Question: Question: Questions to be discussed before class 1. What is your assessment of HPC's capital budgeting process. Show transcribed image text Questions to be discussed

Question: Questions to be discussed before class 1. What is your assessment of HPC's capital budgeting process.

Show transcribed image text

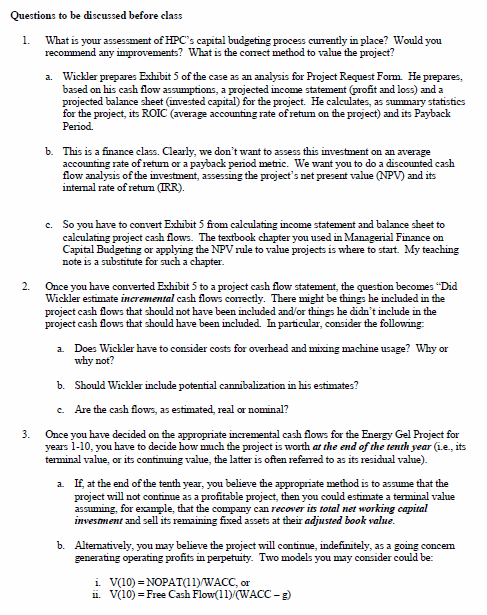

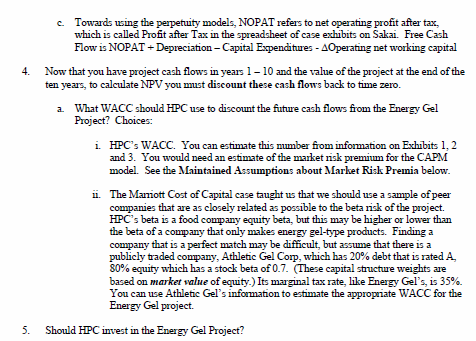

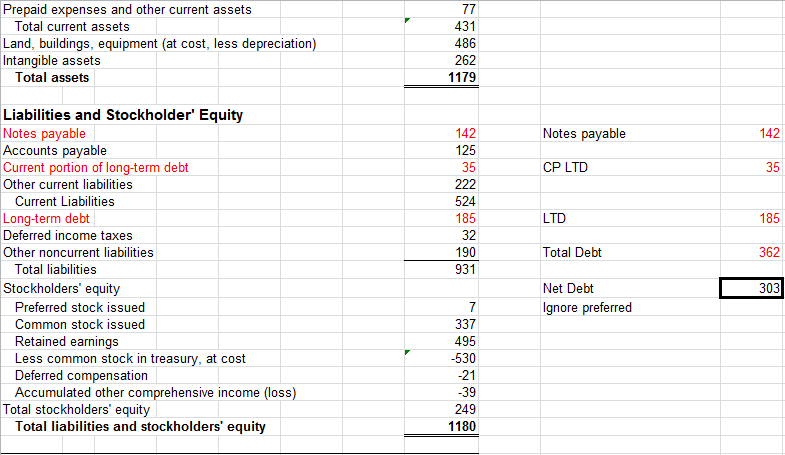

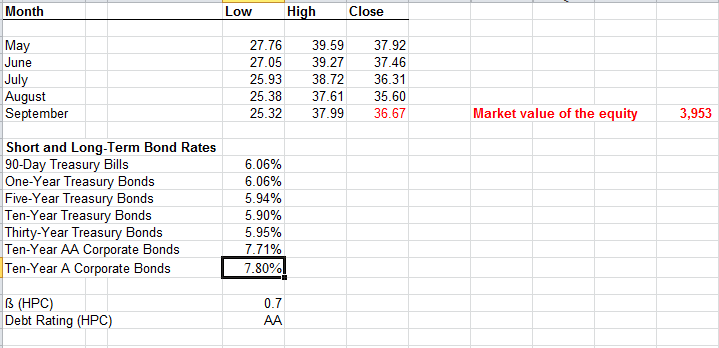

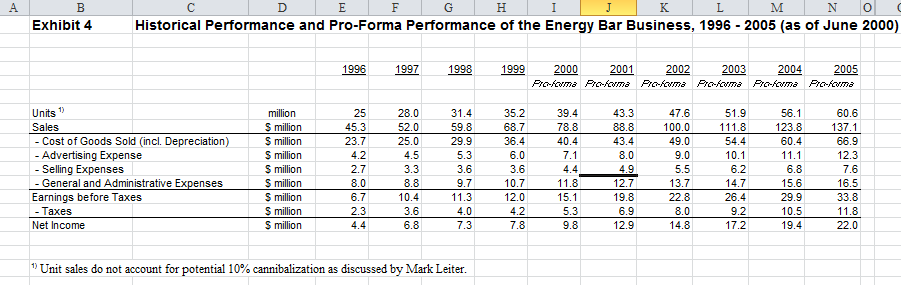

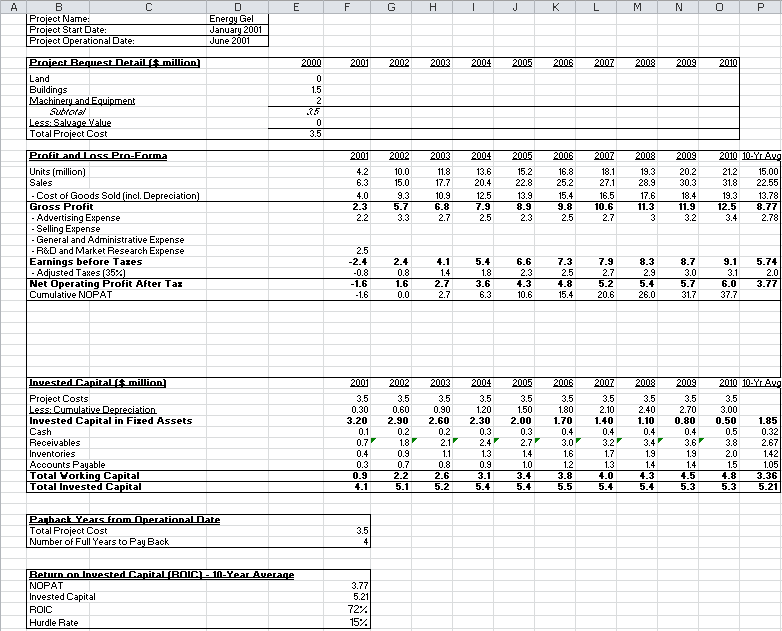

Questions to be discussed before class 1 What is your assessment of HPC's capital budgeting process currently in place? Would you recommend any improvements? What is the corect method to value the project? a. Wickler prepares Exhibit 5 of the case as an analysis for Project Request Form He prepares, based on his cash flow assumptions, a projected income statement (profit and loss) and a projected balance sheet (invested capital) for the project. He calculates, as summary statistics for the project, its ROIC (average accounting rate ofretum on the project) and its Payback Period. This is a finance class. Clearly accounting rate of retum or a payback period metric. We want you to do a discounted cash flow analysis of the investment, assessing the project's net present value (NPV) and its intemal rate of retun (RR). we don't want to assess this investment on an average b. So you have to convert Exhibit 5 from calculating income statement and balance sheet to c. calculating project cash flows. The textbook chapter you used in Managerial Finance on Capital Budgeting or applying the NPV rule to value projects is where to start. My teaching note is a substitute for such a chapter. 2 Once you have converted Exhibit 5 to a project cash flow statement, the question becomes "Did Wickler estimate incremental cash flows conectly. There might be things he included in the project cash flows that should not have been included and/or things he didn't include in the project cash flows that should have been included. In particular, consider the following Does Wickler have to consider costs for overhead and mixing machine usage? Why or why not? a b. Should Wickler include potential cannibalization in his estimates? Are the cash flows, as estimated, real or nominal? c Once you have decided on the appropriate incremental cash flows for the Energy Gel Project for years 1-10, you have to decide how much the project is worth at the end of the tenth year ie, its terminal value, or its continuing value, the latter is often referred to as its residual value) If at the end of the tenth year, you believe the appropriate method is to assume that the project will not continue as a profitable project, then you could estimate a terminal value assuming, for example, that the company can recover its total net working capital invesment