Question

Question part1: Employing a relevant cost approach, prepare: 1. A new profit statement that clearly identifies both the contribution made by each product over the

Question part1:

Employing a relevant cost approach, prepare:

1. A new profit statement that clearly identifies both the contribution made by each product over the last six months and the overall profit.

2. A profit statement that shows the potential situation if production of the dressing tables is stopped and demand for the other products remains the same.

3. A statement that identifies the contribution that the dressing tables would have made in the last six months, had the mirror section not been sub-contracted.

PLEASE I need the answers ASAP. Thank you in advance.

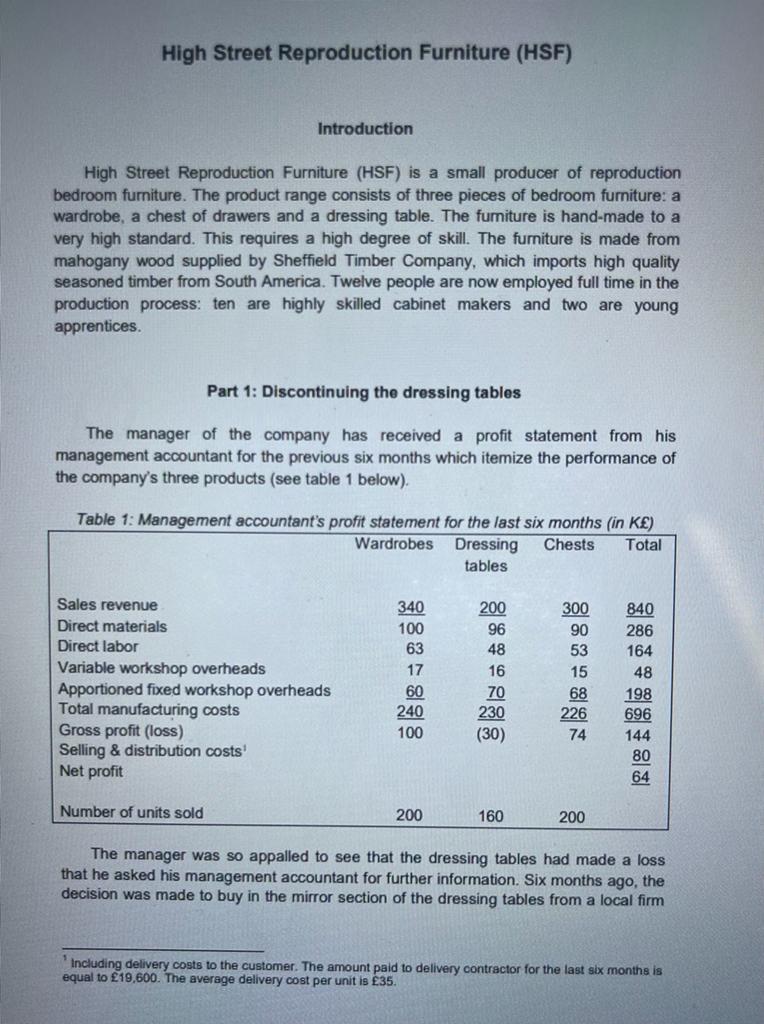

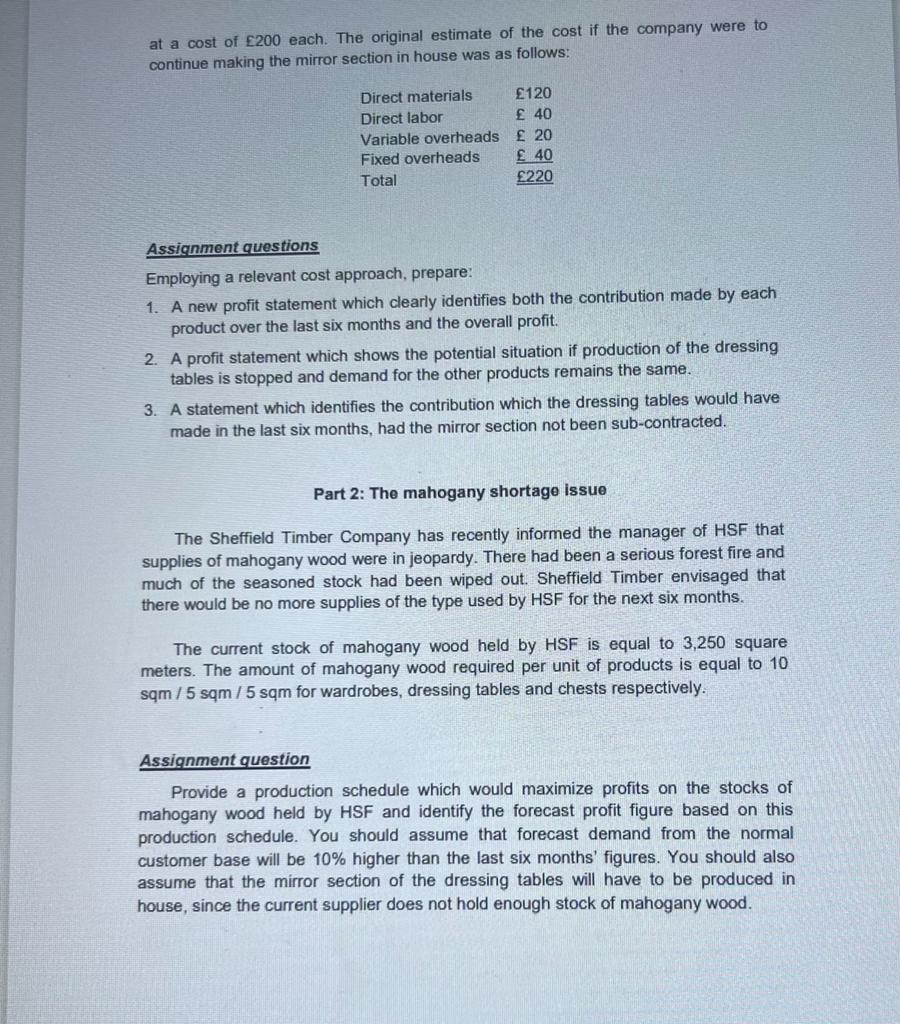

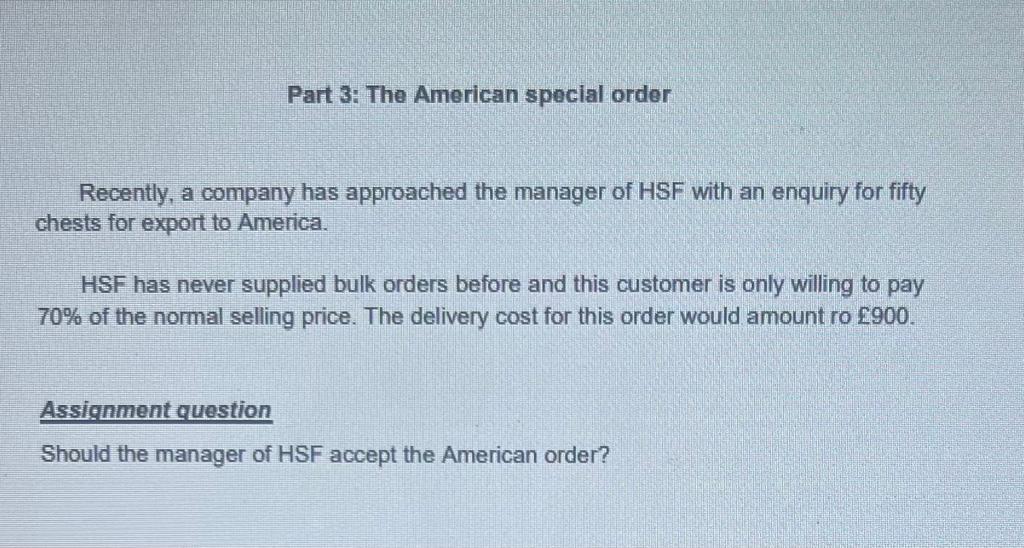

High Street Reproduction Furniture (HSF) Introduction High Street Reproduction Furniture (HSF) is a small producer of reproduction bedroom furniture. The product range consists of three pieces of bedroom furniture: a wardrobe, a chest of drawers and a dressing table. The furniture is hand-made to a very high standard. This requires a high degree of skill. The furniture is made from mahogany wood supplied by Sheffield Timber Company, which imports high quality seasoned timber from South America. Twelve people are now employed full time in the production process: ten are highly skilled cabinet makers and two are young apprentices. Part 1: Discontinuing the dressing tables The manager of the company has received a profit statement from his management accountant for the previous six months which itemize the performance of the company's three products (see table 1 below). Table 1: Management accountant's profit statement for the last six months (in K ) The manager was so appalled to see that the dressing tables had made a loss that he asked his management accountant for further information. Six months ago, the decision was made to buy in the mirror section of the dressing tables from a local firm 'Including delivery costs to the customer. The amount paid to delivery contractor for the last six months is equal to 19,600. The average delivery cost per unit is 35. at a cost of 200 each. The original estimate of the cost if the company were to continue making the mirror section in house was as follows: Assignment questions Employing a relevant cost approach, prepare: 1. A new profit statement which clearly identifies both the contribution made by each product over the last six months and the overall profit. 