Question

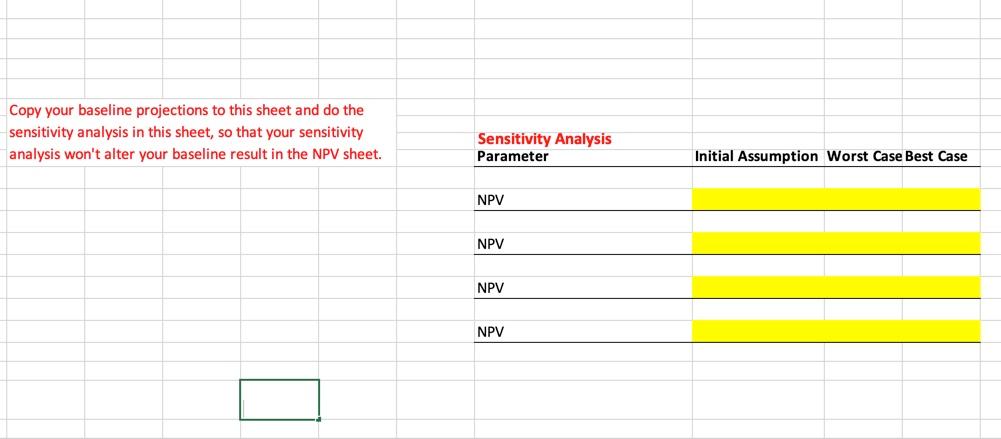

Question: Perform a sensitivity analysis on four parameters: Select four parameters from the list below and clearly explain why those parameters are important to analyze

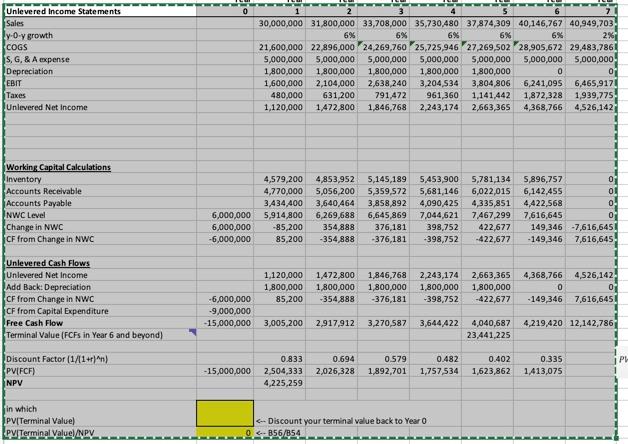

Question: Perform a sensitivity analysis on four parameters: Select four parameters from the list below and clearly explain why those parameters are important to analyze for your company in the word document. The Worst and Best cases for each assumption are already provided. Do the sensitivity analysis in Excel and report your results in the word document (just the NPV results, unlike in the baseline analysis where you need to report your analysis in rows 3-57.)

Parameter

Sales in Year 1 (in thousands) Sales Growth through Year 6 Cost of Goods Sold (% of Sales) Cost of Capital

Accounts Receivable % of Next Year Sales

Initial Worst Case Assumption

$30,000 $27,000 6% 0% 72% 77% 20% 23% 15% 20%

Best Case

$33,000 10% 67% 17% 10%

Inventory % of Next Year COGS Accounts Payable % of Next Year COGS

Initial NWC (in thousands) Sales Growth After Year 6 Free Cash Flow Growth After Year 6 Initial Capital Expenditure (in thousands)

20% 25% 15% 15% 10% 20%

$6,000 $4,500 $7,500 2% 0% 4% 2% 0% 4% $9,000 $7,000 $11,000

For example, vary the parameter Sales in Year 1 from the worst case ($27 million) to the best case ($33 million), holding all the other parameters fixed (at the level of initial assumptions). Then fill in the highlighted blank boxes for NPV in the sheet of Sensitivity Analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started