Question:

Pick two ratios from statements below to analyze- briefly explain what they mean, how you calculated them and how they compare to the industry! (see images)

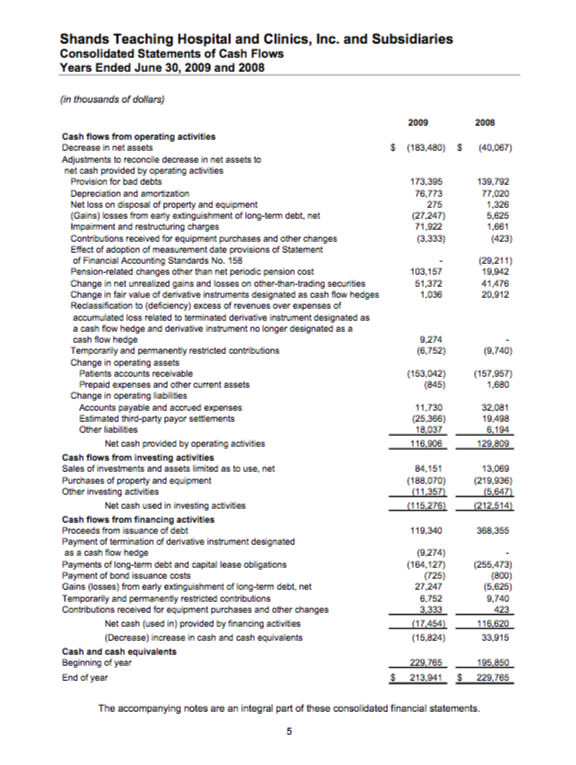

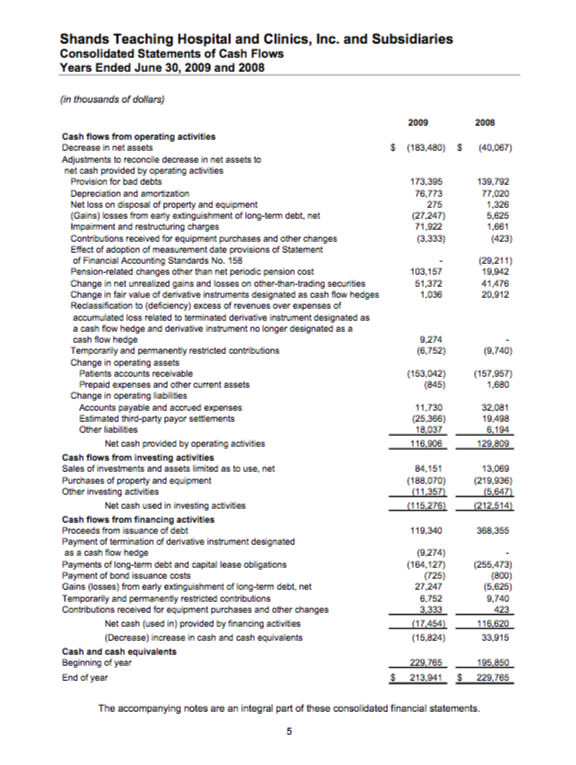

Shands Teaching Hospital and Clinics, Inc. and Subsidiaries Consolidated Statements of Cash Flows Years Ended June 30, 2009 and 2008 in thousands of dollars) 2009 2008 Cash flows from operating activities Decrease in net assets Adjustments to reconcile decrease in net assets to net cash provided by operating activities $ (183,480) (40,067) Provision for bad debts Depreciation and amorization Net loss on disposal of property and equipment (Gains) losses from early extinguishment of long-term debt, net Impairment and restructuring charges Contributions received for equipment purchases and other changes Effect of adoption of measurement date provisions of Statement of Financial Accounting Standards No. 158 Pension-related changes other than net periodic pension cost Change in net unrealized gains and losses on other-han-trading securities Change in fair value of derivative instruments designated as cash flow hedges Redassification to (defciency) excess of revenues over expenses of accumulated loss related to terminated derivative instrument designated as a cash fow hedge and derivative instrument no longer designated as a cash flow hedge Temporarily and permanently restricted contributions Change in operating assets 73.395 76,773 275 27-247) 71,922 (3,333) 139,792 77,020 ,326 5.625 1,661 (29,211) 19.942 103,157 51,372 1.03641476 20,912 9.274 (6.752)(9.740) 153,042) (157.957 1,680 Prepaid expenses and other curent assets (845) Change in operating liabilities Accounts payable and accrued expensers 11,730 (25,366) 32.081 19.498 Estimated third-party payor settiements Other liabilities Net cash provided by operating activities Cash flows from investing activities Sales of investments and assets limited as to use, net Purchases of property and equipment Other investing activities 84,151 13,069 88,070) (219,936) (11.35715647 115 275)212 514 Net cash used in investing activites Cash flows from financing activities Proceeds from issuance of debt Payment of termination of derivative instrument designated as a cash flow hedge Payments of long-term debt and capital lease obligations Payment of bond issuance costs Gains (losses) from early extinguishment of long-term debt, net Temporariy and permanenty restricted contributions Contibutions received for equipment purchases and other changes 19.340368,356 (9 274) 164,127) 255,473) (800) (5,625) 9,740 27.247 6,752 Net cash (used in) provided by financing activities Decrease) increase in cash and cash equivalents (15,824) 33,915 Cash and cash equivalents Beginning of year End of year 229765 213.941 S 229.765 The accompanying notes are an integral part of these consolidated financial statements