Question

QUESTION ONE: QUESTION TWO: As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The first payment will occur

QUESTION ONE:

QUESTION TWO:

As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The first payment will occur in a year and will be for $10,000. You will continue receiving money monetary awards annually with each award increasing by 4 percent over the previous award, and these monetary awards will continue forever. If the appropriate interest rate is 14 percent, what is the present value of this award?

QUESTION THREE:

You plan to buy some property in Florida 9 years from today. To do this, you estimate that you will need $22,000 at that time. You would like to accumulate these funds by making equal annual deposits into your savings account, which pays 15 percent annually. If you make your first deposit at the end of this year, and you would like your account to reach $22,000 when the final deposit is made, how much will you have to deposit into the account annually?

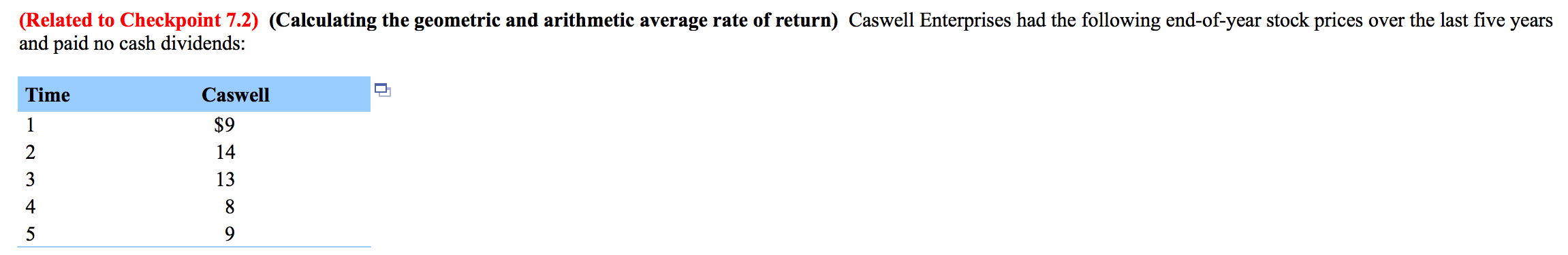

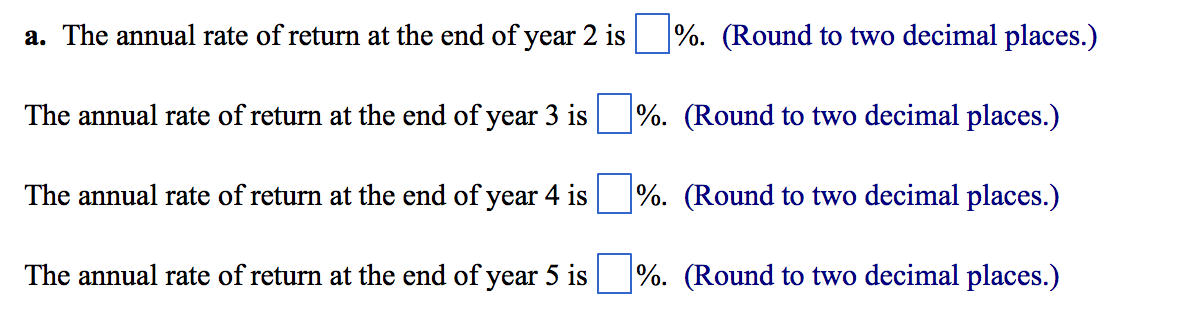

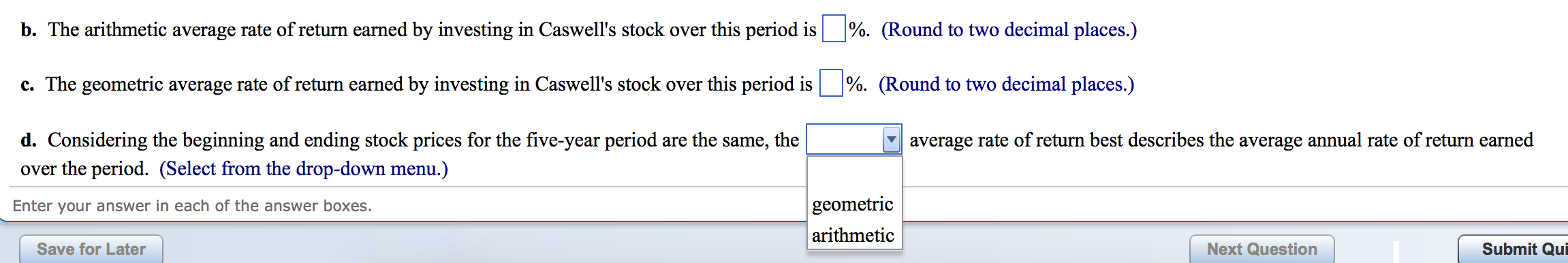

(Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Caswell Enterprises had the following end-of-year stock prices over the last five years and paid no cash dividends Time Caswell $9 14 13 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started