QUESTION - Prepare the adjusting entries, post to the ledger, prepare Adjusted Trial Balance and prepare closing entries.

Background and Facts

Paella Williams is the owner of Happy n Healthy Pets a business specialising in pet care services which she started several years ago. Paella operates the business herself and employs one person Trent Lachem to assist her. The business is GST registered. Happy n Healthy specialises in smaller pets mainly dogs and cats and birds. The business provides services such as pet washing and grooming, pet minding and feeding, pet walking and transport for health checks at the vet. Paella has a variety of clients with whom she has built up strong relationships. She offers them terms of 30 days. Paella submits her Business Activity Statements quarterly on an accruals basis and pays GST and PAYG Tax quarterly. The next payment is due on June 30th . The business is operated from a large shed which was built at the back of her house two years ago. To finance this Paella took out a loan over a five year period. Currently the business uses a manual accounting system but plans to move to a Xero accounting system in June.

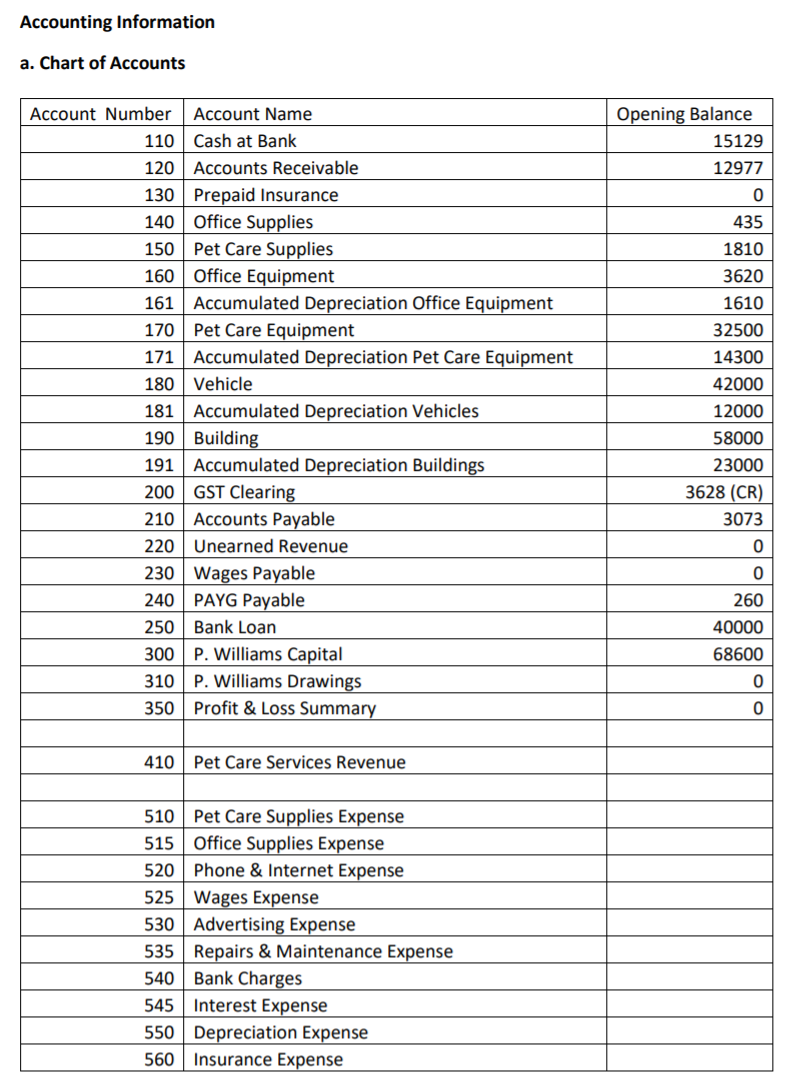

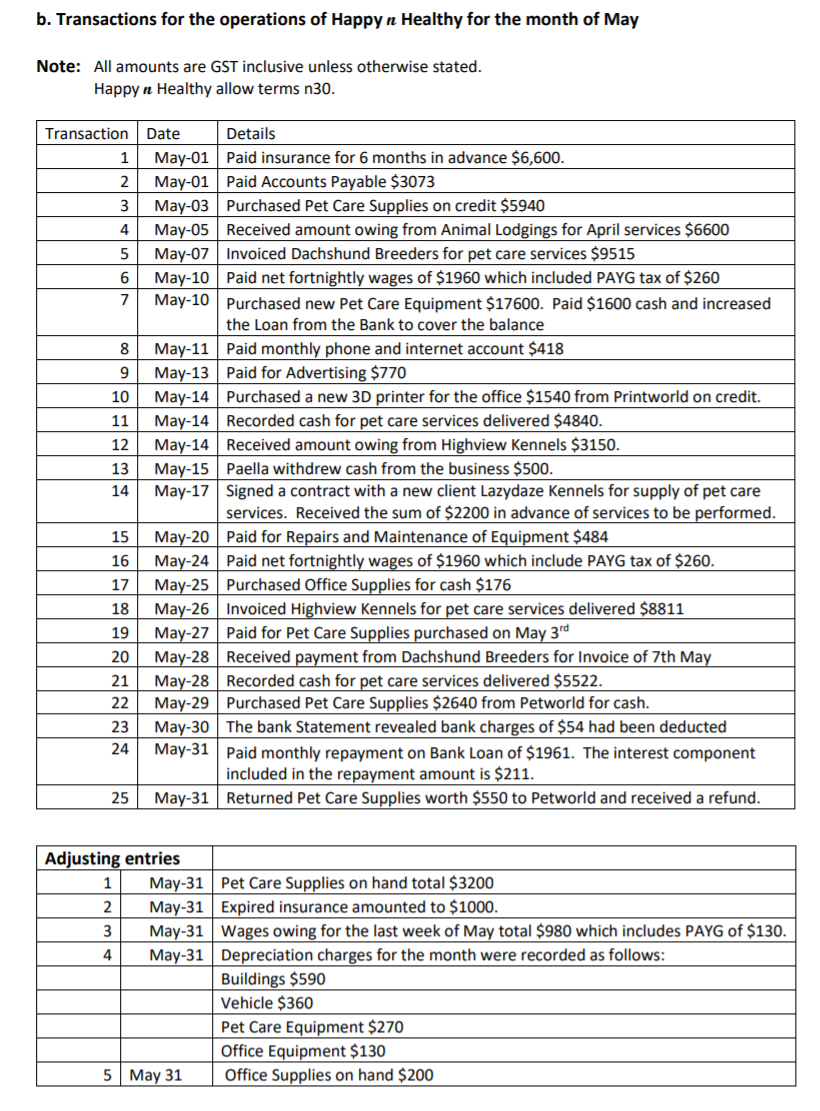

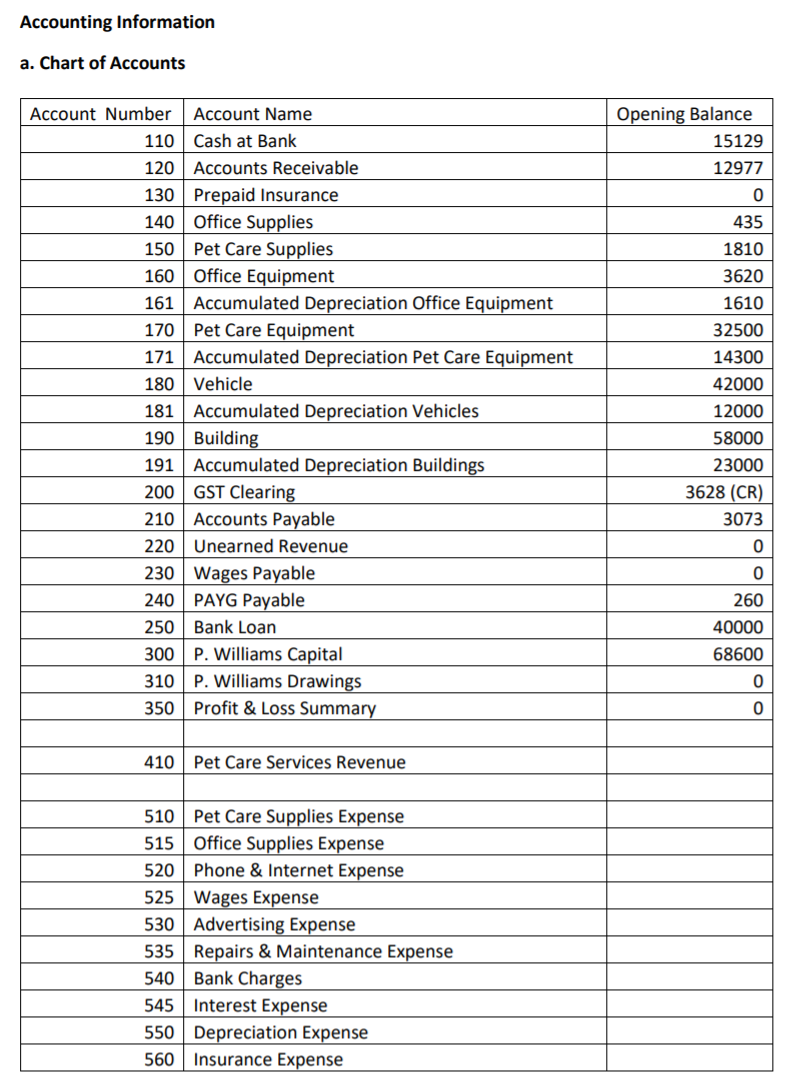

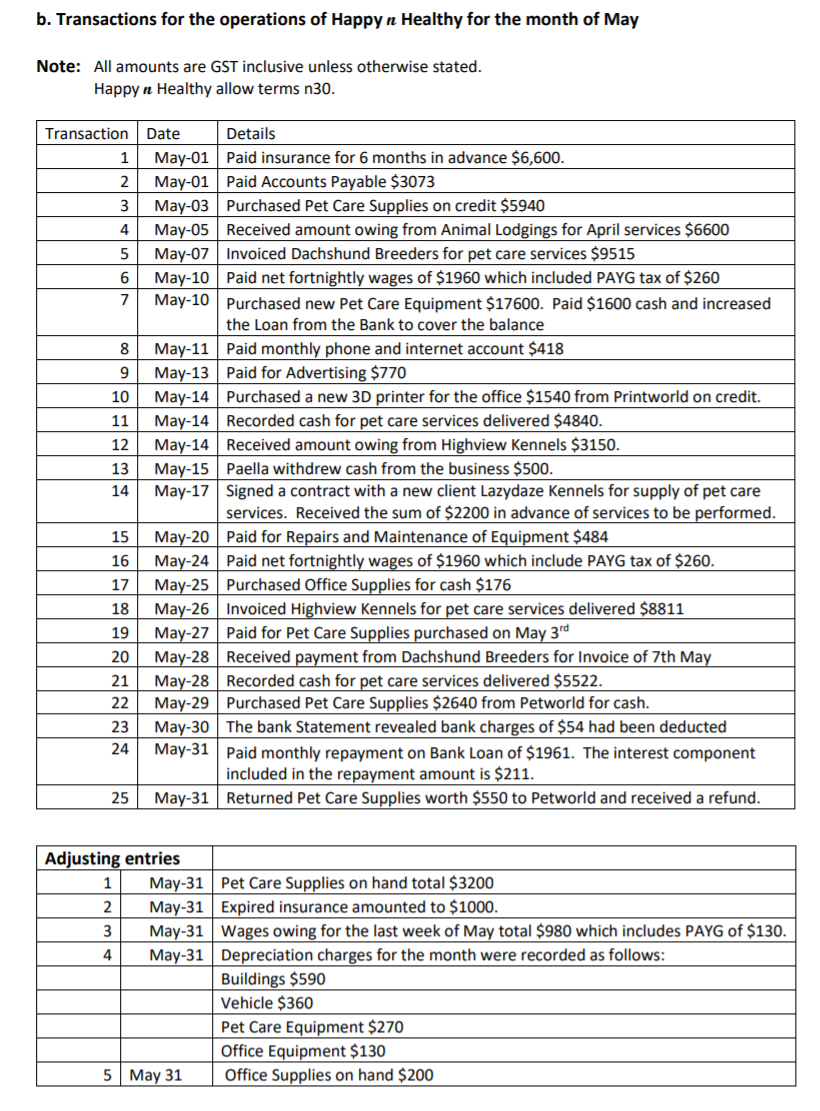

Accounting Information a. Chart of Accounts Account Number Account Name 110 Cash at Bank 120 Accounts Receivable 130 Prepaid Insurance 140 Office Supplies 150 Pet Care Supplies 160 Office Equipment 161 Accumulated Depreciation Office Equipment 170 Pet Care Equipment 171 Accumulated Depreciation Pet Care Equipment 180 Vehicle 181 Accumulated Depreciation Vehicles 190 Building 191 Accumulated Depreciation Buildings 200 GST Clearing 210 Accounts Payable 220 Unearned Revenue 230 Wages Payable 240 PAYG Payable 250 Bank Loan 300 P. Williams Capital 310 P. Williams Drawings 350 Profit & Loss Summary Opening Balance 15129 12977 0 435 1810 3620 1610 32500 14300 42000 12000 58000 23000 3628 (CR) 3073 0 0 260 40000 68600 0 0 410 Pet Care Services Revenue 510 Pet Care Supplies Expense 515 Office Supplies Expense 520 Phone & Internet Expense 525 Wages Expense 530 Advertising Expense 535 Repairs & Maintenance Expense 540 Bank Charges 545 Interest Expense 550 Depreciation Expense 560 Insurance Expense b. Transactions for the