Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question one You work as a management accountant at Pips Inc. You boss has presented to you the following costs: 1. Annual depreciation of equipment,

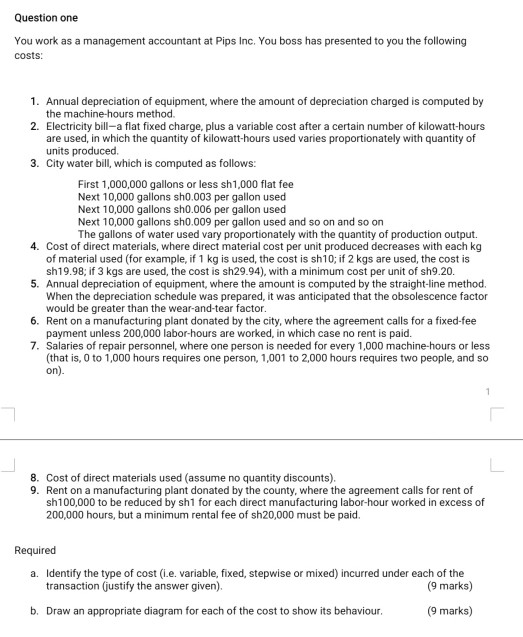

Question one You work as a management accountant at Pips Inc. You boss has presented to you the following costs: 1. Annual depreciation of equipment, where the amount of depreciation charged is computed by the machine-hours method. 2. Electricity bill-a flat fixed charge, plus a variable cost after a certain number of kilowatt-hours are used, in which the quantity of kilowatt-hours used varies proportionately with quantity of units produced 3. City water bill, which is computed as follows: First 1,000,000 gallons or less sh 1,000 flat fee Next 10,000 gallons sho.003 per gallon used Next 10,000 gallons sh0.006 per gallon used Next 10,000 gallons sho.009 per gallon used and so on and so on The gallons of water used vary proportionately with the quantity of production output. 4. Cost of direct materials, where direct material cost per unit produced decreases with each kg of material used (for example, if 1 kg is used, the cost is shio; if 2 kgs are used, the cost is sh19.98; if 3 kgs are used, the cost is sh29.94), with a minimum cost per unit of sh9.20. 5. Annual depreciation of equipment, where the amount is computed by the straight-line method. When the depreciation schedule was prepared, it was anticipated that the obsolescence factor would be greater than the wear-and-tear factor. 6. Rent on a manufacturing plant donated by the city, where the agreement calls for a fixed-fee payment unless 200,000 labor-hours are worked in which case no rent is paid. 7. Salaries of repair personnel, where one person is needed for every 1,000 machine-hours or less (that is, 0 to 1,000 hours requires one person, 1,001 to 2,000 hours requires two people, and so on). 8. Cost of direct materials used (assume no quantity discounts). 9. Rent on a manufacturing plant donated by the county, where the agreement calls for rent of sh100,000 to be reduced by sh1 for each direct manufacturing labor-hour worked in excess of 200,000 hours, but a minimum rental fee of sh20,000 must be paid. Required a. Identify the type of cost (1.e. variable, fixed, stepwise or mixed) incurred under each of the transaction (justify the answer given). (9 marks) b. Draw an appropriate diagram for each of the cost to show its behaviour. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started