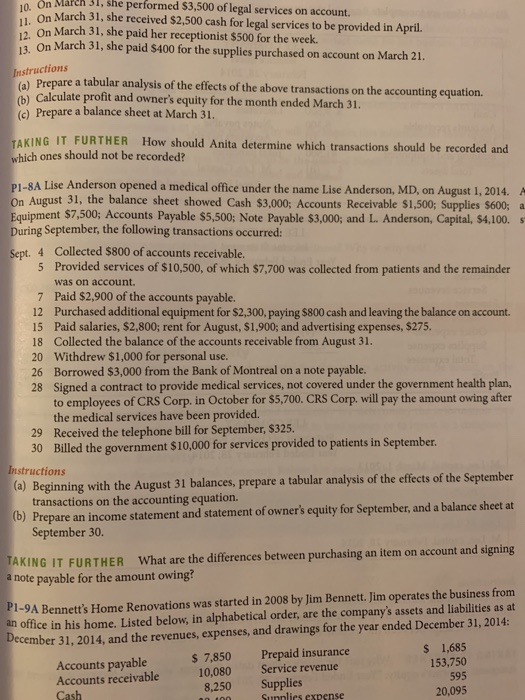

10. On March 31, she performed $3,500 of legal services on account. 11. On March 31, she received $2,500 cash for legal services to be provided in April. 12. On March 31, she paid her receptionist $500 for the week. 13. On March 31, she paid $400 for the supplies purchased on account on March 21. Instructions (a) Prepare a tabular analysis of the effects of the above transactions on the accounting equation. (6) Calculate profit and owner's equity for the month ended March 31. (c) Prepare a balance sheet at March 31. TAKING IT FURTHER How should Anita determine which transactions should be recorded and which ones should not be recorded? P1-8A Lise Anderson opened a medical office under the name Lise Anderson, MD, on August 1, 2014. A On August 31, the balance sheet showed Cash $3,000; Accounts Receivable $1,500; Supplies $600; a Equipment $7,500; Accounts Payable $5,500; Note Payable $3,000; and L. Anderson, Capital, $4,100.5 During September, the following transactions occurred: Sept. 4 Collected $800 of accounts receivable. 5 Provided services of $10,500, of which $7,700 was collected from patients and the remainder was on account 7 Paid $2,900 of the accounts payable. 12 Purchased additional equipment for $2,300, paying $800 cash and leaving the balance on account. 15 Paid salaries, $2,800; rent for August, $1,900; and advertising expenses, $275. 18 Collected the balance of the accounts receivable from August 31. 20 Withdrew $1,000 for personal use. 26 Borrowed $3,000 from the Bank of Montreal on a note payable. 28 Signed a contract to provide medical services, not covered under the government health plan, to employees of CRS Corp. in October for $5,700. CRS Corp. will pay the amount owing after the medical services have been provided. 29 Received the telephone bill for September, $325. 30 Billed the government $10,000 for services provided to patients in September. Instructions (a) Beginning with the August 31 balances, prepare a tabular analysis of the effects of the September transactions on the accounting equation. (b) Prepare an income statement and statement of owner's equity for September, and a balance sheet at September 30. TAKING IT FURTHER What are the differences between purchasing an item on account and signing a note payable for the amount owing? P1-9A Bennett's Home Renovations was started in 2008 by Jim Bennett. Jim operates the business from an office in his home. Listed below, in alphabetical order, are the company's assets and liabilities as at December 31, 2014, and the revenues, expenses, and drawings for the year ended December 31, 2014: $ 1,685 Accounts payable $ 7,850 Prepaid insurance 10,080 Service revenue 153,750 Accounts receivable Supplies 595 Cash 20,095 8,250 non Supplies expense