operations of Happy n Healthy for the month of May Note: All amounts are GST inclusive unless otherwise stated. Happy n Healthy allow terms n30. Transaction 1 2 3 4 5 6 7 891 10 11 12 13 14 Date Details May-01 Paid insurance for 6 months in advance $6,600. May-01 Paid Accounts Payable $3073 May-03 Purchased Pet Care Supplies on credit $5940 May-05 Received amount owing from Animal Lodgings for April services $6600 May-07 Invoiced Dachshund Breeders for pet care services $9515 May-10 Paid net fortnightly wages of $1960 which included PAYG tax of $260 May-10 Purchased new Pet Care Equipment $17600. Paid $1600 cash and increased the Loan from the Bank to cover the balance May-11 Paid monthly phone and internet account $418 May-13 Paid for Advertising $770 May-14 Purchased a new 3D printer for the office $1540 from Printworld on credit. May-14 Recorded cash for pet care services delivered $4840. May-14 Received amount owing from Highview Kennels $3150. May-15 Paella withdrew cash from the business $500. May-17 Signed a contract with a new client Lazydaze Kennels for supply of pet care services. Received the sum of $2200 in advance of services to be performed. May-20 Paid for Repairs and Maintenance of Equipment $484 May-24 Paid net fortnightly wages of $1960 which include PAYG tax of $260. May-25 Purchased Office Supplies for cash $176 May-26 Invoiced Highview Kennels for pet care services delivered $8811 May-27 Paid for Pet Care Supplies purchased on May 3rd May-28 Received payment from Dachshund Breeders for Invoice of 7th May May-28 Recorded cash for pet care services delivered $5522. May-29 Purchased Pet Care Supplies $2640 from Petworld for cash. May-30 The bank Statement revealed bank charges of $54 had been deducted May-31 Paid monthly repayment on Bank Loan of $1961. The interest component included in the repayment amount is $211. May-31 Returned Pet Care Supplies worth $550 to Petworld and received a refund. 15 16 17 18 19 20 21 22 23 24 25 4 Adjusting entries 1 May-31 Pet Care Supplies on hand total $3200 2 May-31 Expired insurance amounted to $1000. 3 May-31 Wages owing for the last week of May total $980 which includes PAYG of $130. May-31 Depreciation charges for the month were recorded as follows: Buildings $590 Vehicle $360 Pet Care Equipment $270 Office Equipment $130 5 May 31 Office Supplies on hand $200