2. A profit statement which shows the potential situation if production of the dressing tables is stopped and demand for the other products remains the same. 3. A statement which identifies the contribution which the dressing tables would have made in the last six months, had the mirror section not been sub-contracted. Part 2: The mahogany shortage issue The Sheffield Timber Company has recently informed the manager of HSF that supplies of mahogany wood were in jeopardy. There had been a serious forest fire and much of the seasoned stock had been wiped out. Sheffield Timber envisaged that there would be no more supplies of the type used by HSF for the next six months. The current stock of mahogany wood held by HSF is equal to 3,250 square meters. The amount of mahogany wood required per unit of products is equal to 10 sqm / 5 sqm / 5 sqm for wardrobes, dressing tables and chests respectively. Assignment question Provide a production schedule which would maximize profits on the stocks of mahogany wood held by HSF and identify the forecast profit figure based on this production schedule. You should assume that forecast demand from the normal customer base will be 10% higher than the last six months' figures. You should also assume that the mirror section of the dressing tables will have to be produced in house, since the current supplier does not hold enough stock of mahogany wood. Part 3: The American special order Recently, a company has approached the manager of HSF with an enquiry for fifty chests for export to America. HSF has never supplied bulk orders before and this customer is only willing to pay 70% of the normal selling price. The delivery cost for this order would amount ro 900. Assignment question Should the manager of HSF accept the American order? High Street Reproduction Furniture (HSF) Introduction High Street Reproduction Furniture (HSF) is a small producer of reproduction bedroom furniture. The product range consists of three pieces of bedroom furniture: a wardrobe, a chest of drawers and a dressing table. The furniture is hand-made to a very high standard. This requires a high degree of skill. The furniture is made from mahogany wood supplied by Sheffield Timber Company, which imports high quality seasoned timber from South America. Twelve people are now employed full time in the production process: ten are highly skilled cabinet makers and two are young apprentices. Part 1: Discontinuing the dressing tables The manager of the company has received a profit statement from his management accountant for the previous six months which itemize the performance of the company's three products (see table 1 below). Table 1: Management accountant's profit