and sell its remaining fixed assets at their adjusted book value a. b. Altematively, you may believe the project will continue, indefinitely, as a going concem generating operating profits in perpetuity. Two models you may consider could be V(10) NOPAT(1)WACC, or . V(10) Free Cash Flow(11(WACC ) Towards using the perpetuity models, NOPAT refers to net operating profit after tax which is called Profit after Tax in the spreadsheet of case exhibits on Sakai Free Cash Flow is NOPAT Depreciation -Capital Expenditures - AOperating net working capital c 4. Now that you have project cash flows in years 1 -10 and the value of the project at the end of the ten years, to calculate NPV you must discount these cash flows back to time zero. What WACC should HPC use to discount the future cash flows from the Energy Gel Project? Choices a . HPC's WACC. You can estimate this mumber frominformation on Exhibits 1, 2 and 3. You would need an estimate of the market risk premium for the CAPM model. See the Maintained Assumptions about Market Risk Premia below. . The Mamiott Cost of Capital case taught us that we should use a sample of peer companies that are as closely related as possible to the beta risk of the project. HPC's beta is a food company equity beta, but this may be higher or lower than the beta of a company that only makes energy gel-type products. Finding a company that is a perfect match may be difficult, but assume that there is a publicly traded company, Athletic Gel Corp, which has 20% debt that is rated A S0% equity which has a stock beta of 0.7. (These capital structure weights are based on market value of equity.) Its marginal tax rate, like Energy Gel's, is 35% You can use Athletic Gel's infomation to estimate the appropriate WACC for the Energy Gel project Should HPC invest in the Energy Gel Project? 5. Prepaid expenses and other current assets 77 Total current assets 431 Land, buildings, equipment (at cost, less depreciation) Intangible assets Total assets 486 262 1179 Liabilities and Stockholder' Equity Notes payable Accounts payable Current portion of long-term debt Notes payable 142 142 125 CP LTD 35 Other current liabilities 222 Current Liabilities 524 |Long-term debt Deferred income taxes 185 LTD 185 32 Other noncurrent liabilities 190 Total Debt 362 Total liabilities 931 Stockholders' equity Net Debt 303 Preferred stock issued 7 Ignore preferred Common stock issued 337 Retained earnings Less common stock in treasury, at cost Deferred compensation Accumulated other comprehensive income (loss) Total stockholders' equity Total liabilities and stockholders' equity 495 -530 21 -39 249 1180 High Month Low Close May June 27.76 37.92 37.46 39.59 27.05 39.27 25.93 July August September 38.72 36.31 25.38 37.61 35.60 Market value of the equity 25.32 3,953 37.99 36.67 Short and Long-Term Bond Rates 90-Day Treasury Bills One-Year Treasury Bonds Five-Year