data is available for each of the four machine groups: Machine groups B D Total Sh. 6000 Sh. Sh. Sh. Sh. 5000 000 000 Tooling costs 5,400 4,100 2,600 1,200 13,300 Supervision 5,170 4,720 3,630 3,160 16,680 Supplies 1,200 200 400 2,600 Cost of machines 32.000 24,000 10,000 18,000 84.000 Machine maintenance hours 3.000 2,000 4.000 1,000 10.000 Number of direct workers 6 6 2 2 16 Total number of workers 26 34 15 10 85 Floor space (square feet) 3.000 2,400 1,600 1,000 8,000 Machine running hours 30 60 25 10 125 Machine power rating 55.000 27,000 8.000 15,000 105,000 (kilowatts) 800 Required: (a) Machine hour overhead absorption rate for each of the four groups of machines (9 Marks) (b) The overhead cost to be absorbed by product Lati it: 0 It utilizes the following time resources of the indicated machine groups: Hours Machine group 8 3 B 1 D (3 Marks) Direct labour cost is Sh.22,000,000 and the direct wages percentage method is used. (3 Marks) (Total: 15 Marks)