Question

Question: Prepare financial statement forecasts (i.e., balance sheets, statements of operations, and implied statements of cash flows) for Diamond for fiscal years 2012 to 2016.

Question: Prepare financial statement forecasts (i.e., balance sheets, statements of operations, and implied statements of cash flows) for Diamond for fiscal years 2012 to 2016. Assume that the reported amounts in the financial statements are correct. Use the list of forecasting assumptions below, adding other assumptions you believe are necessary.

Revenue Growth 3% per year

Advertising 5% of sales

Amortization - $8,189 each year

Acquisition and integration related expenses reduce by $2,800 each year

Interest rate on long-term debt 4.5%

Effective income tax rate 33%

PP&E Turnover expected to decline 0.2 each year from 2011 levels

Treasury Stock additional purchases of $1,817 each year

Long-term debt issue $3,500 each year

Common stock issue $1,803 each year

No other borrowings, repayments, or equity issuances during forecast period

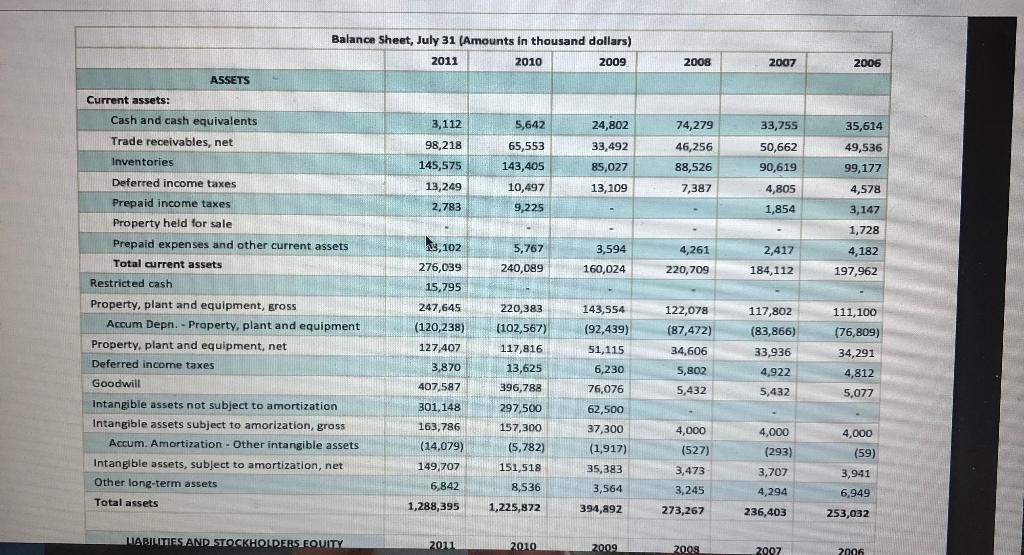

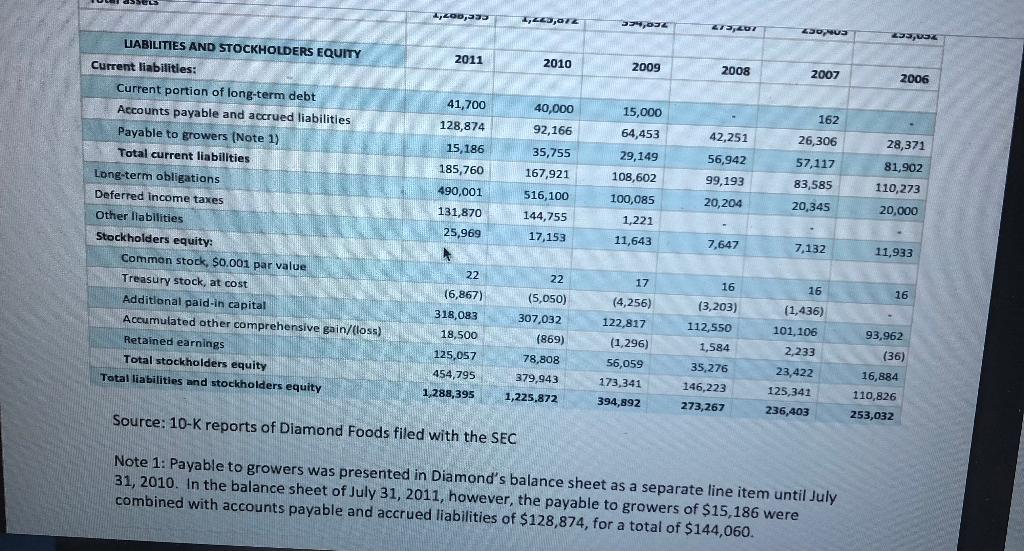

Balance Sheet, July 31 (Amounts in thousand dollars) 2011 2010 2009 2008 2007 2006 ASSETS Current assets: Cash and cash equivalents Trade receivables, net 3,112 5,642 24,802 74,279 33,75S 35,614 65,553 33,492 46,256 49,536 98,218 145,575 50,662 90,619 Inventories 143,405 85,027 88,526 99,177 4,578 13,249 10,497 13,109 7,387 4,805 2,783 9,225 - - Deferred income taxes Prepaid income taxes Property held for sale Prepaid expenses and other current assets 1,854 3,147 - - 1,728 13,102 3,594 4,182 Total current assets 5,767 240,089 4,261 220,709 2,417 184,112 160,024 197,962 276,039 15,795 247,645 143,554 117,802 Restricted cash Property, plant and equipment, gross Accum Depn. - Property, plant and equipment Property, plant and equipment, net Deferred income taxes 220,383 (102,567) 117,816 (83,866) (92,439) 51,115 (120,238) 127,407 3,870 407,587 122,078 (87,472) 34.606 5,802 5,432 33,936 111,100 (76,809) 34,291 4,812 5,077 6,230 13,625 396,788 4,922 Goodwill 76,076 5,432 301.148 297,500 - 4,000 4,000 Intangible assets not subject to amortization Intangible assets subject to amorization, gross Accum. Amortization - Other intangible assets Intangible assets, subject to amortization, net Other long-term assets Total assets 163,786 (14,079) 149,707 157,300 (5,782) 151 518 62,500 37,300 (1,917) 35,383 3,564 4,000 (527) 3,473 (59) 6,842 (293) 3,707 4,294 236,403 8,536 3,245 3,941 6,949 1,288,395 1,225,872 394,892 273,267 253,032 LABILITIES AND STOCKHOLDERS EQUITY 2011 2010 2009 2009 2007 2006 1,200,- 4,223,72 579,034 ZILUT 230, US 23OZ 2011 2010 2009 2008 2008 2007 2006 15,000 64,453 162 40,000 92,166 35,755 167,921 42,251 26,306 28,371 29,149 56,942 41,700 128,874 15,186 185,760 490,001 131,870 25,969 57,117 83,585 99,193 81,902 110,273 LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities: Current portion of long-term debt Accounts payable and accrued liabilities Payable to growers (Note 1) Total current liabilities Long-term obligations Deferred Income taxes Other liabilities Stockholders equity: Common stock, $0.001 par value Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive gain/(loss) Retained earnings Total stockholders equity Tatal liabilities and stockholders equity 516,100 144,755 108,602 100,085 1,221 20,204 20,345 20,000 17,153 11,643 7,647 7,132 11,933 22 22 16 (6,867) 318,083 18,500 93,962 (5,050) 307,032 (869) 78,808 379,943 1,225,872 17 (4,256) 