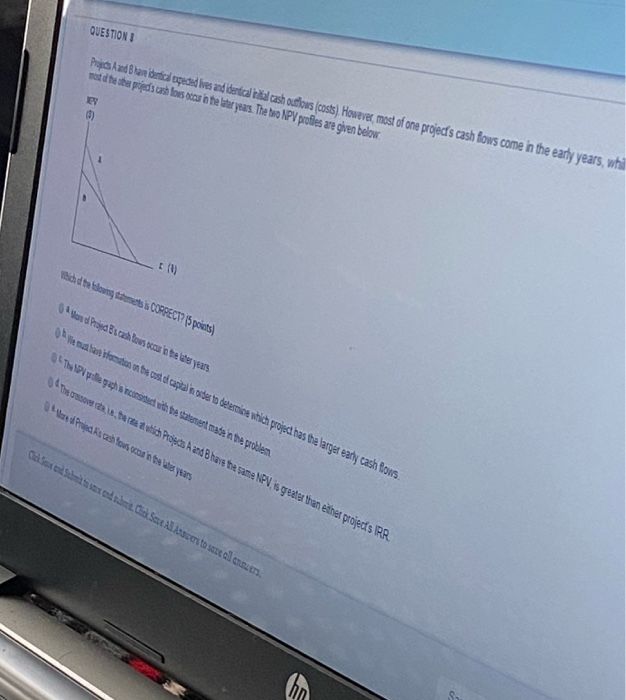

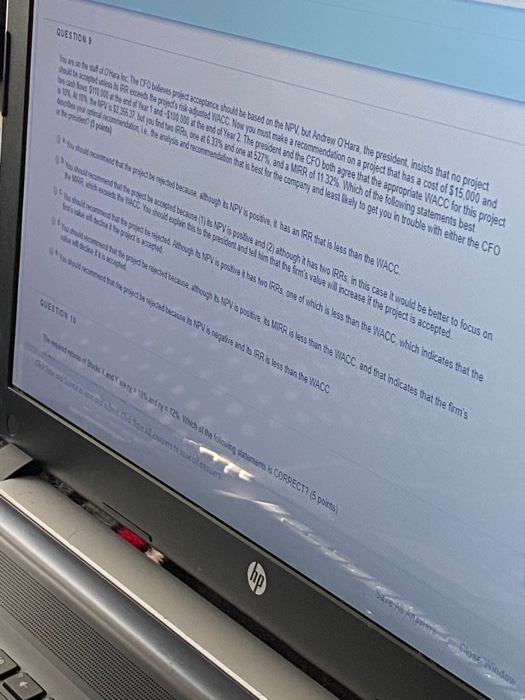

QUESTION ProjpesAant Blan burtical ueded lives and identical hial cash outflows (costs) However, most of one projects cash fows come in the early years, whil met dhe te pods cash for contre later years. The ho NPV profiles are given below. Whird te sowie aumets CORRECT? points) Hand Producah low scour in the years Wie m an vote on the case di capital in order to determine which project has the large early cash flows The pillegal strict with a statement mata na problem O now it is there a which Projects and have the same NPV is greater then either projects RA O ared Priya show can be whes years Sud e d . Sel acesta seal seers QUESTIONS d Wun ma wachs P t e. De fleste F o sta predstak h A o und PS, e n . De hobe based on the NPV but Andrew Ohara, the president, insists that no project C Now you must make a recommendation on a pred that has a cost of $15.000 and n d Yes 2 The president and the CFO both agree that the appropriate WACC for this projed 03527% anda IR 1132%. Which of the Ilowing statements best beste man and last to you in trouble with either the CFO O m W heb A WCY wa wamedha te ben, bous . Pris position,t has an RR batis less than the WACC. b ebate vas P is houpa o wth has two Rs. In this case would be better to focus on tellin babasa vinarase the predis accepted postia that coed which is less than the WACC which indicates that the s w A ho WOSIS P is set V asthan a wc and an indicates that the finis R ANCO A S PECT 5 ons QUESTION 10 Thanged hans dodas X and Yvery=10% and ry=12%. Which of the following statements is CORRECT? (5 points) The makes in equilibrin und Stock Y has the lower expected dividend yield, then it must have the higher expected growth rate! Yu Sud Xhan the same didendyed, then StockY must have a lower expected capital gains yield than Stock X 1 Sud X und 9. Yhave the same curent Guided and the same expeded dividend growth rate, then StockY must sell for a higher price so mostrar a light sidend yuld tan SarkX QUESTION 1 Santa Mony a 0 Dawa uning tasted a Th s 0 and the stock is in equilibrium, which a Ausse n's QUESTION ProjpesAant Blan burtical ueded lives and identical hial cash outflows (costs) However, most of one projects cash fows come in the early years, whil met dhe te pods cash for contre later years. The ho NPV profiles are given below. Whird te sowie aumets CORRECT? points) Hand Producah low scour in the years Wie m an vote on the case di capital in order to determine which project has the large early cash flows The pillegal strict with a statement mata na problem O now it is there a which Projects and have the same NPV is greater then either projects RA O ared Priya show can be whes years Sud e d . Sel acesta seal seers QUESTIONS d Wun ma wachs P t e. De fleste F o sta predstak h A o und PS, e n . De hobe based on the NPV but Andrew Ohara, the president, insists that no project C Now you must make a recommendation on a pred that has a cost of $15.000 and n d Yes 2 The president and the CFO both agree that the appropriate WACC for this projed 03527% anda IR 1132%. Which of the Ilowing statements best beste man and last to you in trouble with either the CFO O m W heb A WCY wa wamedha te ben, bous . Pris position,t has an RR batis less than the WACC. b ebate vas P is houpa o wth has two Rs. In this case would be better to focus on tellin babasa vinarase the predis accepted postia that coed which is less than the WACC which indicates that the s w A ho WOSIS P is set V asthan a wc and an indicates that the finis R ANCO A S PECT 5 ons QUESTION 10 Thanged hans dodas X and Yvery=10% and ry=12%. Which of the following statements is CORRECT? (5 points) The makes in equilibrin und Stock Y has the lower expected dividend yield, then it must have the higher expected growth rate! Yu Sud Xhan the same didendyed, then StockY must have a lower expected capital gains yield than Stock X 1 Sud X und 9. Yhave the same curent Guided and the same expeded dividend growth rate, then StockY must sell for a higher price so mostrar a light sidend yuld tan SarkX QUESTION 1 Santa Mony a 0 Dawa uning tasted a Th s 0 and the stock is in equilibrium, which a Ausse n's