Treasury Bonds Ten-Year Treasury Bonds Thirty-Year Treasury Bonds Ten-Year AA Corporate Bonds Ten-Year A Corporate Bonds 6.06% 6.06% 5.94% 5.90% 5.95% 7.71% 7.80% () Debt Rating (HPC) 0.7 AA F A B C D G T K I M N C Historical Performance and Pro-Forma Performance of the Energy Bar Business, 1996 - 2005 (as of June 2000) Exhibit 4 1999 2001 1996 1997 1998 2000 2002 2003 2004 2005 Pro-foma Pofoma Pro-kcma Pro-forma Pro-foma Pro-foma Units 1 31.4 47,6 million 25 28.0 35.2 39.4 43.3 51.9 56.1 60.6 S million S million S million S million S million S million 52.0 25.0 68.7 88.8 137.1 Sales 45.3 59.8 78.8 100.0 111.8 123.8 - Cost of Goods Sold (incl. Depreciation) - Advertising Expense - Selling Expenses - General and Administrative Expenses Earnings before Taxes - Taxes 29.9 40.4 23.7 36.4 43.4 49.0 54.4 60.4 66.9 4.2 4.5 5.3 6.0 7.1 8.0 9.0 10.1 11.1 12.3 2.7 3.3 3.6 3.6 4.4 4.9 5.5 6.2 6.8 7.6 8.0 8.8 9.7 10.7 11.8 12.7 13.7 14.7 15.6 16.5 22.8 6.7 10.4 11.3 12.0 15.1 19.8 26.4 29.9 33.8 S million 2.3 3.6 4.0 4.2 5.3 6.9 8.0 9.2 10.5 11.8 S million Net Income 4.4 6.8 7.3 7.8 9.8 12.9 14.8 17.2 19.4 22.0 1Unit sales do not account for potential 10% cannibalization as discussed by Mark Leiter. CON C F F H K M Energy Gel January 2001 June 2001 Projeot Name: Project Start Date: Project Operational Date: Project Bequest Detail million 2000 2002 2003 2004 2005 2006 2007 2008 2009 2010 2001 Land 0 Buildings Machinery and Equipment Subtotal Less: Saluage Value Total Project Cost 15 2 0 3.5 Profit andLoss Pro-Eorma 2002 2004 2005 2008 2010 10-YrAug 2001 2003 2006 2007 2009 Units (million) Sales -Cost of Goods Sold (incl. Depreciation) Gross Profit - Advertising Expense Selling Expense - General and Administrative Expense - R&D and Market Research Expense Earnings before Tazes -Adjusted Tawes (35%) Net Operating Profit After Taz Cumulative NOPAT 4.2 10.0 11.8 13.6 15.2 16.8 18.1 19.3 20.2 21.2 15.00 6.3 15.0 17.7 20.4 22.8 25,2 27.1 28.9 30.3 31.8 22.55 4.0 9.3 10.9 12.5 13.9 15.4 16.5 17.6 18.4 19.3 13.78 9.8 11.9 2.3 5.7 6.8 7.9 8.9 10.6 11.3 12.5 8.77 2.2 3.3 2.7 2.5 2.3 2.5 2.7 3 3.2 3.4 2.78 2.5 -2.4 2.4 4.1 5.4 6.6 7.3 7.9 8.3 8.7 9.1 31 5.74 -0.8 0,8 1.4 18 2.3 2.5 2.7 2.9 3.0 5.7 31.7 2.0 -1.6 1.6 2.7 3.6 4.3 4.8 5.2 5.4 6.0 3.77 26.0 37.7 -1.6 0.0 2.7 6.3 10.6 15.4 20.6 Inuested Capital($ million 2001 2002 2004 2005 2006 2007 2008 2009 2010 10-Yr Avg 2003 Projeot Costs Less: Cumulatiue Depreaiation Invested Capital in Fized Assets 3.5 3.5 3.5 3.5 3.5 3.5 3.5 3.5 3.5 3.5 0.30 0.60 0.90 1.20 1.50 1.80 2.10 2.40 2.70 3.00 3.20 0.1 2.90 2.60 2.30 2.00 1.70 1.40 1.10 0.80 0.50 1.85 Cash 0,2 0.2 0.3 0.3 0.4 0.4 0.4 0.4 0.5 0.32 Receivables Inventories 0.7 1,8 2.1 2.4 2.7 3.0 3.2 3.4 3.6 3.8 2.67 0.4 0,9 11 13 1,4 1,6 17 1.9 1.9 2.0 1,42 Accounts Payable Total Vorking Capital Total Invested Capital 0.3 0.7 2.2 5.1 0.8 0.9 1,0 3.4 5.4 1.2 3.8 5.5 1.3 1,4 4.3 5.4 1.4 4.5 