Question

QUESTION ONE Meza Limited has an authorized share capital of sh 20 million divided into 1,500,000 ordinary shares of sh 10 each. An extract of

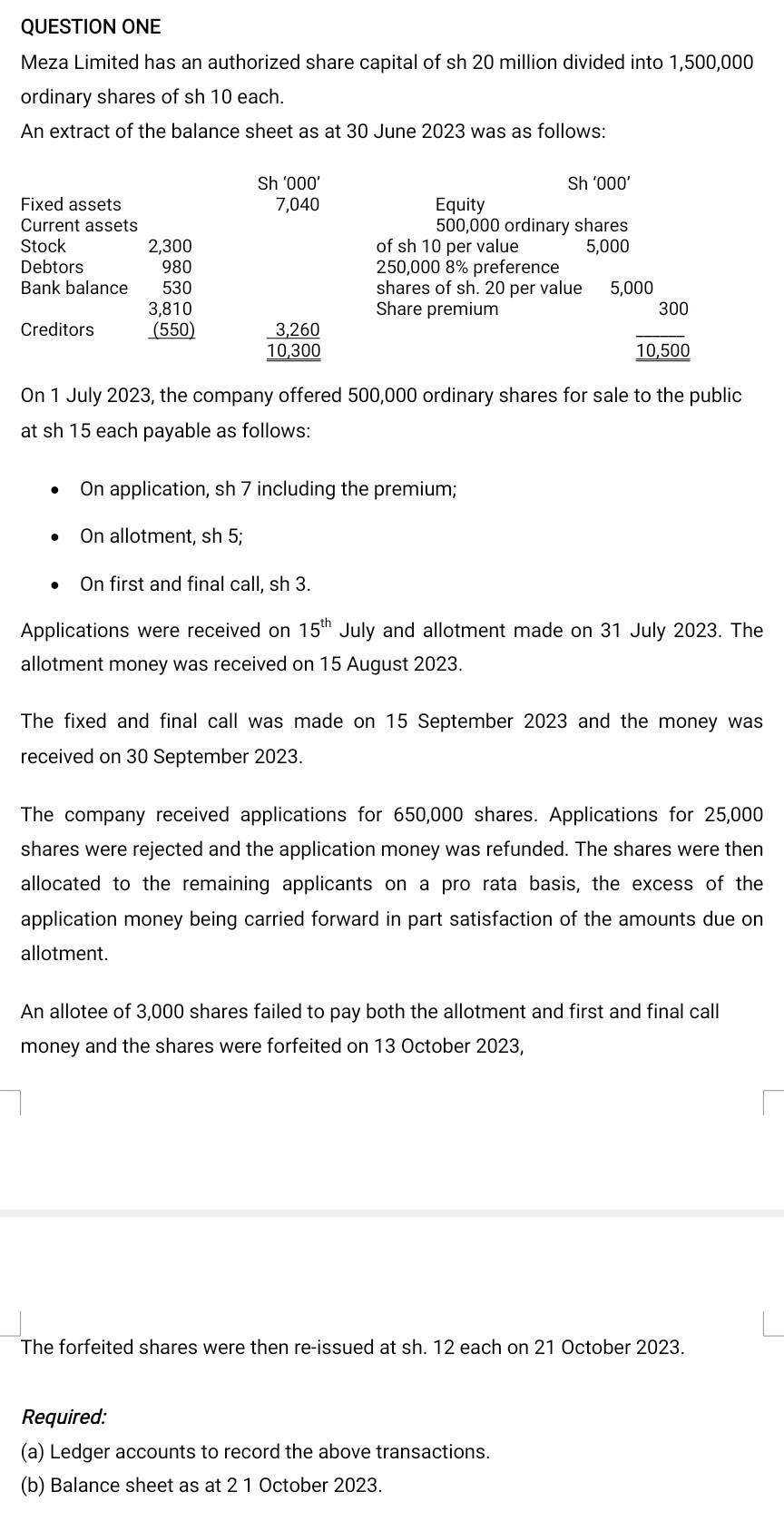

QUESTION ONE Meza Limited has an authorized share capital of sh 20 million divided into 1,500,000 ordinary shares of sh 10 each. An extract of the balance sheet as at 30 June 2023 was as follows: Sh 000 Sh 000 Fixed assets 7,040 Equity Current assets 500,000 ordinary shares Stock 2,300 of sh 10 per value 5,000 Debtors 980 250,000 8% preference Bank balance 530 shares of sh. 20 per value 5,000 3,810 Share premium 300 Creditors (550) 3,260 ______ 10,300 10,500 On 1 July 2023, the company offered 500,000 ordinary shares for sale to the public at sh 15 each payable as follows: On application, sh 7 including the premium; On allotment, sh 5; On first and final call, sh 3. Applications were received on 15th July and allotment made on 31 July 2023. The allotment money was received on 15 August 2023. The fixed and final call was made on 15 September 2023 and the money was received on 30 September 2023. The company received applications for 650,000 shares. Applications for 25,000 shares were rejected and the application money was refunded. The shares were then allocated to the remaining applicants on a pro rata basis, the excess of the application money being carried forward in part satisfaction of the amounts due on allotment. An allotee of 3,000 shares failed to pay both the allotment and first and final call money and the shares were forfeited on 13 October 2023, The forfeited shares were then re-issued at sh. 12 each on 21 October 2023.

Required: (a) Ledger accounts to record the above transactions. (b) Balance sheet as at 2 1 October 2023.

QUESTION ONE Meza Limited has an authorized share capital of sh 20 million divided into 1,500,000 ordinary shares of sh 10 each. An extract of the balance sheet as at 30 June 2023 was as follows: On 1 July 2023 , the company offered 500,000 ordinary shares for sale to the public at sh 15 each payable as follows: - On application, sh 7 including the premium; - On allotment, sh 5; - On first and final call, sh 3 . Applications were received on 15th July and allotment made on 31 July 2023 . The allotment money was received on 15 August 2023. The fixed and final call was made on 15 September 2023 and the money was received on 30 September 2023. The company received applications for 650,000 shares. Applications for 25,000 shares were rejected and the application money was refunded. The shares were then allocated to the remaining applicants on a pro rata basis, the excess of the application money being carried forward in part satisfaction of the amounts due on allotment. An allotee of 3,000 shares failed to pay both the allotment and first and final call money and the shares were forfeited on 13 October 2023, The forfeited shares were then re-issued at sh. 12 each on 21 October 2023. Required: (a) Ledger accounts to record the above transactions. (b) Balance sheet as at 21 October 2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started