Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE You have been employed as a financial advisor with Image registrars Limited. Your first assignment is to explain the nature of Financial Markets

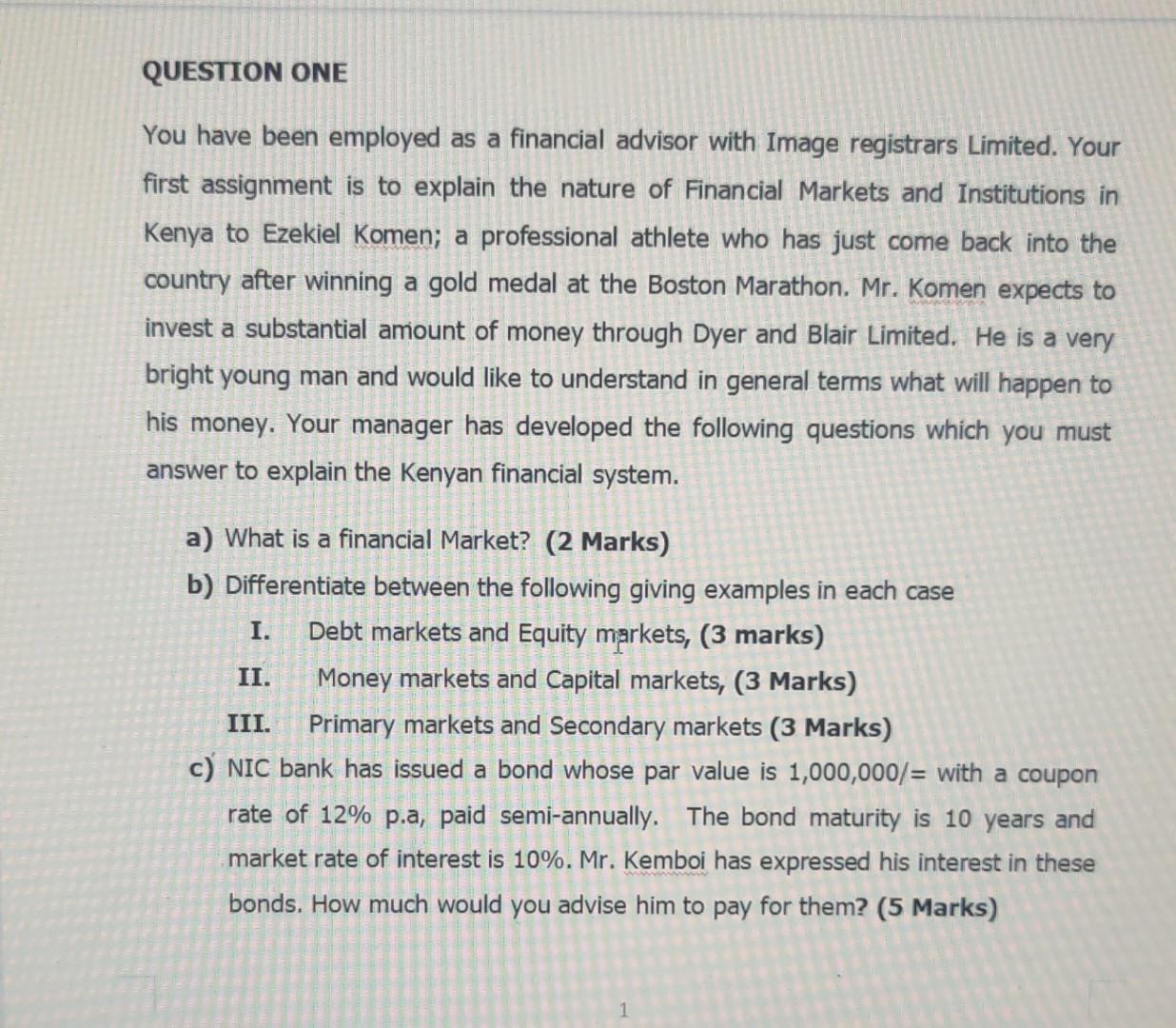

QUESTION ONE You have been employed as a financial advisor with Image registrars Limited. Your first assignment is to explain the nature of Financial Markets and Institutions in Kenya to Ezekiel Komen; a professional athlete who has just come back into the country after winning a gold medal at the Boston Marathon. Mr. Komen expects to invest a substantial amount of money through Dyer and Blair Limited. He is a very bright young man and would like to understand in general terms what will happen to his money. Your manager has developed the following questions which you must answer to explain the Kenyan financial system. a) What is a financial Market? (2 Marks) b) Differentiate between the following giving examples in each case I. Debt markets and Equity markets, (3 marks) II. Money markets and Capital markets, (3 Marks) III. Primary markets and Secondary markets (3 Marks) c) NIC bank has issued a bond whose par value is 1,000,000/= with a coupon rate of 12% p.a, paid semi-annually. The bond maturity is 10 years and market rate of interest is 10%. Mr. Kemboi has expressed his interest in these bonds. How much would you advise him to pay for them? (5 Marks) 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started