5.3 1.5 4.8 5.3 1.05 0,9 2.6 3.1 4.0 3.36 4.1 5.2 5.4 5.4 5.21 Pa hack Years from Opecational Date Total Project Cost Number of Full Years to Pay Back 3.5 10-Year Awerage Beturn on Invested Capital (BOIC) NOPAT 3.77 Invested Capital 5.21 72% ROIC 15% Hurdle Rate Questions to be discussed before class 1 What is your assessment of HPC's capital budgeting process currently in place? Would you recommend any improvements? What is the corect method to value the project? a. Wickler prepares Exhibit 5 of the case as an analysis for Project Request Form He prepares, based on his cash flow assumptions, a projected income statement (profit and loss) and a projected balance sheet (invested capital) for the project. He calculates, as summary statistics for the project, its ROIC (average accounting rate ofretum on the project) and its Payback Period. This is a finance class. Clearly accounting rate of retum or a payback period metric. We want you to do a discounted cash flow analysis of the investment, assessing the project's net present value (NPV) and its intemal rate of retun (RR). we don't want to assess this investment on an average b. So you have to convert Exhibit 5 from calculating income statement and balance sheet to c. calculating project cash flows. The textbook chapter you used in Managerial Finance on Capital Budgeting or applying the NPV rule to value projects is where to start. My teaching note is a substitute for such a chapter. 2 Once you have converted Exhibit 5 to a project cash flow statement, the question becomes "Did Wickler estimate incremental cash flows conectly. There might be things he included in the project cash flows that should not have been included and/or things he didn't include in the project cash flows that should have been included. In particular, consider the following Does Wickler have to consider costs for overhead and mixing machine usage? Why or why not? a b. Should Wickler include potential cannibalization in his estimates? Are the cash flows, as estimated, real or nominal? c Once you have decided on the appropriate incremental cash flows for the Energy Gel Project for years 1-10, you have to decide how much the project is worth at the end of the tenth year ie, its terminal value, or its continuing value, the latter is often referred to as its residual value) If at the end of the tenth year, you believe the appropriate method is to assume that the project will not continue as a profitable project, then you could estimate a terminal value assuming, for example, that the company can recover its total net working capital invesment and sell its remaining fixed assets at their adjusted book value a. b. Altematively, you may believe the project will continue, indefinitely, as a going concem generating operating profits in perpetuity. Two models you may consider could be V(10) NOPAT(1)WACC, or . V(10) Free Cash Flow(11(WACC ) Towards