Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question One The future earnings, dividends, and common stock price of CHAPS Consult Ltd are expected to grow 7% per year. CHAPS'common stock currently sells

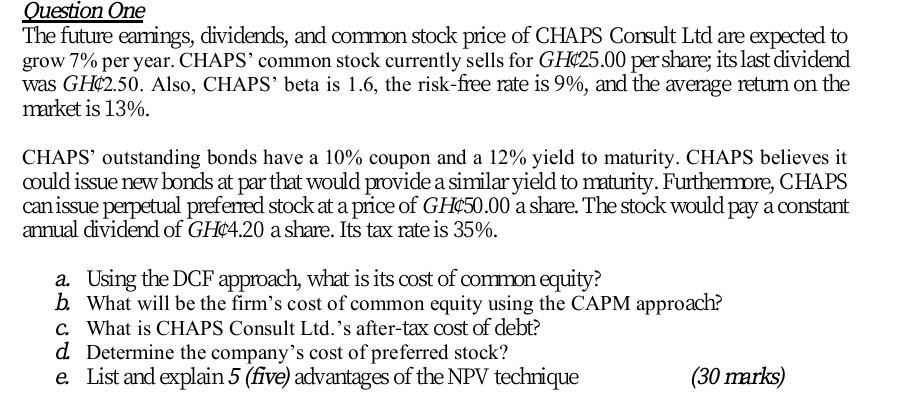

Question One The future earnings, dividends, and common stock price of CHAPS Consult Ltd are expected to grow 7% per year. CHAPS'common stock currently sells for GH25.00 per share; its last dividend was GH2.50. Also, CHAPS'beta is 1.6, the risk-free rate is 9%, and the average retum on the market is 13%. CHAPS' outstanding bonds have a 10% coupon and a 12% yield to maturity. CHAPS believes it could issue new bonds at par that would provide a similar yield to maturity. Furthermore, CHAPS can issue perpetual preferred stock at a price of GH50.00 a share. The stock would pay a constant annual dividend of GH4.20 a share. Its tax rate is 35%. a. Using the DCF approach, what is its cost of common equity? b. What will be the firm's cost of common equity using the CAPM approach? c. What is CHAPS Consult Ltd.'s after-tax cost of debt? d Determine the company's cost of preferred stock? e. List and explain 5 (five) advantages of the NPV technique (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started