Answered step by step

Verified Expert Solution

Question

1 Approved Answer

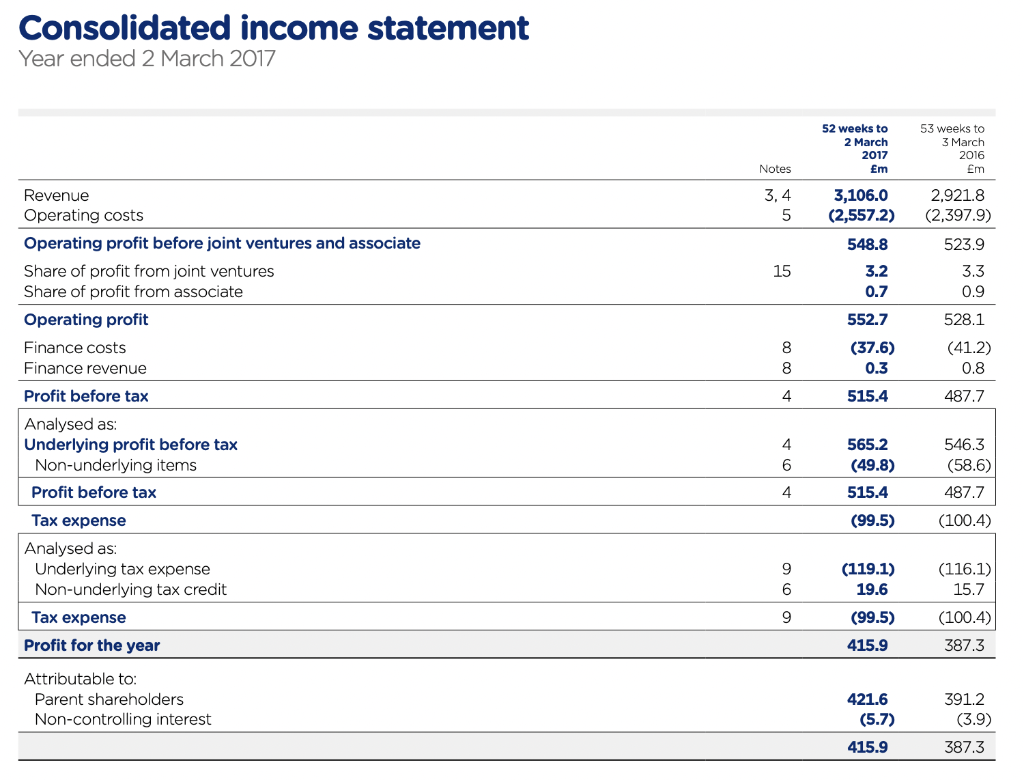

Question - Reformulate this Income statement and clearly demonstrate the net operating profit after tax (NOPAT), and Core NOPAT Consolidated income statement Year ended 2

Question - Reformulate this Income statement and clearly demonstrate the net operating profit after tax (NOPAT), and Core NOPAT

Consolidated income statement Year ended 2 March 2017 52 weeks to 2 March 2017 Em 53 weeks to 3 March 2016 Em Notes 3,4 5 3,106.0 (2,557.2) 548.8 Revenue Operating costs Operating profit before joint ventures and associate Share of profit from joint ventures Share of profit from associate Operating profit Finance costs Finance revenue 2,921.8 (2,397.9) 523.9 3.3 0.9 15 3.2 0.7 552.7 528.1 8 (41.2) 0000 (37.6) 0.3 8 0.8 Profit before tax 4 515.4 487.7 4 565.2 6 (49.8) 546.3 (58.6) 487.7 (100.4) 4 515.4 (99.5) Analysed as: Underlying profit before tax Non-underlying items Profit before tax Tax expense Analysed as: Underlying tax expense Non-underlying tax credit Tax expense Profit for the year 9 6 (119.1) 19.6 (116.1) 15.7 (100.4) 387.3 9 (99.5) 415.9 Attributable to: Parent shareholders Non-controlling interest 421.6 (5.7) 391.2 (3.9) 415.9 387.3 Consolidated income statement Year ended 2 March 2017 52 weeks to 2 March 2017 Em 53 weeks to 3 March 2016 Em Notes 3,4 5 3,106.0 (2,557.2) 548.8 Revenue Operating costs Operating profit before joint ventures and associate Share of profit from joint ventures Share of profit from associate Operating profit Finance costs Finance revenue 2,921.8 (2,397.9) 523.9 3.3 0.9 15 3.2 0.7 552.7 528.1 8 (41.2) 0000 (37.6) 0.3 8 0.8 Profit before tax 4 515.4 487.7 4 565.2 6 (49.8) 546.3 (58.6) 487.7 (100.4) 4 515.4 (99.5) Analysed as: Underlying profit before tax Non-underlying items Profit before tax Tax expense Analysed as: Underlying tax expense Non-underlying tax credit Tax expense Profit for the year 9 6 (119.1) 19.6 (116.1) 15.7 (100.4) 387.3 9 (99.5) 415.9 Attributable to: Parent shareholders Non-controlling interest 421.6 (5.7) 391.2 (3.9) 415.9 387.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started