Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Part 1 - Tom and Alice Honeycutt, ages 45 and 46, respectively, live at 101 Glass Road, Delton, MI 49046. Tom is a county

Question: Part 1

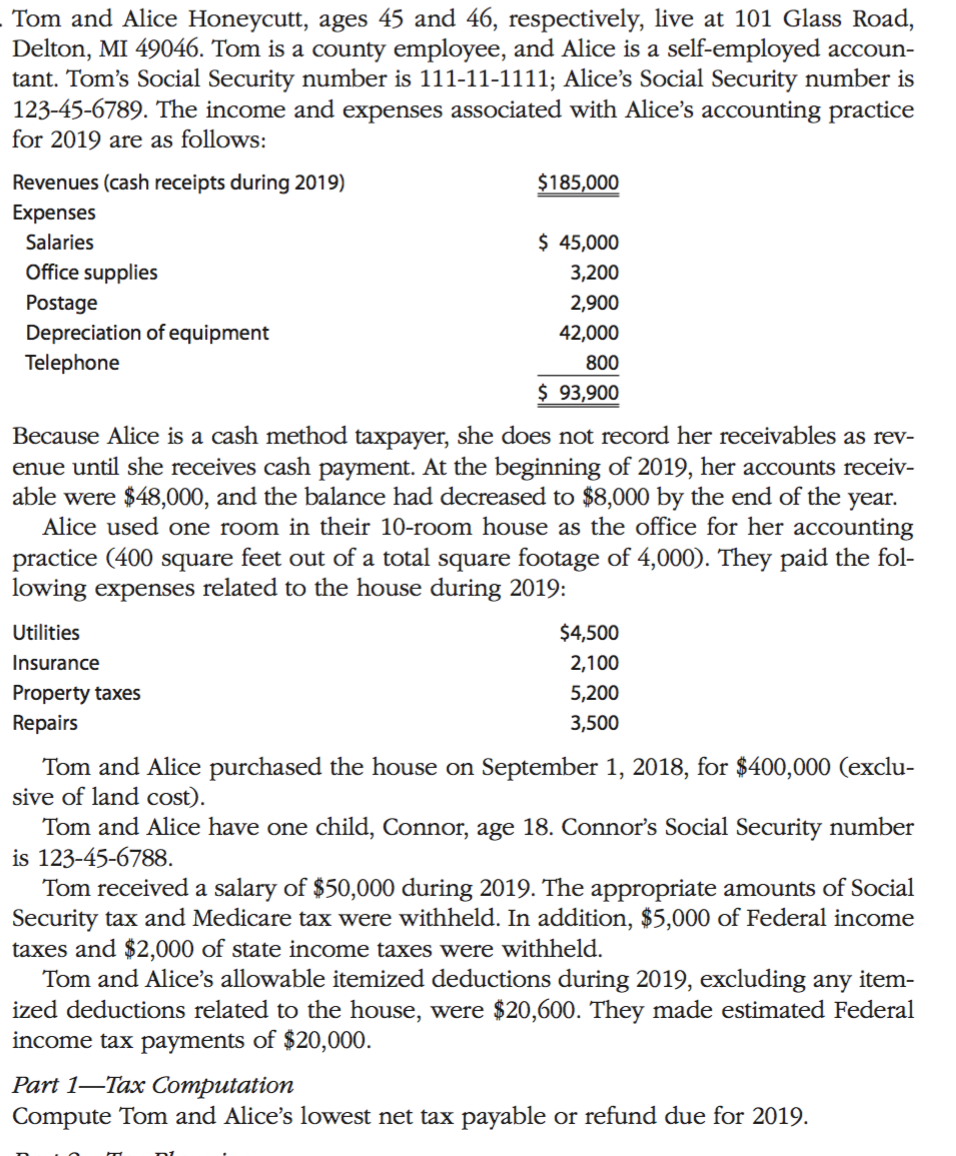

- Tom and Alice Honeycutt, ages 45 and 46, respectively, live at 101 Glass Road, Delton, MI 49046. Tom is a county employee, and Alice is a self-employed accoun- tant. Tom's Social Security number is 111-11-1111; Alice's Social Security number is 123-45-6789. The income and expenses associated with Alice's accounting practice for 2019 are as follows: Revenues (cash receipts during 2019) $185,000 Expenses Salaries $ 45,000 Office supplies 3,200 Postage 2,900 Depreciation of equipment 42,000 Telephone 800 $ 93,900 Because Alice is a cash method taxpayer, she does not record her receivables as rev- enue until she receives cash payment. At the beginning of 2019, her accounts receiv- able were $48,000, and the balance had decreased to $8,000 by the end of the year. Alice used one room in their 10-room house as the office for her accounting practice (400 square feet out of a total square footage of 4,000). They paid the fol- lowing expenses related to the house during 2019: $4,500 2,100 Utilities Insurance Property taxes Repairs 5,200 3,500 Tom and Alice purchased the house on September 1, 2018, for $400,000 (exclu- sive of land cost). Tom and Alice have one child, Connor, age 18. Connor's Social Security number is 123-45-6788. Tom received a salary of $50,000 during 2019. The appropriate amounts of Social Security tax and Medicare tax were withheld. In addition, $5,000 of Federal income taxes and $2,000 of state income taxes were withheld. Tom and Alice's allowable itemized deductions during 2019, excluding any item- ized deductions related to the house, were $20,600. They made estimated Federal income tax payments of $20,000. Part 1Tax Computation Compute Tom and Alice's lowest net tax payable or refund due for 2019. niStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started