122,817 (1,296) 56,059 173,341 394,892 16 (3,203) 112,550 1,584 35,276 146,223 273,267 16 (1,436) 101,106 2,233 23,422 125,341 236,403 125,057 454,795 1,288,395 (36) 16,884 110,826 253,032 Source: 10-K reports of Diamond Foods filed with the SEC Note 1: Payable to growers was presented in Diamond's balance sheet as a separate line item until July 31, 2010. In the balance sheet of July 31, 2011, however, the payable to growers of $15,186 were combined with accounts payable and accrued liabilities of $128,874, for a total of $144,060. Balance Sheet, July 31 (Amounts in thousand dollars) 2011 2010 2009 2008 2007 2006 ASSETS Current assets: Cash and cash equivalents Trade receivables, net 3,112 5,642 24,802 74,279 33,75S 35,614 65,553 33,492 46,256 49,536 98,218 145,575 50,662 90,619 Inventories 143,405 85,027 88,526 99,177 4,578 13,249 10,497 13,109 7,387 4,805 2,783 9,225 - - Deferred income taxes Prepaid income taxes Property held for sale Prepaid expenses and other current assets 1,854 3,147 - - 1,728 13,102 3,594 4,182 Total current assets 5,767 240,089 4,261 220,709 2,417 184,112 160,024 197,962 276,039 15,795 247,645 143,554 117,802 Restricted cash Property, plant and equipment, gross Accum Depn. - Property, plant and equipment Property, plant and equipment, net Deferred income taxes 220,383 (102,567) 117,816 (83,866) (92,439) 51,115 (120,238) 127,407 3,870 407,587 122,078 (87,472) 34.606 5,802 5,432 33,936 111,100 (76,809) 34,291 4,812 5,077 6,230 13,625 396,788 4,922 Goodwill 76,076 5,432 301.148 297,500 - 4,000 4,000 Intangible assets not subject to amortization Intangible assets subject to amorization, gross Accum. Amortization - Other intangible assets Intangible assets, subject to amortization, net Other long-term assets Total assets 163,786 (14,079) 149,707 157,300 (5,782) 151 518 62,500 37,300 (1,917) 35,383 3,564 4,000 (527) 3,473 (59) 6,842 (293) 3,707 4,294 236,403 8,536 3,245 3,941 6,949 1,288,395 1,225,872 394,892 273,267 253,032 LABILITIES AND STOCKHOLDERS EQUITY 2011 2010 2009 2009 2007 2006 1,200,- 4,223,72 579,034 ZILUT 230, US 23OZ 2011 2010 2009 2008 2008 2007 2006 15,000 64,453 162 40,000 92,166 35,755 167,921 42,251 26,306 28,371 29,149 56,942 41,700 128,874 15,186 185,760 490,001 131,870 25,969 57,117 83,585 99,193 81,902 110,273 LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities: Current portion of long-term debt Accounts payable and accrued liabilities Payable to growers (Note 1) Total current liabilities Long-term obligations Deferred Income taxes Other liabilities Stockholders equity: Common stock, $0.001 par value Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive gain/(loss) Retained earnings Total stockholders equity Tatal liabilities and stockholders equity 516,100 144,755 108,602 100,085 1,221 20,204 20,345 20,000 17,153 11,643 7,647 7,132 11,933 22 22 16 (6,867) 318,083 18,500 93,962 (5,050) 307,032 (869) 78,808 379,943 1,225,872 17 (4,256) 122,817 (1,296) 56,059 173,341 394,892 16 (3,203) 112,550 1,584 35,276 146,223 273,267 16 (1,436) 101,106 2,233 23,422 125,341 236,403 125,057 454,795 1,288,395 (36) 16,884 110,826 253,032 Source: 10-K reports of Diamond Foods filed with the SEC Note 1: Payable to growers was presented in Diamond's balance sheet as a separate line item until July 31, 2010. In the balance sheet of July 31, 2011, however, the payable to growers of $15,186 were combined with accounts payable and accrued liabilities of $128,874, for a total of $144,060Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started