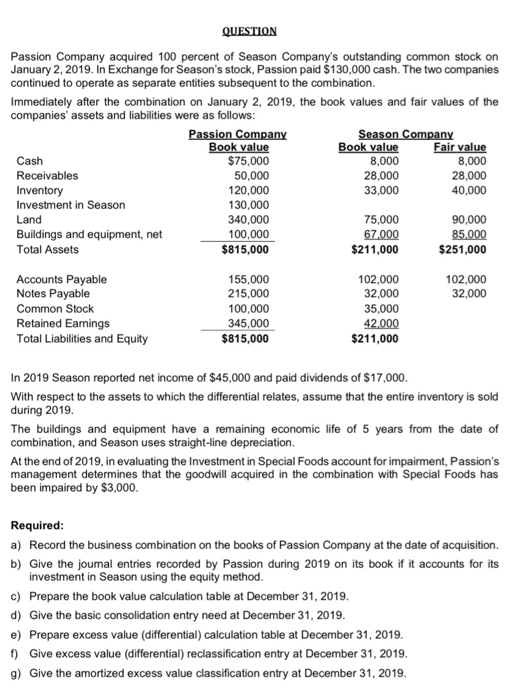

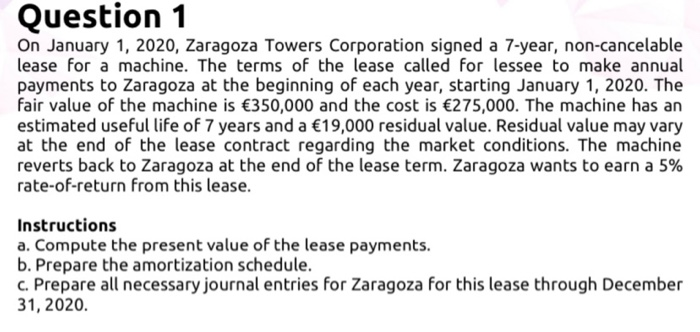

QUESTION Passion Company acquired 100 percent of Season Company's outstanding common stock on January 2, 2019. In Exchange for Season's stock, Passion paid $130,000 cash. The two companies continued to operate as separate entities subsequent to the combination. Immediately after the combination on January 2, 2019, the book values and fair values of the companies' assets and liabilities were as follows: Passion Company Season Company Book value Book value Fair value Cash $75,000 8,000 8,000 Receivables 50,000 28,000 28,000 Inventory 120,000 33,000 40,000 Investment in Season 130,000 Land 340,000 75,000 90,000 Buildings and equipment, net 100,000 67.000 85.000 Total Assets $815,000 $211,000 $251,000 Accounts Payable 155,000 102,000 102,000 Notes Payable 215,000 32,000 32,000 Common Stock 100,000 35,000 Retained Earnings 345,000 42.000 Total Liabilities and Equity $815,000 $211,000 In 2019 Season reported net income of $45,000 and paid dividends of $17,000. With respect to the assets to which the differential relates, assume that the entire inventory is sold during 2019. The buildings and equipment have a remaining economic life of 5 years from the date of combination, and Season uses straight-line depreciation. At the end of 2019, in evaluating the Investment in Special Foods account for impairment, Passion's management determines that the goodwill acquired in the combination with Special Foods has been impaired by $3,000. Required: a) Record the business combination on the books of Passion Company at the date of acquisition. b) Give the journal entries recorded by Passion during 2019 on its book if it accounts for its investment in Season using the equity method. c) Prepare the book value calculation table at December 31, 2019. d) Give the basic consolidation entry need at December 31, 2019. e) Prepare excess value (differential) calculation table at December 31, 2019. f) Give excess value (differential) reclassification entry at December 31, 2019. 9) Give the amortized excess value classification entry at December 31, 2019. Question 1 on January 1, 2020, Zaragoza Towers Corporation signed a 7-year, non-cancelable lease for a machine. The terms of the lease called for lessee to make annual payments to Zaragoza at the beginning of each year, starting January 1, 2020. The fair value of the machine is 350,000 and the cost is 275,000. The machine has an estimated useful life of 7 years and a 19,000 residual value. Residual value may vary at the end of the lease contract regarding the market conditions. The machine reverts back to Zaragoza at the end of the lease term. Zaragoza wants to earn a 5% rate-of-return from this lease. Instructions a. Compute the present value of the lease payments. b. Prepare the amortization schedule. c. Prepare all necessary journal entries for Zaragoza for this lease through December 31, 2020