Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE Reuben purchased 80% of Susan on 18 January, 2000 when the balance on Susan's retained earnings was k20m. Reuben's goodwill on acquisition amounted

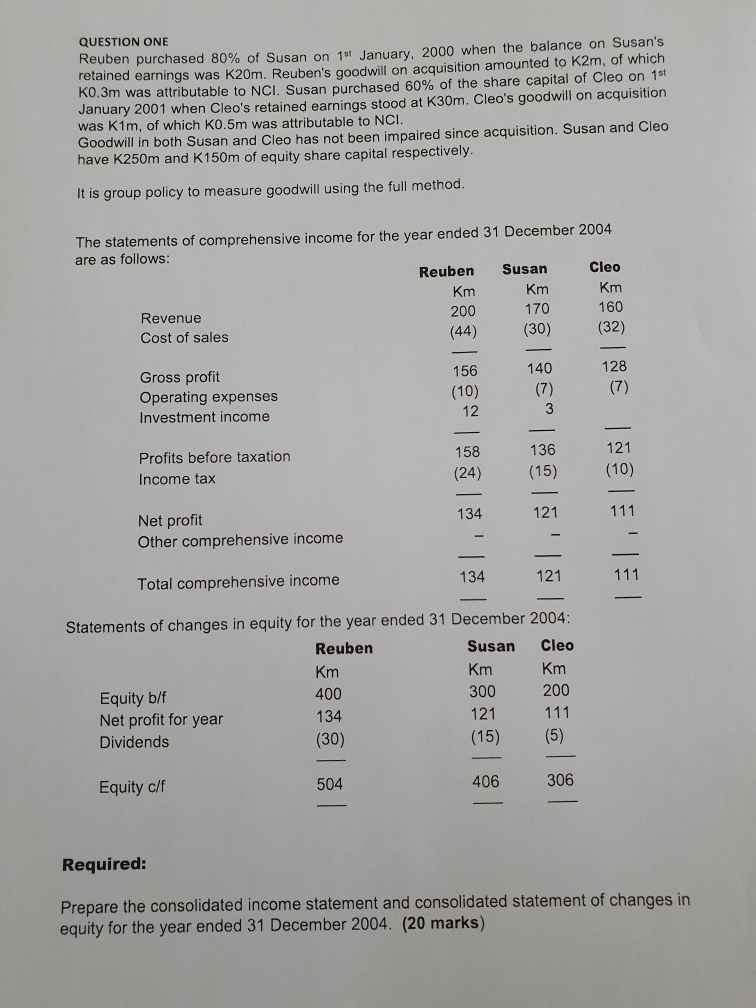

QUESTION ONE Reuben purchased 80% of Susan on 18 January, 2000 when the balance on Susan's retained earnings was k20m. Reuben's goodwill on acquisition amounted to K2m, of which K0.3m was attributable to NCI. Susan purchased 60% of the share capital of Cleo on 154 January 2001 when Cleo's retained earnings stood at K30m. Cleo's goodwill on acquisition was K1m, of which K0.5m was attributable to NCI. Goodwill in both Susan and Cleo has not been impaired since acquisition. Susan and Cleo have K250m and K150m of equity share capital respectively. It is group policy to measure goodwill using the full method. The statements of comprehensive income for the year ended 31 December 2004 are as follows: Reuben Susan Cleo Km Km Km Revenue 200 170 160 Cost of sales (44) (30) (32) 156 (10) 12 140 (7) 128 (7) Gross profit Operating expenses Investment income Profits before taxation Income tax 158 (24) 136 (15) 121 (10) 134 121 111 Net profit Other comprehensive income 134 Total comprehensive income 121 111 Statements of changes in equity for the year ended 31 December 2004: Reuben Susan Cleo Km Km Km 400 300 Equity b/f 200 Net profit for year 134 121 111 Dividends (30) (15) (5) Equity c/f 504 406 306 Required: Prepare the consolidated income statement and consolidated statement of changes in equity for the year ended 31 December 2004. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started