using the perpetuity models, NOPAT refers to net operating profit after tax which is called Profit after Tax in the spreadsheet of case exhibits on Sakai Free Cash Flow is NOPAT Depreciation -Capital Expenditures - AOperating net working capital c 4. Now that you have project cash flows in years 1 -10 and the value of the project at the end of the ten years, to calculate NPV you must discount these cash flows back to time zero. What WACC should HPC use to discount the future cash flows from the Energy Gel Project? Choices a . HPC's WACC. You can estimate this mumber frominformation on Exhibits 1, 2 and 3. You would need an estimate of the market risk premium for the CAPM model. See the Maintained Assumptions about Market Risk Premia below. . The Mamiott Cost of Capital case taught us that we should use a sample of peer companies that are as closely related as possible to the beta risk of the project. HPC's beta is a food company equity beta, but this may be higher or lower than the beta of a company that only makes energy gel-type products. Finding a company that is a perfect match may be difficult, but assume that there is a publicly traded company, Athletic Gel Corp, which has 20% debt that is rated A S0% equity which has a stock beta of 0.7. (These capital structure weights are based on market value of equity.) Its marginal tax rate, like Energy Gel's, is 35% You can use Athletic Gel's infomation to estimate the appropriate WACC for the Energy Gel project Should HPC invest in the Energy Gel Project? 5. Prepaid expenses and other current assets 77 Total current assets 431 Land, buildings, equipment (at cost, less depreciation) Intangible assets Total assets 486 262 1179 Liabilities and Stockholder' Equity Notes payable Accounts payable Current portion of long-term debt Notes payable 142 142 125 CP LTD 35 Other current liabilities 222 Current Liabilities 524 |Long-term debt Deferred income taxes 185 LTD 185 32 Other noncurrent liabilities 190 Total Debt 362 Total liabilities 931 Stockholders' equity Net Debt 303 Preferred stock issued 7 Ignore preferred Common stock issued 337 Retained earnings Less common stock in treasury, at cost Deferred compensation Accumulated other comprehensive income (loss) Total stockholders' equity Total liabilities and stockholders' equity 495 -530 21 -39 249 1180 High Month Low Close May June 27.76 37.92 37.46 39.59 27.05 39.27 25.93 July August September 38.72 36.31 25.38 37.61 35.60 Market value of the equity 25.32 3,953 37.99 36.67 Short and Long-Term Bond Rates 90-Day Treasury Bills One-Year Treasury Bonds Five-Year Treasury Bonds Ten-Year Treasury Bonds Thirty-Year Treasury Bonds Ten-Year AA Corporate Bonds Ten-Year A Corporate Bonds 6.06% 6.06% 5.94% 5.90% 5.95% 7.71% 7.80% () Debt Rating (HPC) 0.7 AA F A B C D G T K I M N C Historical Performance and Pro-Forma Performance of the Energy Bar Business, 1996 - 2005 (as of