Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Provide the journal entries relating to the investment property for the year ending 31 December 20x8. You should provide narrations which have a brief

Question:

Provide the journal entries relating to the investment property for the year ending 31 December 20x8. You should provide narrations which have a brief explanation of the accounting treatment in relation to each journal entry

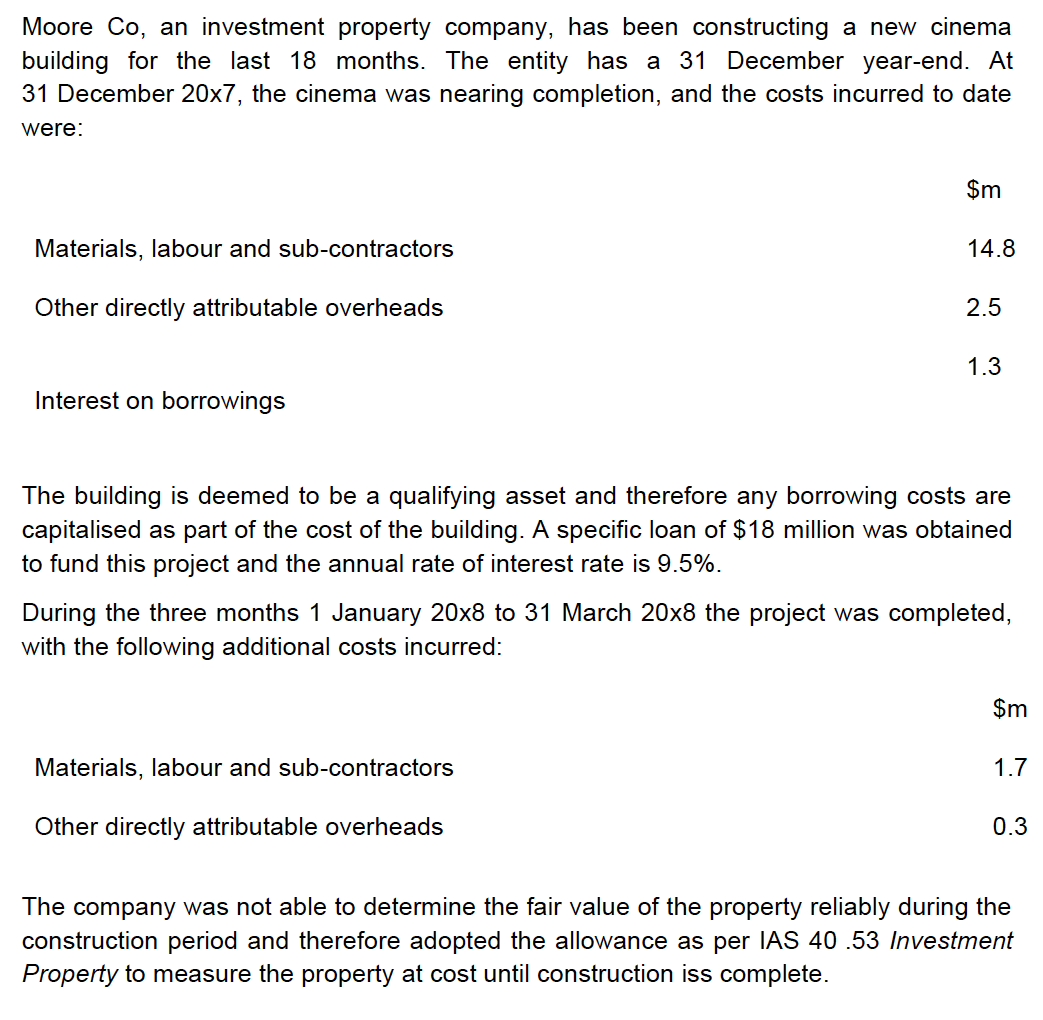

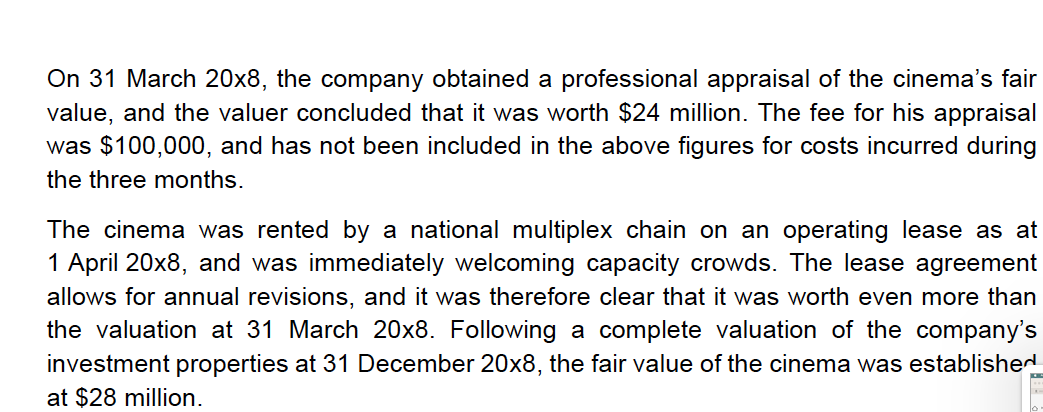

Moore Co, an investment property company, has been constructing a new cinema building for the last 18 months. The entity has a 31 December year-end. At 31 December 207, the cinema was nearing completion, and the costs incurred to date were: Materials, labour and sub-contractors Other directly attributable overheads Interest on borrowings The building is deemed to be a qualifying asset and therefore any borrowing costs are capitalised as part of the cost of the building. A specific loan of $18 million was obtained to fund this project and the annual rate of interest rate is 9.5%. During the three months 1 January 208 to 31 March 208 the project was completed, with the following additional costs incurred: $m Materials, labour and sub-contractors 1.7 Other directly attributable overheads 0.3 The company was not able to determine the fair value of the property reliably during the construction period and therefore adopted the allowance as per IAS 40.53 Investment Property to measure the property at cost until construction iss complete. On 31 March 208, the company obtained a professional appraisal of the cinema's fair value, and the valuer concluded that it was worth $24 million. The fee for his appraisal was $100,000, and has not been included in the above figures for costs incurred during the three months. The cinema was rented by a national multiplex chain on an operating lease as at 1 April 20x8, and was immediately welcoming capacity crowds. The lease agreement allows for annual revisions, and it was therefore clear that it was worth even more than the valuation at 31 March 208. Following a complete valuation of the company's investment properties at 31 December 208, the fair value of the cinema was establisher at $28 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started