Answered step by step

Verified Expert Solution

Question

1 Approved Answer

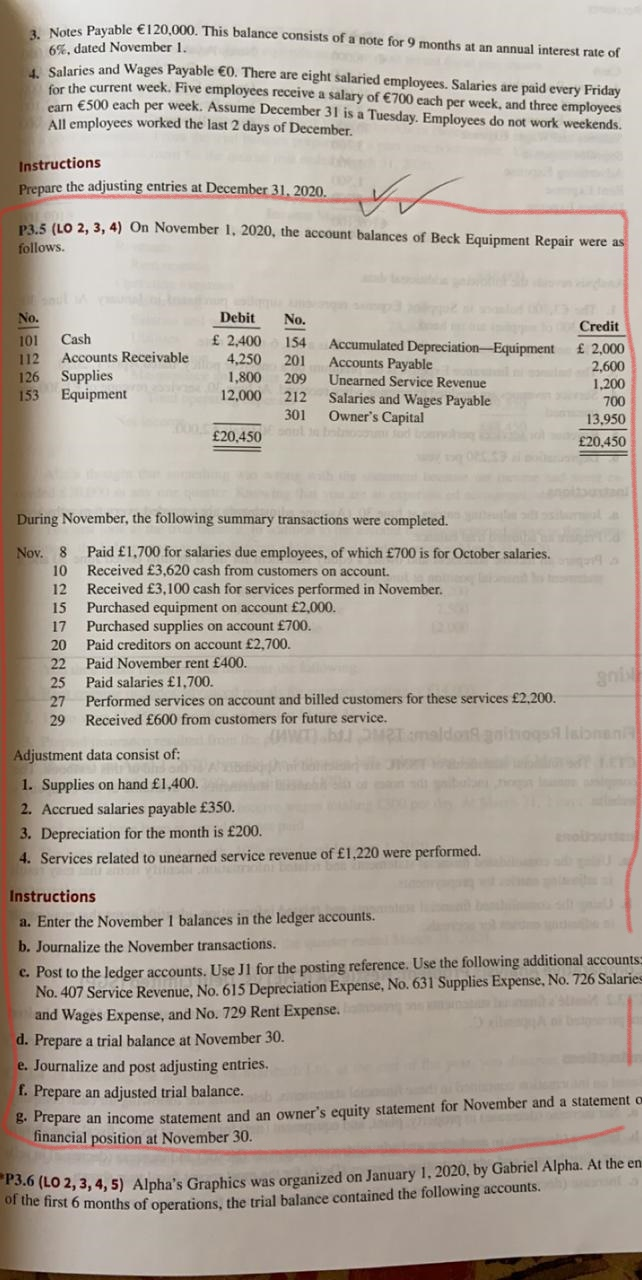

question P3.5 6%, dated November 1. 3. Notes Payable 120,000. This balance consists of a note for 9 months at an annual interest rate of

question P3.5

6%, dated November 1. 3. Notes Payable 120,000. This balance consists of a note for 9 months at an annual interest rate of Salaries and Wages Payable 0. There are eight salaried employees. Salaries are paid every Friday for the current week. Five employees receive a salary of 700 each per week, and three employees earn 500 each per week. Assume December 31 is a Tuesday. Employees do not work weekends. All employees worked the last 2 days of December Instructions Prepare the adjusting entries at December 31, 2020. P3.5 (LO 2, 3, 4) On November 1, 2020, the account balances of Beck Equipment Repair were as follows. No. No. 101 112 126 153 Cash Accounts Receivable Supplies Equipment Debit 2,400 4.250 1,800 12.000 Credit 2.000 2,600 154 201 209 212 301 Accumulated Depreciation Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Owner's Capital 1.200 700 13,950 20,450 20,450 During November, the following summary transactions were completed. Nov. 8 Paid 1,700 for salaries due employees, of which 700 is for October salaries. 10 Received 3,620 cash from customers on account. 12 Received 3,100 cash for services performed in November. 15 Purchased equipment on account 2,000. 17 Purchased supplies on account 700. 20 Paid creditors on account 2,700. 22 Paid November rent 400. 25 Paid salaries 1,700. 27 Performed services on account and billed customers for these services 2,200. 29 Received 600 from customers for future service. do togsson Adjustment data consist of: 1. Supplies on hand 1,400. 2. Accrued salaries payable 350. 3. Depreciation for the month is 200. 4. Services related to unearned service revenue of 1,220 were performed. Instructions a. Enter the November 1 balances in the ledger accounts. b. Journalize the November transactions. c. Post to the ledger accounts. Use Jl for the posting reference. Use the following additional accounts: No. 407 Service Revenue, No. 615 Depreciation Expense, No. 631 Supplies Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. d. Prepare a trial balance at November 30. e. Journalize and post adjusting entries, f. Prepare an adjusted trial balance. 8. Prepare an income statement and an owner's equity statement for November and a statemento financial position at November 30. 23.6 (LO 2, 3, 4, 5) Alpha's Graphics was organized on January 1, 2020, by Gabriel Alpha. At the en of the first 6 months of operations, the trial balance contained the following accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started