June 2000) Exhibit 4 1999 2001 1996 1997 1998 2000 2002 2003 2004 2005 Pro-foma Pofoma Pro-kcma Pro-forma Pro-foma Pro-foma Units 1 31.4 47,6 million 25 28.0 35.2 39.4 43.3 51.9 56.1 60.6 S million S million S million S million S million S million 52.0 25.0 68.7 88.8 137.1 Sales 45.3 59.8 78.8 100.0 111.8 123.8 - Cost of Goods Sold (incl. Depreciation) - Advertising Expense - Selling Expenses - General and Administrative Expenses Earnings before Taxes - Taxes 29.9 40.4 23.7 36.4 43.4 49.0 54.4 60.4 66.9 4.2 4.5 5.3 6.0 7.1 8.0 9.0 10.1 11.1 12.3 2.7 3.3 3.6 3.6 4.4 4.9 5.5 6.2 6.8 7.6 8.0 8.8 9.7 10.7 11.8 12.7 13.7 14.7 15.6 16.5 22.8 6.7 10.4 11.3 12.0 15.1 19.8 26.4 29.9 33.8 S million 2.3 3.6 4.0 4.2 5.3 6.9 8.0 9.2 10.5 11.8 S million Net Income 4.4 6.8 7.3 7.8 9.8 12.9 14.8 17.2 19.4 22.0 1Unit sales do not account for potential 10% cannibalization as discussed by Mark Leiter. CON C F F H K M Energy Gel January 2001 June 2001 Projeot Name: Project Start Date: Project Operational Date: Project Bequest Detail million 2000 2002 2003 2004 2005 2006 2007 2008 2009 2010 2001 Land 0 Buildings Machinery and Equipment Subtotal Less: Saluage Value Total Project Cost 15 2 0 3.5 Profit andLoss Pro-Eorma 2002 2004 2005 2008 2010 10-YrAug 2001 2003 2006 2007 2009 Units (million) Sales -Cost of Goods Sold (incl. Depreciation) Gross Profit - Advertising Expense Selling Expense - General and Administrative Expense - R&D and Market Research Expense Earnings before Tazes -Adjusted Tawes (35%) Net Operating Profit After Taz Cumulative NOPAT 4.2 10.0 11.8 13.6 15.2 16.8 18.1 19.3 20.2 21.2 15.00 6.3 15.0 17.7 20.4 22.8 25,2 27.1 28.9 30.3 31.8 22.55 4.0 9.3 10.9 12.5 13.9 15.4 16.5 17.6 18.4 19.3 13.78 9.8 11.9 2.3 5.7 6.8 7.9 8.9 10.6 11.3 12.5 8.77 2.2 3.3 2.7 2.5 2.3 2.5 2.7 3 3.2 3.4 2.78 2.5 -2.4 2.4 4.1 5.4 6.6 7.3 7.9 8.3 8.7 9.1 31 5.74 -0.8 0,8 1.4 18 2.3 2.5 2.7 2.9 3.0 5.7 31.7 2.0 -1.6 1.6 2.7 3.6 4.3 4.8 5.2 5.4 6.0 3.77 26.0 37.7 -1.6 0.0 2.7 6.3 10.6 15.4 20.6 Inuested Capital($ million 2001 2002 2004 2005 2006 2007 2008 2009 2010 10-Yr Avg 2003 Projeot Costs Less: Cumulatiue Depreaiation Invested Capital in Fized Assets 3.5 3.5 3.5 3.5 3.5 3.5 3.5 3.5 3.5 3.5 0.30 0.60 0.90 1.20 1.50 1.80 2.10 2.40 2.70 3.00 3.20 0.1 2.90 2.60 2.30 2.00 1.70 1.40 1.10 0.80 0.50 1.85 Cash 0,2 0.2 0.3 0.3 0.4 0.4 0.4 0.4 0.5 0.32 Receivables Inventories 0.7 1,8 2.1 2.4 2.7 3.0 3.2 3.4 3.6 3.8 2.67 0.4 0,9 11 13 1,4 1,6 17 1.9 1.9 2.0 1,42 Accounts Payable Total Vorking Capital Total Invested Capital 0.3 0.7 2.2 5.1 0.8 0.9 1,0 3.4 5.4 1.2 3.8 5.5 1.3 1,4 4.3 5.4 1.4 4.5 5.3 1.5 4.8 5.3 1.05 0,9 2.6 3.1 4.0 3.36 4.1 5.2 5.4 5.4 5.21 Pa hack Years from Opecational Date Total Project Cost Number of Full Years to Pay Back 3.5 10-Year Awerage Beturn on Invested Capital (BOIC) NOPAT 3.77 Invested Capital 5.21 72% ROIC 15% Hurdle Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts