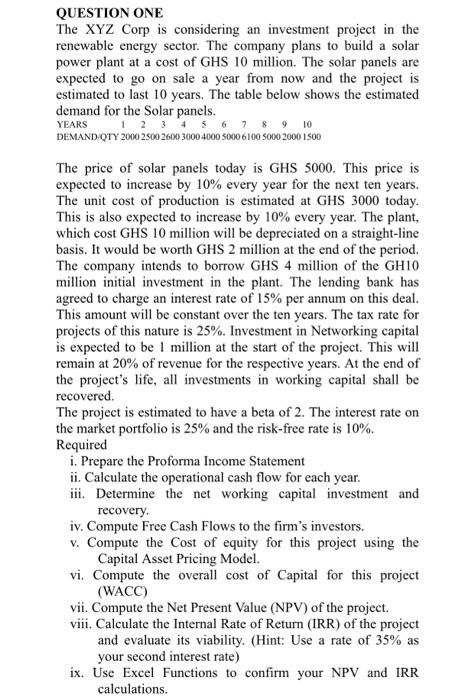

QUESTION ONE The XYZ Corp is considering an investment project in the renewable energy sector. The company plans to build a solar power plant at a cost of GHS 10 million. The solar panels are expected to go on sale a year from now and the project is estimated to last 10 years. The table below shows the estimated demand for the Solar panels. YEARS 12345678910 DEMANDQTY 2000250026003000400050006100500020001500 The price of solar panels today is GHS 5000 . This price is expected to increase by 10% every year for the next ten years. The unit cost of production is estimated at GHS 3000 today. This is also expected to increase by 10% every year. The plant, which cost GHS 10 million will be depreciated on a straight-line basis. It would be worth GHS 2 million at the end of the period. The company intends to borrow GHS 4 million of the GH10 million initial investment in the plant. The lending bank has agreed to charge an interest rate of 15% per annum on this deal. This amount will be constant over the ten years. The tax rate for projects of this nature is 25%. Investment in Networking capital is expected to be 1 million at the start of the project. This will remain at 20% of revenue for the respective years. At the end of the project's life, all investments in working capital shall be recovered. The project is estimated to have a beta of 2 . The interest rate on the market portfolio is 25% and the risk-free rate is 10%. Required i. Prepare the Proforma Income Statement ii. Calculate the operational cash flow for each year. iii. Determine the net working capital investment and recovery. iv. Compute Free Cash Flows to the firm's investors. v. Compute the Cost of equity for this project using the Capital Asset Pricing Model. vi. Compute the overall cost of Capital for this project (WACC) vii. Compute the Net Present Value (NPV) of the project. viii. Calculate the Internal Rate of Return (IRR) of the project and evaluate its viability. (Hint: Use a rate of 35% as your second interest rate) ix. Use Excel Functions to confirm your NPV and IRR calculations. QUESTION ONE The XYZ Corp is considering an investment project in the renewable energy sector. The company plans to build a solar power plant at a cost of GHS 10 million. The solar panels are expected to go on sale a year from now and the project is estimated to last 10 years. The table below shows the estimated demand for the Solar panels. YEARS 12345678910 DEMANDQTY 2000250026003000400050006100500020001500 The price of solar panels today is GHS 5000 . This price is expected to increase by 10% every year for the next ten years. The unit cost of production is estimated at GHS 3000 today. This is also expected to increase by 10% every year. The plant, which cost GHS 10 million will be depreciated on a straight-line basis. It would be worth GHS 2 million at the end of the period. The company intends to borrow GHS 4 million of the GH10 million initial investment in the plant. The lending bank has agreed to charge an interest rate of 15% per annum on this deal. This amount will be constant over the ten years. The tax rate for projects of this nature is 25%. Investment in Networking capital is expected to be 1 million at the start of the project. This will remain at 20% of revenue for the respective years. At the end of the project's life, all investments in working capital shall be recovered. The project is estimated to have a beta of 2 . The interest rate on the market portfolio is 25% and the risk-free rate is 10%. Required i. Prepare the Proforma Income Statement ii. Calculate the operational cash flow for each year. iii. Determine the net working capital investment and recovery. iv. Compute Free Cash Flows to the firm's investors. v. Compute the Cost of equity for this project using the Capital Asset Pricing Model. vi. Compute the overall cost of Capital for this project (WACC) vii. Compute the Net Present Value (NPV) of the project. viii. Calculate the Internal Rate of Return (IRR) of the project and evaluate its viability. (Hint: Use a rate of 35% as your second interest rate) ix. Use Excel Functions to confirm your NPV and IRR calculations