Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Part I:Usethis link to access the 2018 annual report for Facebook Inc. Use the annual report to answer the following questions: Link for question

Question Part I:Usethis link to access the 2018 annual report for Facebook Inc. Use the annual report to answer the following questions:

Link for question 1: https://s21.q4cdn.com/399680738/files/doc_financials/annual_reports/2018-Annual-Report.pdf

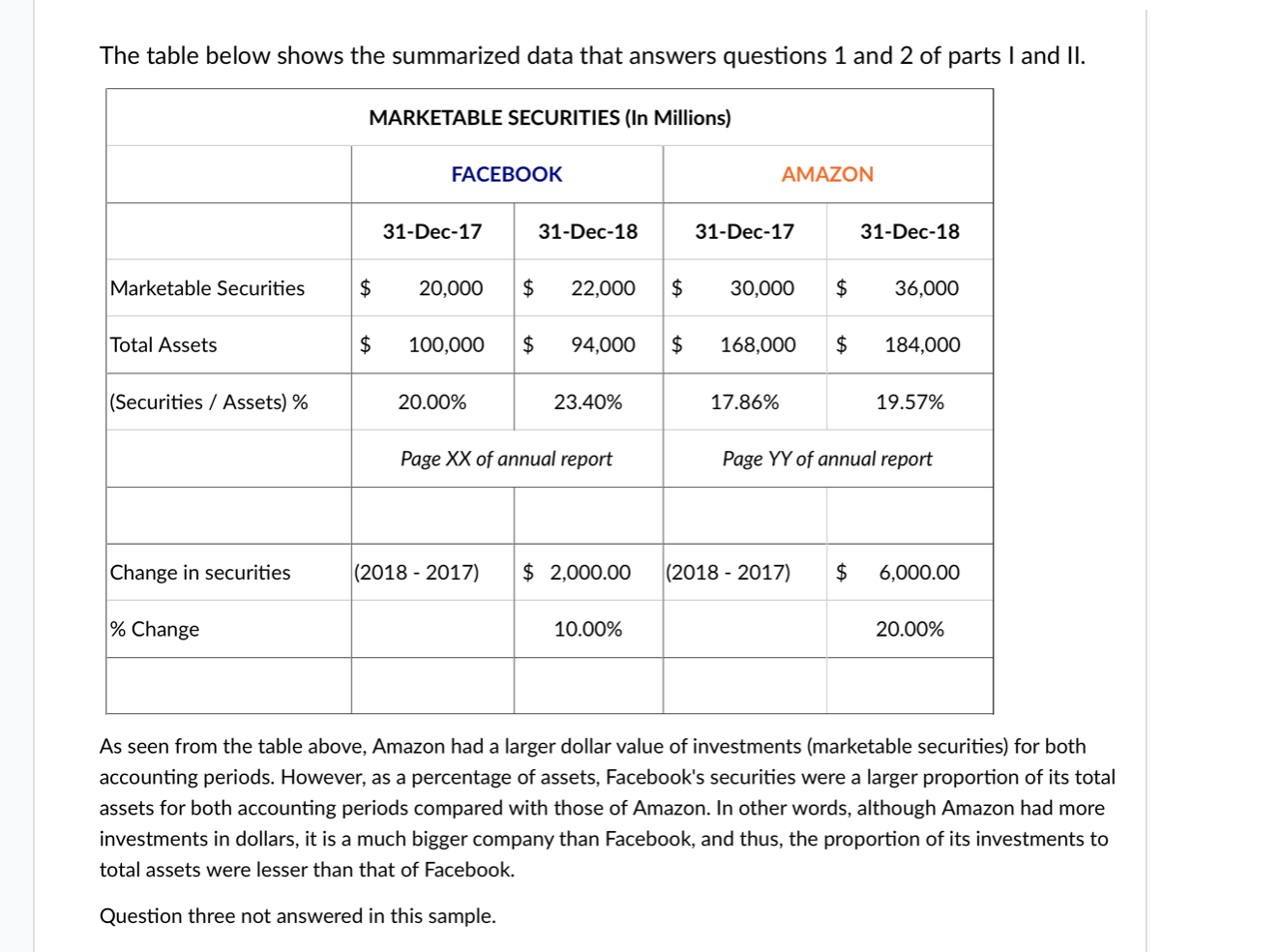

- Go to Page 57 and locate the balance sheet. Under current assets, what dollar value were marketable securities on Dec 31, 2017 and on Dec 31, 2018? Did the marketable securities increase or decrease? What was the percentage decrease or increase (to two decimal places)?

- Divide the marketable securities as at Dec 31, 2017 by the total assets on that same date and express you answer as a percentage to two decimal places. Do the same thing for Dec 31, 2018? What is the change from 2017 to 2018?

- Go to page 64 to access the "Notes to the Financial Statements". Scroll all the way until you get to "Fair Value of Financial Instruments". Read the entire subsection.What is an example of a marketable security would meet the level 1 input?

Question Part II:Usethis link to access the 2018 annual report for Amazon. Use the annual report to answer the following questions:

Link for question 2: https://ir.aboutamazon.com/static-files/0f9e36b1-7e1e-4b52-be17-145dc9d8b5ec/

- Go to Page 39 and locate the balance sheet. Under current assets, what dollar value were marketable securities on Dec 31, 2017 and on Dec 31, 2018? Did the marketable securities increase or decrease? What was the percentage decrease or increase (to two decimal places)?

- Divide the marketable securities as at Dec 31, 2017 by the total assets on that same date and express you answer as a percentage to two decimal places. Do the same thing for Dec 31, 2018? What is the change from 2017 to 2018?

- Go to page 41 to access the "Notes to the Financial Statements". Scroll all the way until you get to "Fair Value of Financial Instruments". Read the entire subsection.Is the disclosure note similar to that of Facebook?

Sample Response:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started