statement for the last six months (in K ) The manager was so appalled to see that the dressing tables had made a loss that he asked his management accountant for further information. Six months ago, the decision was made to buy in the mirror section of the dressing tables from a local firm 'Including delivery costs to the customer. The amount paid to delivery contractor for the last six months is equal to 19,600. The average delivery cost per unit is 35. at a cost of 200 each. The original estimate of the cost if the company were to continue making the mirror section in house was as follows: Assignment questions Employing a relevant cost approach, prepare: 1. A new profit statement which clearly identifies both the contribution made by each product over the last six months and the overall profit. 2. A profit statement which shows the potential situation if production of the dressing tables is stopped and demand for the other products remains the same. 3. A statement which identifies the contribution which the dressing tables would have made in the last six months, had the mirror section not been sub-contracted. Part 2: The mahogany shortage issue The Sheffield Timber Company has recently informed the manager of HSF that supplies of mahogany wood were in jeopardy. There had been a serious forest fire and much of the seasoned stock had been wiped out. Sheffield Timber envisaged that there would be no more supplies of the type used by HSF for the next six months. The current stock of mahogany wood held by HSF is equal to 3,250 square meters. The amount of mahogany wood required per unit of products is equal to 10 sqm / 5 sqm / 5 sqm for wardrobes, dressing tables and chests respectively. Assignment question Provide a production schedule which would maximize profits on the stocks of mahogany wood held by HSF and identify the forecast profit figure based on this production schedule. You should assume that forecast demand from the normal customer base will be 10% higher than the last six months' figures. You should also assume that the mirror section of the dressing tables will have to be produced in house, since the current supplier does not hold enough stock of mahogany wood. Part 3: The American special order Recently, a company has approached the manager of HSF with an enquiry for fifty chests for export to America. HSF has never supplied bulk orders before and this customer is only willing to pay 70% of the normal selling price. The delivery cost for this order would amount ro 900. Assignment question Should the manager of HSF accept the American order

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started